February 6, 2026

S&P 500 futures +0.3% Friday morning after being down more than 1% overnight, following Thursday’s broad selloff that left all major indexes down over 1% and the S&P on a third straight decline. Software fell for a seventh consecutive session, remaining the main drag.

Overnight, Asian markets were mostly lower, with South Korea and Hong Kong lagging, while Japan outperformed. European equities are flat to slightly higher. Treasuries are little changed after Thursday’s sharp bull steepening. The dollar is steady. Commodities are mixed: gold -0.1%, silver -4%, WTI crude +0.7%. Bitcoin futures +4.6%, rebounding after dipping toward $60K.

The rebound attempt appears driven more by oversold conditions, particularly in software, and some pushback against extreme AI-competition narratives. Elevated hyperscaler capex remains supportive for the broader AI complex, with semis outperforming early. As with Alphabet (GOOGL) earlier this week, hyperscalers are showing tangible benefits from investment ramps via cloud growth. Headlines are otherwise light; geopolitics remain elevated into U.S.–Iran talks, with the U.S. urging Americans to leave Iran.

Company Highlights

- Amazon (AMZN): Shares pressured post-earnings; AWS growth accelerated to ~24% and beat, but $200B capex guidance overshadowed results.

- Microchip Technology (MCHP): Guided above expectations; commentary consistent with a cyclical recovery.

- Fortinet (FTNT): Strong product sales.

- Reddit (RDDT): Beat and raised guidance with positive monetization takeaways.

- Roblox (RBLX): Surged on a strong 22–26% bookings growth outlook.

- Doximity (DOCS): Sold off on a much softer Q4 revenue growth guide; slow start to upfront selling flagged.

- Affirm (AFRM) / BILL Holdings (BILL): Both beat and raised.

- Other notable decliners: Molina Healthcare (MOH), Illumina (ILMN), Coty (COTY), Hub Group (HUBG), Werner Enterprises (WERN).

- Bloom Energy (BE): Jumped on improved guidance.

Macro & Events

- Today: Preliminary University of Michigan consumer sentiment (consensus 55.0) at 10:00 ET.

- Fed: Vice Chair Jefferson speaks at 12:00 ET.

- Next week: Retail sales (Tue), employment report (Wed), CPI (Fri); Treasury auctions $125B across 3-, 10-, and 30-year maturities.

U.S. equities sold off sharply Thursday (Dow -1.20% | S&P 500 -1.23% | Nasdaq -1.59% | Russell 2000 -1.79%), finishing near session lows, as soft labor-market data triggered a risk-off move and unwound some of the recent pro-cyclical rotation. The equal-weight S&P 500 (RSP) held up better, down just 0.9%, highlighting ongoing resilience beneath the surface even as index performance was dragged lower by large-cap tech and software.

The macro catalyst was a clear downside surprise in employment indicators. December JOLTS job openings fell to 6.54M, the lowest level since September 2020 and well below expectations, while initial claims rose to 231K, above consensus. Challenger layoffs surged to the highest January level since 2009. Together, the data prompted a bullish steepening in rates, with front-end Treasury yields falling 9–10 bp, and cooled momentum behind the recent “run-it-hot” growth narrative.

The dollar index rose 0.3%, tracking toward its strongest week since October. Commodities weakened: WTI crude -2.8%, gold -1.2%, silver -9.1%. Bitcoin futures dropped nearly 14% to around $63K, the lowest since October 2024. Geopolitical headlines remained active, with U.S.–Iran nuclear talks reportedly back on for Friday.

Tech remained under heavy scrutiny. Software sold off again amid intensifying AI competition headlines (new Claude and GPT releases), while semiconductors held up better on the back of blowout capex guidance from Alphabet, even as crowded positioning and index concentration weighed on sentiment.

Sector Highlights

Leadership skewed defensive but uneven. Financials, Energy, Health Care, Industrials, and Utilities outperformed as falling front-end yields and earnings visibility supported balance-sheet-driven sectors. Technology was the primary laggard, weighed down by software and mega-cap pressure, while Consumer Discretionary and Materials also underperformed amid weaker growth expectations and commodity declines. The session highlighted how broadening beneath the surface continues, even as macro shocks and tech concentration drive headline index volatility.

Information Technology

- Alphabet (GOOGL): Issued outsized capex guidance, pressuring the stock, though takeaways were very positive on accelerating Search and Cloud growth and AI monetization.

- Microsoft (MSFT): One of the weakest mega-caps; downgraded at Stifel on valuation, Azure growth concerns, and heavy capex weighing on margin leverage.

- Qualcomm (QCOM): Shares fell on guidance reflecting memory shortages, particularly at Chinese OEMs; automotive and IoT demand remained a bright spot.

- Arm (ARM): Outperformed peers after earnings, supported by data-center royalty growth.

- Super Micro Computer (SMCI): Held up well on continued strong AI-server demand.

- FactSet (FDS): Sold off alongside other financial data names after Anthropic highlighted new Claude capabilities aimed at financial research.

- Workday (WDAY): Announced plans to cut ~2% of its workforce.

- Ciena (CIEN): Set to join the S&P 500.

Communication Services

- Amazon (AMZN): Among the worst performers in mega-cap tech amid broader growth and capex concerns.

- Snap (SNAP): Dropped despite an earnings beat; Q1 revenue guidance and engagement metrics underwhelmed.

Consumer Discretionary

- Tapestry (TPR): Strong beat and raised guidance driven by Coach momentum and margin upside despite tariff headwinds.

- Peloton (PTON): Sold off sharply on weaker FY revenue outlook and CFO departure.

- Ralph Lauren (RL): Beat and raised guidance, but shares fell on guidance for Q4 margin compression tied to tariffs and marketing spend.

- O’Reilly Automotive (ORLY): Comps beat but EPS missed on higher expenses; 2026 margin outlook softer.

Consumer Staples

- Hershey (HSY): Beat and raised guidance with strength in salty snacks; confection volumes pressured by price elasticity.

- Estée Lauder (EL): Shares dropped sharply after guiding FY EPS below Street, citing macro uncertainty and tariff headwinds.

Health Care

- McKesson (MCK): Strong beat and raised guidance; North America Pharma the standout, easing fears of structural slowdown.

- Cardinal Health (CAH): Beat and raised FY guidance on profit growth across pharma and medical segments.

- Cigna (CI): Beat on Evernorth strength; FY outlook broadly in line.

- Novo Nordisk (NVO): Pressured after Hims announced a low-cost compounded alternative to Wegovy; pricing pressure narrative intensified.

- Bristol Myers Squibb (BMY): Results supported by growth portfolio performance.

Financials

- Allstate (ALL): Strong beat with improved combined ratio; announced dividend increase and $4B buyback.

- KKR (KKR): Shares fell on earnings miss despite announcing a $1.4B deal to acquire Arctos Partners.

Energy

- Phillips 66 (PSX): Sector outperformed earlier in the week, but energy stocks broadly pulled back with crude prices.

- Headlines also included Saudi oil price cuts for Asian buyers and continued Venezuela supply uncertainty.

Industrials

- XPO (XPO): Beat with improving LTL execution and cost discipline.

- Cummins (CMI): Fell on guidance underwhelming, despite improving demand signals in trucking and data-center power.

- Rockwell Automation (ROK): Shares declined on softer organic growth outlook.

Materials

- Fluence Energy (FLNC): Plunged on a major earnings miss tied to project ramp costs despite longer-term data-center demand optimism.

Eco Data Releases | Friday February 6th, 2026

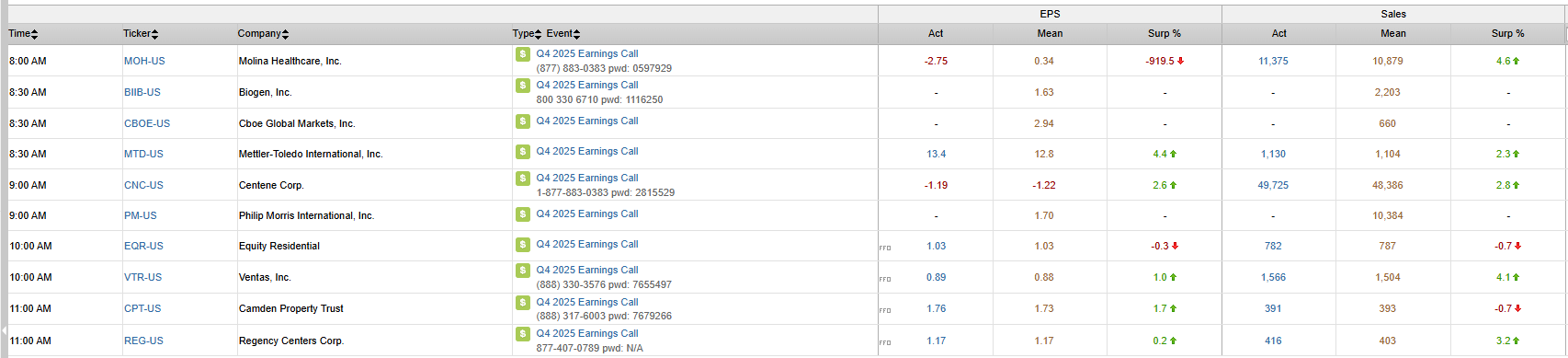

S&P 500 Constituent Earnings Announcements | Friday February 6th, 2026

Data sourced from FactSet Research Systems Inc.