February 11, 2026

S&P futures little changed in Wednesday morning trading following Tuesday’s mixed session, where equities finished just off their lows. Mega-cap tech and AI infrastructure remained under pressure, banks lagged, and advisory firms saw additional weakness on AI competition concerns. Defensives and rate-sensitive groups, including homebuilders, outperformed.

Overseas, Asian markets were mostly higher with Australia and South Korea leading; Japan was closed for a holiday. European equities are down ~0.4%. Treasuries are modestly firmer with yields down ~1 bp. The dollar is off 0.2%. Gold (+1.3%) and silver (+5.5%) are stronger, bitcoin futures are down 2.8%, and WTI crude is up 1.4%.

Headlines are relatively quiet ahead of this morning’s January employment report, the week’s macro focal point. Consensus looks for +70K payrolls versus +50K in December, with annual benchmark revisions also due. Focus remains on AI-driven competitive disruption (broadening beyond software), softer recent macro data, White House efforts to temper expectations for slower job growth, dollar weakness, heavy hyperscaler capex funding activity, strong Q4 earnings metrics, geopolitical risks, and positioning dynamics tied to CTA flows and the ongoing broadening-out narrative.

Fed speakers Schmid, Bowman, and Hammack are on deck today, alongside a $42B 10-year Treasury auction. Claims and existing home sales arrive Thursday, with a $25B 30-year auction. January CPI is due Friday (core +0.3% m/m, +2.5% y/y expected).

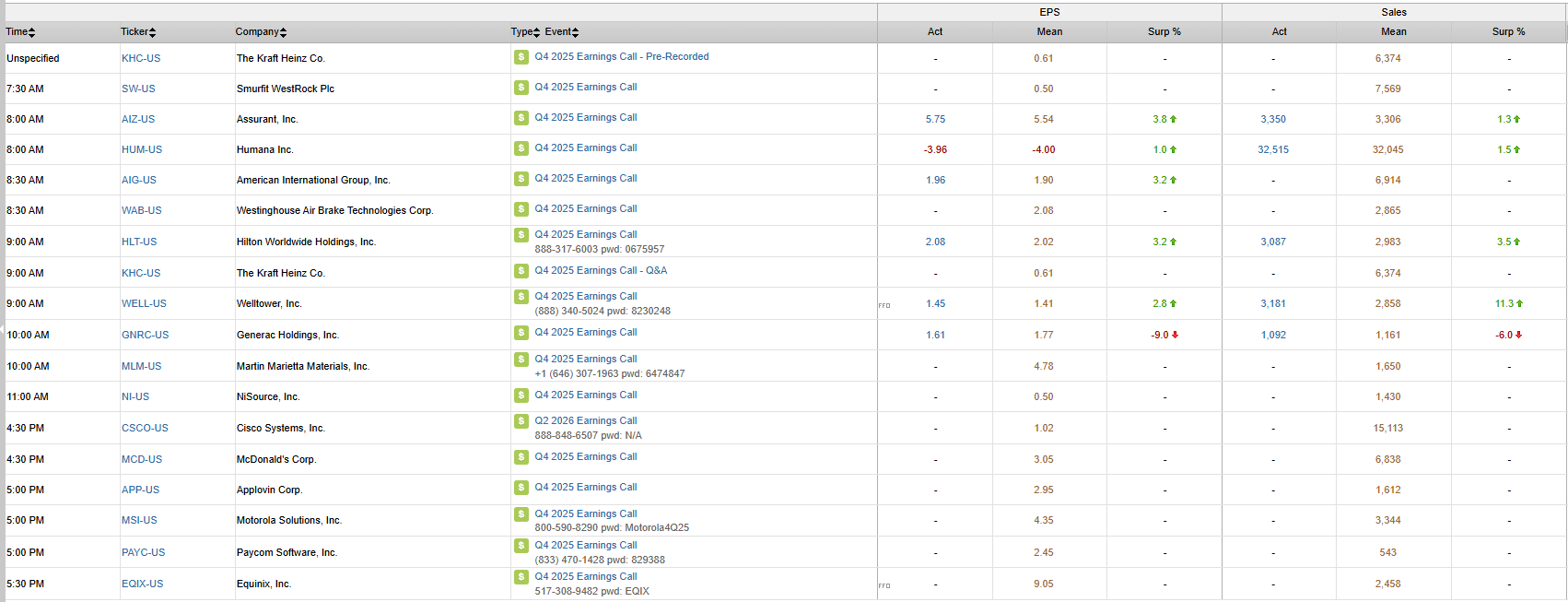

Earnings remain active.

- Gilead (GILD) beat and guided above on HIV strength, though Yeztugo guidance drew scrutiny.

- Robinhood (HOOD) missed on Q4 revenue, pressured by crypto weakness.

- Cloudflare (NET) surged on accelerating revenue growth (+34%), strong AI pipeline commentary.

- Klaviyo (KVYO) and Teradata (TDC) also outperformed within software.

- Pegasystems (PEGA) saw slightly softer ACV growth, while Rapid7 (RPD) fell on weak guidance.

- Ford (F) commentary suggested potential upside to largely in-line 2026 EBIT guidance.

- Lyft (LYFT) declined on a weaker Q1 EBITDA outlook.

- Zillow (ZG) fell on softer Q1 EBITDA guidance tied to legal expenses.

- Mattel (MAT) dropped sharply after soft Q4 results and weak 2026 guidance reflecting strategic investment spending.

- Activist Ancora reportedly built a $200M stake in Warner Bros. Discovery (WBD) and favors a transaction with Skydance.

- Rambus (RMBS) declined following its CFO departure.

U.S. equities finished mixed Tuesday (Dow +0.10% | S&P 500 -0.33% | Nasdaq -0.59% | Russell 2000 -0.34%), ending just off session lows as defensive positioning and lower rates offset continued pressure in mega-cap technology. Breadth was positive overall, with the equal-weight S&P 500 outperforming the cap-weighted index by roughly 70 bp and closing at a fresh record alongside the Dow. The divergence reflected ongoing rotation away from concentrated AI leadership and toward cyclicals and defensive yield plays.

Treasuries rallied meaningfully, with the curve flattening as long-end yields fell ~6–7 bp (10Y at 4.14%, 30Y at 4.78%). The $58B 3-year auction was well received, stopping through with solid foreign demand. Markets continued to digest softer December retail sales and White House efforts to temper expectations ahead of Wednesday’s payrolls report. Hawkish Fed commentary contrasted with slightly steeper rate-cut pricing in futures, reinforcing the policy tension narrative.

December retail sales were flat m/m versus expectations for +0.4%, while control-group sales fell 0.1% m/m versus +0.4% expected. Import prices rose 0.1% and export prices 0.3%. The NFIB small business optimism index unexpectedly declined in January. Fed speakers struck a cautious tone: Cleveland Fed President Hammack suggested rates could remain on hold for some time, while Dallas Fed President Logan described policy as within neutral but flexible should labor conditions soften.

The dollar was little changed (DXY 96.84), though yen strength remained notable. Gold fell 0.6% to $5,049, silver declined 2.3%, bitcoin futures dropped 2.6%, and WTI crude slipped 0.1% to $64.29. NYSE breadth was positive 1.64:1, while Nasdaq breadth was negative 1.13:1.

Month-to-date performance shows continued divergence: Dow +2.65%, Russell +2.53%, S&P +0.04%, Nasdaq -1.53%.

Markets now turn to Wednesday’s January payrolls report (consensus +70K) and Friday’s CPI (core +0.3% m/m, +2.5% y/y), with Treasury supply continuing through the week. The key theme remains rotation: equal-weight strength, defensive leadership, and consolidation in AI-heavy mega caps.

Sector Highlights

Defensive and rate-sensitive areas led as yields declined. Utilities (+1.59%) and Real Estate (+1.39%) were the top performers, benefiting from the Treasury rally. Materials (+1.29%) gained on strength in chemicals and select industrial inputs, while Consumer Discretionary (+0.45%) was supported by homebuilders, hotels, and housing-linked names. Industrials (+0.12%) finished modestly higher, while Energy (-0.08%) was roughly flat alongside softer crude.

Growth and financial exposure lagged. Communication Services (-0.84%) led the downside amid weakness in select digital and media names. Financials (-0.75%) were pressured by advisory and brokerage stocks on AI competition concerns. Consumer Staples (-0.63%) and Healthcare (-0.63%) underperformed on mixed earnings and biotech weakness. Technology (-0.58%) declined as mega-cap and AI infrastructure names consolidated recent gains.

Information Technology

- Taiwan Semiconductor Manufacturing (TSM) reported January revenue up 37% y/y; shares rose modestly.

- Credo Technology (CRDO) surged on a positive fiscal Q3 preannouncement, guiding revenue nearly 20% above prior outlook.

- Datadog (DDOG) rallied after beating on earnings and billings; FY guidance seen as better than feared.

- Entegris (ENTG) gained on Q4 beat and constructive Q1 guide.

- ON Semiconductor (ON) delivered EPS ahead but non-core exits and forward commentary weighed on sentiment.

- ZoomInfo Technologies (GTM) fell despite a beat; competition and downmarket softness cited.

- Upwork (UPWK) declined sharply on weaker Q1 guidance.

- Coherent (COHR) slipped on reports of a large secondary block sale.

Communication Services

- Spotify Technology (SPOT) jumped on better KPIs, MAU growth, and margin guidance.

- Warner Bros. Discovery (WBD) rose after Paramount Skydance enhanced its $30/share bid with a ticking fee provision.

Consumer Discretionary

- Marriott International (MAR) advanced on stronger-than-expected EBITDA guidance and solid international demand trends.

- Ferrari (RACE) gained on higher ASPs and better 2026 guidance.

- Hasbro (HAS) surged on a strong Q4 beat and $1B buyback announcement.

- Goodyear Tire & Rubber (GT) fell on an EPS miss and weak Americas replacement volumes.

- Under Armour (UAA) declined after a downgrade citing North America turnaround risks.

Consumer Staples

- Coca-Cola (KO) beat on EPS and margins but revenue guidance trailed expectations.

Health Care

- AstraZeneca (AZN) gained on earnings beat with oncology strength.

- Incyte (INCY) declined on EPS miss and softer Opzelura guidance.

- Oscar Health (OSCR) rose after issuing strong 2026 revenue guidance despite Q4 misses.

Financials

- S&P Global (SPGI) fell after EPS miss and cautious 2026 guidance.

- Charles Schwab (SCHW) declined alongside advisory peers amid AI-driven tax-planning competition concerns.

- Cincinnati Financial (CINF) highlighted improved underwriting trends.

Industrials

- Xylem (XYL) fell on softer Q1 organic growth guidance.

- Amentum Holdings (AMTM) declined on revenue miss and FCF burn.

- Saia (SAIA) slipped on EPS miss and weaker shipment metrics.

Materials

- DuPont de Nemours (DD) gained after Q4 EBITDA beat and constructive 2026 outlook.

Energy

- BP (BP) fell after suspending its $750M quarterly buyback and scrapping prior CFFO return targets.

Eco Data Releases | Wednesday February 11th, 2026

S&P 500 Constituent Earnings Announcements | Wednesday February 11th, 2026

Data sourced from FactSet Research Systems Inc.