February 12, 2026

S&P futures +0.3% in Thursday morning trading after Wednesday’s mixed session, where the S&P 500 finished flat but dispersion remained elevated. Memory and semis outperformed, software sold off again, and AI-related competitive pressure continued to weigh on financials—now extending to CRE brokers and services. Energy and defensive sectors also held up better.

Overnight, Asian markets were mixed to higher with South Korea up more than 3%. Europe is up ~0.7%, helped by a solid earnings batch. Treasuries are modestly firmer following Wednesday’s yield backup. The dollar is little changed. Gold (-0.2%), silver (-0.9%), bitcoin (-0.5%), and WTI crude (-0.3%) are softer.

There are no major directional catalysts this morning. The hotter January payrolls report, ongoing AI disruption themes, and persistent market dispersion remain central talking points. Geopolitically, reports suggest the U.S. and China may extend their trade truce for up to a year ahead of Trump’s April visit. The House voted to end tariffs on Canada, though with limited near-term policy impact. The Pentagon is reportedly preparing a second carrier deployment to the Middle East, even as talks with Iran continue.

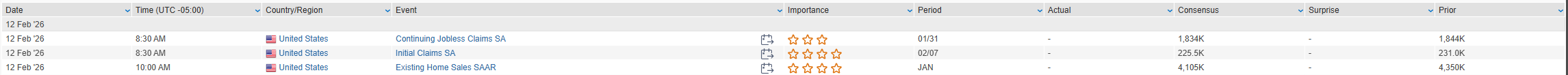

Today’s macro focus is on initial jobless claims (expected 224K after last week’s 231K spike) and January existing home sales (seen -3.2% m/m). Treasury auctions $25B of 30-year bonds. CPI is due Friday (headline and core both +0.3% m/m, +2.5% y/y expected).

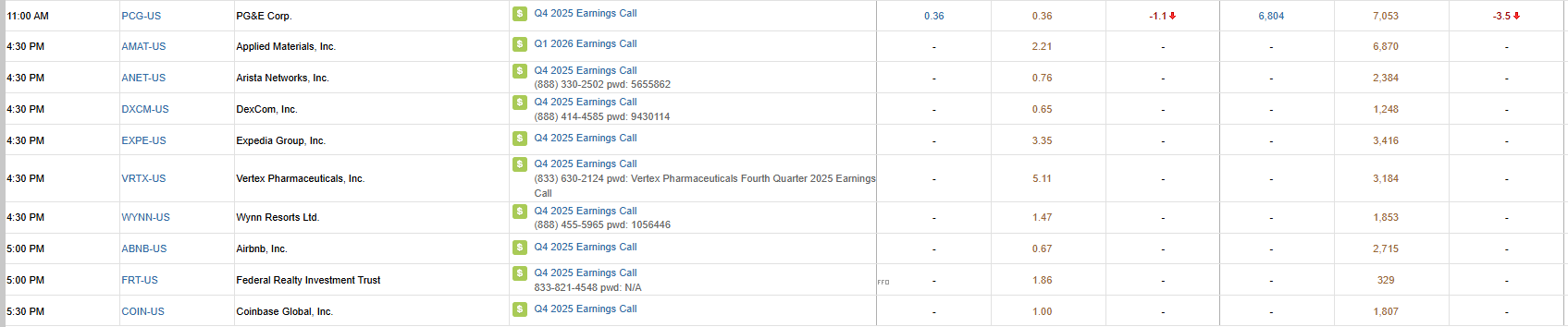

Earnings movers:

- Cisco (CSCO) beat on fiscal Q1 with AI-driven networking strength but shares were pressured by memory-related margin headwinds.

- McDonald’s (MCD) posted strong Q4 comps; near-term weather headwinds and a high bar tempered enthusiasm.

- AppLovin (APP) beat and raised guidance but fell amid broader software pressure.

- Equinix (EQIX) surged on strong bookings and Q1 momentum.

- Motorola Solutions (MSI) benefited from guidance pointing to double-digit bookings growth.

- Rollins (ROL) declined on a Q4 miss, citing weather.

- Tyler Technologies (TYL) fell on weaker Q4 results and a below-consensus FY26 revenue guide.

- Watts Water (WTS) beat on stronger sales and margins, with positive commentary on data-center exposure.

- Cognex (CGNX) rallied on upgraded through-cycle margin guidance.

- Paycom (PAYC) slipped on a lower 2026 outlook.

- Fastly (FSLY) surged on growth acceleration, large-customer strength, and AI-driven traffic gains.

U.S. equities finished mixed Wednesday (Dow -0.13% | S&P 500 0.00% | Nasdaq -0.16% | Russell 2000 -0.38%), reversing early gains as a stronger-than-expected January payrolls report pushed yields higher and reinforced underlying market dispersion. Major averages closed little changed to modestly lower, with continued rotation away from mega-cap growth and toward selective cyclicals and commodity-linked sectors.

January nonfarm payrolls rose 130K, well above ~70K consensus. Prior two months were revised down by a modest combined 17K. The unemployment rate fell to 4.3% versus expectations for 4.4%. Annual benchmark revisions (-898K through March 2025) were broadly in line with prior preliminary estimates. The firmer data revived elements of the “run-it-hot” narrative and pressured rates.

Treasuries sold off following the report. The 2-year yield rose 6 bp to 3.51%, the 10-year gained 3 bp to 4.17%, and the 30-year climbed 3 bp to 4.81%. The $42B 10-year auction tailed by 1.4 bp with weaker bid-to-cover and foreign demand. Fed’s Schmid cautioned that further rate cuts risk allowing inflation to persist.

The dollar rose 0.10% (DXY 96.90). Gold rallied 1.61% to $5,111.9 and silver gained 4.4%. WTI crude rose 1.56% to $64.96 despite an 8.5M barrel inventory build. Bitcoin futures fell 1.8%. NYSE breadth was positive (1.17:1), while Nasdaq breadth was negative (1.61:1), highlighting continued internal divergence.

Month-to-date: Dow +2.51%, Russell +2.13%, S&P +0.04%, Nasdaq -1.69%.

The dominant themes remain dispersion and selective broadening. Stronger payrolls revived rate pressure and weighed on Financials and growth-sensitive areas, while Energy, Materials, and defensive sectors led. AI disruption fears continue to pressure software and advisory firms, even as semis and memory extend year-to-date leadership.

Sector Highlights

Energy (+2.59%) led on firmer crude and rising geopolitical tension. Consumer Staples (+1.40%) and Materials (+1.30%) outperformed on defensive rotation and industrial metals strength. Utilities (+0.87%), Healthcare (+0.60%), Industrials (+0.51%), and Technology (+0.21%) also finished higher, though Tech gains were driven primarily by semis and memory while mega-cap software lagged. Real Estate (+0.05%) was flat.

Financials (-1.49%) led the downside amid weakness in brokers and advisory firms on AI competition concerns. Communication Services (-1.31%) declined with select internet and digital names under pressure. Consumer Discretionary (-0.55%) fell on weakness in airlines, cruise lines, toys, and housing-linked retail.

Information Technology

- Teradata (TDC) +29.6% — Q4 results and 2026 guidance better than expected; ARR acceleration and margin expansion potential highlighted.

- Vertiv Holdings (VRT) +24.5% — Strong hyperscale-driven orders; Q1 and FY guidance ahead.

- GlobalFoundries (GFS) +16.4% — Q4 beat with strength in communications and datacenter demand; $500M buyback announced.

- Lattice Semiconductor (LSCC) +16.3% — Server demand strength and favorable product mix; Q1 guide ahead.

- Unity Software (U) -26.3% — Weak Q1 guidance and ongoing AI disruption concerns.

- Astera Labs (ALAB) -21.4% — Margin and opex concerns overshadowed strong Q4 results.

- Pegasystems (PEGA) -11.9% — ACV growth softer despite overall beat and raised buyback.

- Shopify (SHOP) -6.5% — Revenue beat but weaker Q1 FCF margin outlook.

- Upstart Holdings (UPST) -15.2% — Margin guide disappointed despite revenue beat.

- Rambus (RMBS) Lower — CFO departure weighed on shares.

- Apple (AAPL) Lower — Reports of potential Siri delay.

Communication Services

- Cloudflare (NET) +5.1% — Revenue growth accelerated to +34%; strong AI pipeline commentary.

- Warner Bros. Discovery (WBD) Higher — Activist Ancora reportedly built $200M stake favoring Skydance deal.

- Meta Platforms (META) Higher — Pershing Square disclosed $2B stake.

- Alphabet (GOOGL) Lower — Among notable mega-cap decliners.

- T-Mobile US (TMUS) +5.1% — Financial results largely in line; churn and 2026 adds guide scrutinized.

Consumer Discretionary

- BorgWarner (BWA) +22.5% — Margin strength and entry into data-center market.

- Generac (GNRC) +17.9% — Constructive 2026 outlook tied to data center demand.

- Mattel (MAT) -25.0% — Weak Q4 and disappointing 2026 operating income guidance.

- Lyft (LYFT) -17.0% — Softer Q1 EBITDA guidance.

- Zillow Group (ZG) -17.1% — Legal expenses and earnings miss weighed.

Consumer Staples

- Gilead Sciences (GILD) +5.8% — HIV franchise strength; Yeztugo guide conservative but in line.

Health Care

- Tenet Healthcare (THC) +17.3% — Earnings beat; solid EBITDA guide.

- Humana (HUM) -3.3% — Weak 2026 EPS guidance.

- Moderna (MRNA) -3.5% — FDA declined to review influenza vaccine application.

Financials

- Robinhood Markets (HOOD) -8.8% — Revenue and EBITDA miss despite EPS beat.

- Advisory/brokerage peers broadly lower on AI competition concerns.

Industrials

- Terex (TEX) +16.6% — Strong bookings and 2026 guide ahead.

- Science Applications International (SAIC) -16.0% — Preannouncement below consensus.

- Parsons (PSN) -14.2% — Revenue miss and Federal Solutions weakness.

- Martin Marietta Materials (MLM) -6.6% — EBITDA miss and softer guidance.

Materials

- Solstice Advanced Materials (SOLS) +17.4% — Datacenter, AI, and nuclear demand strength.

Energy

- Crude strength supported integrated and E&P names broadly, though individual moves were more modest relative to sector ETF gains.

Eco Data Releases | Thursday February 12th, 2026

S&P 500 Constituent Earnings Announcements | Thursday February 12th, 2026

Data sourced from FactSet Research Systems Inc.