February 13, 2026

S&P futures -0.4% in Friday morning trading after Thursday’s 1.6% decline marked a third straight down day for the S&P 500. Software and Mag 7 names led the downside, while trucking/logistics, CRE brokers, private equity, and banks also came under pressure. Defensives outperformed, with Utilities and Consumer Staples both up over 1%. Treasuries are slightly weaker this morning (yields +2 bp). The dollar is up 0.1%. Gold (+0.9%) and silver (+3.3%) are firmer, bitcoin futures are up 1.9%, and WTI crude is up 0.4%.

Markets continue to struggle for stabilization ahead of this morning’s CPI release despite constructive post-close earnings from several tech names and an FT report that the Trump administration may scale back some steel and aluminum tariffs. The broader AI narrative has increasingly turned into a market headwind, driven by mega-cap underperformance (capex scrutiny, FCF and buyback concerns, asset-light to asset-heavy transition) and an unrelenting disruption trade that has failed to attract sustained dip-buying. Positioning remains a focus as well, with concerns around stretched CTA longs following recent technical breaks, including the S&P 500’s 50-day moving average.

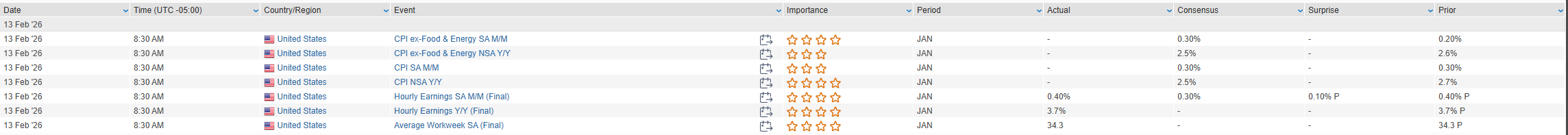

January CPI is due at 8:30 a.m. ET, with headline and core both expected at +0.3% m/m and +2.5% y/y. Looking ahead, next week’s calendar includes Empire manufacturing and housing sentiment Tuesday; housing starts, durable goods, industrial production, and FOMC minutes Wednesday; trade balance, claims, Philly Fed, and pending home sales Thursday; and PCE inflation, flash PMIs, and new home sales Friday.

Earnings movers:

- Applied Materials (AMAT) sharply higher on a strong beat and guidance for >20% growth in its semiconductor equipment business in 2026.

- Arista Networks (ANET) up big after raising growth guidance to +25% and easing margin concerns tied to memory costs.

- Airbnb (ABNB) boosted by strong gross bookings and EBITDA margin expansion.

- Expedia (EXPE) results mostly positive, though 2026 top-line guidance seen as underwhelming.

- Toast (TOST) weaker as solid Q4 was overshadowed by softer 2026 EBITDA guidance.

- Instacart (CART) higher on +14% GTV growth.

- Pinterest (PINS) fell on Q4 miss and weak Q1 guide.

- Dutch Bros (BROS) surged on a ~350 bp comp growth beat.

- DraftKings (DKNG) pressured by softer 2026 outlook.

- Coinbase (COIN) missed on softer crypto volumes, though profitability commentary constructive.

- Ingersoll Rand (IR) posted Q4 beat with solid order growth; guidance viewed as conservative.

- Rivian (RIVN) higher on improved gross margin and reaffirmed R2 timeline.

Other headlines:

- SEI Investments (SEI) rose on a rental agreement with Hatchbo.

- Humana (HUM) reportedly in advanced talks to acquire MaxHealth for ~$1B.

- Mattel (MAT) CEO purchased 65K shares.

U.S. equities sold off Thursday (Dow -1.34% | S&P 500 -1.57% | Nasdaq -2.03% | Russell 2000 -2.01%), reversing early gains and finishing near session lows as risk appetite deteriorated further. All major indices are now on track for weekly declines greater than 1%. The risk-off tone reflected continued AI-related disruption fears, renewed pressure on mega-cap tech, and broader deleveraging dynamics as volatility pushed back above 20.

Treasuries rallied meaningfully, reversing much of Wednesday’s post-payrolls yield backup. The 2-year yield fell 6 bp to 3.46%, the 10-year dropped 7 bp to 4.10%, and the 30-year declined 8 bp to 4.73%. The $25B 30-year auction was very well received, stopping through by 2.1 bp with strong bid-to-cover and foreign demand. The move followed Tuesday’s soft 3-year sale and Wednesday’s weak 10-year auction, stabilizing sentiment in rates.

Economic data were mixed. Initial jobless claims printed at 227K (in line with consensus), while continuing claims rose to 1.862M, above expectations. January existing home sales fell 8.4% m/m to 3.91M, well below the 4.105M consensus, with affordability improving but supply constraints persisting.

The dollar edged up 0.1% (DXY 96.92). Commodities weakened sharply: gold fell 3.1% to $4,938.8, silver plunged 9.8%, and WTI crude dropped 2.7% to $62.88. Bitcoin futures declined 3.1% to near $65K. Market breadth was decisively negative (NYSE 2.24:1 decliners; Nasdaq 2.68:1).

Macro themes driving the tape included AI disruption spreading beyond software into CRE brokers, trucking, and financial intermediaries; scrutiny of hyperscaler capex (asset-heavy transition from asset-light models); CTA downside convexity; and rising geopolitical risk tied to Iran and trade uncertainty. January CPI is due Friday (headline and core +0.3% m/m expected).

Month-to-date: Dow +1.14%, S&P -1.53%, Nasdaq -3.69%, Russell +0.08%.

Sector Highlights

Defensives led the relative performance table despite broad index declines. Utilities (+1.50%) and Consumer Staples (+1.29%) outperformed on the rate rally and defensive rotation. Real Estate (+0.31%) also held up comparatively well. Healthcare (-0.17%) was modestly lower but outperformed the broader market. Industrials (-1.20%), Communication Services (-1.46%), and Materials (-1.49%) declined but outpaced growth-heavy sectors.

Technology (-2.65%) led the downside amid continued pressure in software, networking, semis, and hardware. Energy (-2.17%) fell with crude weakness. Financials (-1.99%) were hit by AI competition fears in brokers, IBs, and real estate services. Consumer Discretionary (-1.58%) lagged on airlines, restaurants, casinos, and retail weakness.

Information Technology

- Fastly (FSLY) +72.3% — Strong Q4 and 2026 guidance; AI-driven traffic acceleration and large-customer momentum.

- Cognex (CGNX) +36.4% — Revenue beat; raised through-cycle margin target.

- Zebra Technologies (ZBRA) +8.6% — Q1 and FY26 guidance ahead; resilient margins.

- Cisco Systems (CSCO) -12.3% — Beat and raised guidance, but margins pressured by higher memory costs.

- AppLovin (APP) -19.7% — Beat and raised; concerns around elevated expectations and AI competition.

- Tyler Technologies (TYL) -15.4% — Miss and softer FY26 guide; AI disintermediation concerns cited.

- Bruker (BRKR) -11.6% — EPS miss and cautious FY26 outlook.

- Paycom (PAYC) Lower — 2026 guidance cut.

- Check Point Software (CHKP) Lower on earnings.

Communication Services

- Sphere Entertainment (SPHR) +22.1% — Revenue beat; operating income surged nearly 300% y/y.

- Live Nation Entertainment (LYV) +2.5% — Up following departure of DOJ antitrust head Gail Slater.

- Media names broadly weaker amid risk-off tone.

Consumer Discretionary

- McDonald’s (MCD) Higher — Strong Q4 comps; management commentary positive despite high bar.

- Crocs (CROX) +19.0% — Beat and raised; strong international growth.

- Restaurant Brands International (QSR) -6.2% — Margin pressure despite revenue beat.

- Birkenstock (BIRK) Lower on earnings.

- Casinos, airlines, and specialty retail broadly weak.

Consumer Staples

- UTZ Brands (UTZ) Lower on earnings.

- Off-price retail and grocery names relatively resilient.

Health Care

- Novocure (NVCR) +19.4% — FDA approval of Optune Pax device for pancreatic cancer.

- Viking Therapeutics (VKTX) +6.8% — Oral obesity drug advanced to Phase 3.

- BridgeBio Pharma (BBIO) +3.7% — Positive Phase 3 data.

- Baxter International (BAX) -16.0% — EPS miss and weak FY26 guidance.

- Inspire Medical Systems (INSP) -12.6% — Revenue guide cut.

Financials

- Brokers and advisory firms broadly lower on AI disruption concerns.

- Lincoln National (LNC) +5.6% — Sales growth and FCF outlook positive.

Industrials

- Howmet Aerospace (HWM) +6.0% — Record revenue; strong engine segment.

- Rollins (ROL) -10.5% — Organic growth miss.

- Martin Marietta Materials (MLM) -6.6% — EBITDA miss and softer guide.

- Trucking/logistics stocks under pressure on AI freight disruption concerns.

Materials

- Albemarle (ALB) Lower on earnings.

- Commodity complex broadly weak amid momentum unwind.

Energy

- Crude weakness drove declines across integrated and E&P names.

Eco Data Releases | Friday February 13th, 2026

S&P 500 Constituent Earnings Announcements | Friday February 13th, 2026

Data sourced from FactSet Research Systems Inc.