February 20, 2026

S&P futures are up 0.2% after Thursday’s pullback. Yesterday’s weakness was concentrated in private equity/private credit, big banks, life insurers, credit cards, airlines, and housing-related retail. Utilities and energy outperformed, along with machinery, E&Cs, A&D, and telecom.

Overnight, Asia was mixed: South Korea rallied over 2% (+5.5% for the week), while Japan and Hong Kong fell more than 1%. European markets are up ~0.5%. Treasuries are little changed. The dollar is slightly firmer. Gold +1%, silver +4%, Bitcoin futures +2%, and WTI crude -0.5%.

There is no clear macro catalyst this morning. Geopolitical tensions remain elevated, with reports President Trump could consider a limited strike on Iran to pressure negotiations. AI disruption and hyperscaler capex debates remain central themes, with spillover into private credit this week. Housing remains soft, though broader market stability continues to be underpinned by double-digit earnings growth, solid macro data, fiscal impulse, and constructive flow dynamics.

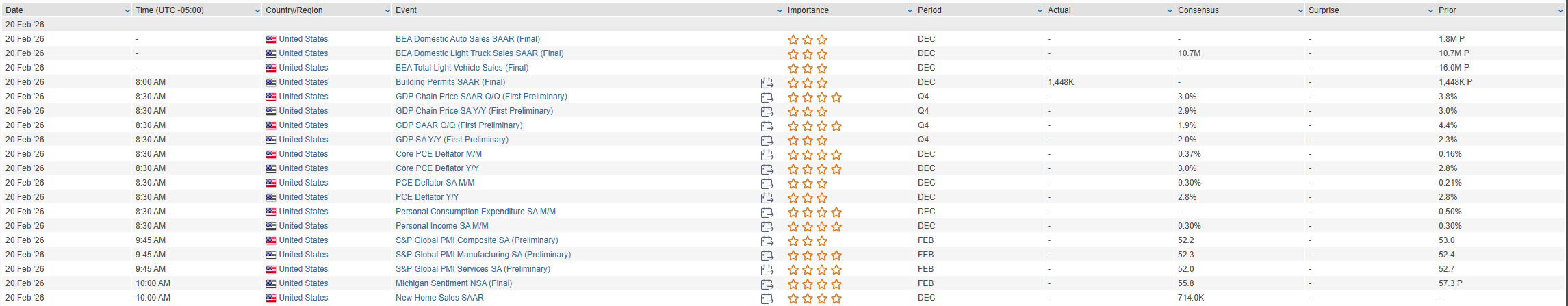

Today’s data includes Q4 GDP, personal income/spending, PCE inflation, flash PMIs, and final University of Michigan sentiment. Fed speakers Logan and Bostic are scheduled, and SCOTUS could release a ruling on tariff authority.

Company Highlights

- NVIDIA (NVDA) – FT reports company is close to finalizing a $30B investment in OpenAI, replacing last year’s proposed $100B long-term commitment.

- Amazon (AMZN) – FT reports AWS experienced at least two recent outages involving its AI tools.

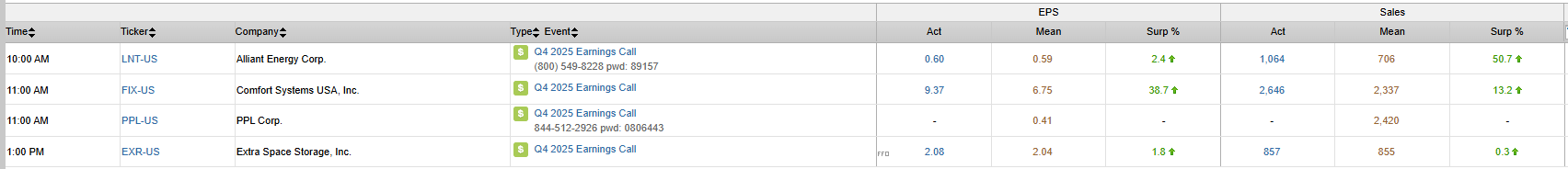

- FIX, LYV, EXR, GH, TXRH, FND, OLED, OPEN, ALRM, and TNDM – Among notable premarket gainers.

- NEM, LNT, AKAM, ST, PTCT, DBX, CC, and CARG – Among notable laggards.

U.S. equities finished mostly lower Thursday (Dow -0.54% | S&P 500 -0.28% | Nasdaq -0.31% | Russell 2000 +0.24%), though well off session lows, as markets balanced firmer economic data against geopolitical tensions and ongoing earnings dispersion.

Rates were little changed overall, with the long end marginally firmer (10-year 4.07%). The dollar strengthened modestly (DXY +0.2%). Commodities extended their recent move: WTI crude climbed another 2.4% to $66.73, building on Wednesday’s 4.5% surge amid escalating U.S.–Iran tensions. Gold finished roughly flat near $5,018, while silver edged higher. Bitcoin futures rose 1.4%.

Economic data again leaned constructive outside of housing. Initial jobless claims fell to 206K (vs 225K consensus), while continuing claims ticked higher but remained manageable. The February Philly Fed index surprised to the upside, though employment remained soft and prices paid improved. December trade widened to $73B from $53B. Housing remained a weak spot: January pending home sales declined 0.8% m/m despite improved mortgage affordability (rates now near 6.0%).

Fed commentary showed nuance. Governor Miran suggested he would revert his 2026 forecast to the September dot plot, implying 100 bp of cuts this year (down from his December 150 bp view), while Minneapolis Fed President Kashkari emphasized protecting Fed independence. Markets continue to monitor potential Supreme Court action on tariff authority and developments in U.S.–Iran negotiations, with President Trump indicating a decision window of roughly ten days.

Sector Highlights

Outperformers:

Utilities (+1.13%), Industrials (+0.77%), Energy (+0.64%), Communication Services (-0.04%), Materials (-0.21%), Healthcare (-0.28%)

Underperformers:

Financials (-0.86%), Technology (-0.53%), Consumer Discretionary (-0.53%), Consumer Staples (-0.38%), Real Estate (-0.33%)

Energy continued to benefit from geopolitical oil risk premium, while machinery and infrastructure-related names held up well. Financials and large-cap growth weighed on the broader indices. Small caps were comparatively resilient.

Information Technology

- Apple (AAPL) was a notable drag among mega-cap tech.

- EPAM Systems (EPAM) fell 17% on softer forward revenue growth guidance despite solid Q4 results.

- Salesforce (CRM) announced plans to acquire Momentum, a conversational AI platform.

- Symbotic (SYM) gained on an upgrade tied to accelerating deployments and AI leverage.

Financials

- Blue Owl Capital (OWL) dropped nearly 6% after selling $1.4B of direct-lending assets to manage liquidity concerns, renewing scrutiny on private credit.

- Larger-cap banks, investment banks, and credit card companies were broadly weaker.

Energy

- Occidental Petroleum (OXY) rose 9% on a Q4 beat, lower capex guidance, and dividend increase.

- Refiners and E&Ps broadly benefited from the continued oil rally.

Industrials

- Deere & Company (DE) gained 11.6% after beating and raising FY26 guidance, citing construction and small agriculture tailwinds.

- Quanta Services (PWR) advanced 6.7% on accelerating demand in its Electric segment and record backlog.

Consumer Discretionary

- Carvana (CVNA) fell 8% on softer retail gross profit per unit.

- Avis Budget Group (CAR) plunged 21% after missing EBITDA and booking a $518M EV fleet impairment.

- Wayfair (W) declined 13% on softer active customer trends.

- YETI Holdings (YETI) fell nearly 5% amid mixed guidance and tariff impact commentary.

- DoorDash (DASH) added 1.6% on solid GOV momentum and improving unit economics.

Consumer Staples

- Molson Coors Beverage Company (TAP) fell nearly 5% after guiding FY26 EPS well below consensus, citing persistent macro headwinds.

Communication Services

- Netflix (NFLX) reportedly considering raising its bid for Warner Bros. Discovery (WBD) if competing offers increase.

- Omnicom Group (OMC) gained 15% on strong geographic revenue growth and positive integration commentary.

Healthcare

- Hims & Hers Health (HIMS) announced plans to acquire Eucalyptus in a deal valued up to $1.15B.

- Hospitals and managed care names outperformed within the sector.

Closing Takeaways

Thursday’s session reflected digestion following Wednesday’s broad risk rally. Energy remained supported by geopolitical oil risk, while defensives and machinery showed relative resilience. Financials and consumer cyclicals lagged as earnings dispersion widened. Macro data continues to support a “solid but uneven” narrative—firm labor and manufacturing data offset by persistent housing softness—while geopolitical tensions and private credit scrutiny add new layers of volatility beneath a relatively stable index backdrop.

Eco Data Releases | Friday February 20th, 2026

S&P 500 Constituent Earnings Announcements | Friday February 20th, 2026

Data sourced from FactSet Research Systems Inc.