March 20, 2025

S&P futures are down 0.6% Thursday morning, giving back earlier gains after Wednesday’s rally saw the S&P, Nasdaq, and Russell 2000 all climb over 1%. Growth and momentum stocks led the move, with all 11 sectors finishing higher and the VIX dropping below 20 for the first time since February. Treasuries are firmer, with yields down 3-4 bps, while the dollar (+0.5%) and gold (+0.4%) tick higher. Bitcoin futures (-0.3%) and WTI crude (-0.1%) are slightly lower.

Macro sentiment remains cautious, with attention on ECB President Lagarde’s warning about Trump’s tariff plans impacting growth and inflation. Markets had initially extended gains on Fed takeaways viewed as positive, including Powell downplaying Michigan inflation expectations, tariff inflation impact being transitory, and ongoing economic strength. The QT taper was another bullish factor, alongside positioning dynamics, with CTAs net short and quarter-end rebalancing seen as supportive. However, the looming April 2 reciprocal tariff decision remains a key overhang.

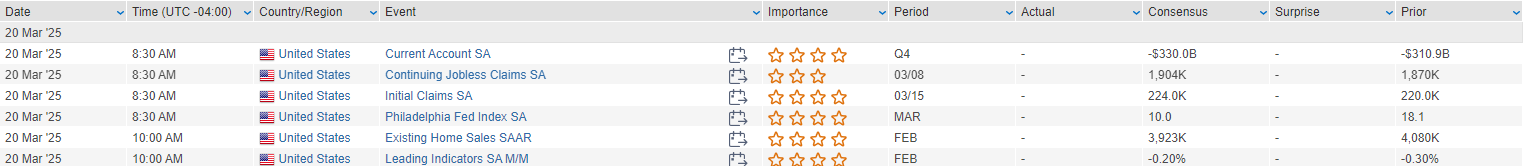

Key economic releases today include initial jobless claims (expected 224K, prior 220K), Philly Fed manufacturing (forecast +8.0, prior +18.1), and existing home sales (expected -3.4% after January’s -3.9%). No major data on Friday, but Fed’s Williams speaks at 09:05 ET. Next week’s calendar includes flash PMIs (Monday), consumer confidence & new home sales (Tuesday), durable goods (Wednesday), final Q4 GDP (Thursday), and PCE inflation (Friday).

Corporate Highlights

- Nvidia – CEO Jensen Huang said the company will invest hundreds of billions of dollars in U.S. chip manufacturing over the next four years as it restructures its supply chain.

- Tencent – AI strategy and monetization focus seen as positive, but stock lagged in Hong Kong on underwhelming AI investment guidance.

- Chevron – White House reportedly considering an extension of its license to pump oil in Venezuela.

- Five Below – Q4 EPS and comps beat, with Q1 guidance showing continued improvement and 2025 outlook factoring in tariff headwinds.

- Quanta Services – Secured deal to acquire Beacon Roofing Supply for $7.7B.

- ProAssurance – Agreed to be acquired by The Doctors Co. for $25/share in cash, a 60% premium, valuing the deal at $1.3B.

Notable earnings today include Accenture before the open, with FedEx, Nike, Micron, and Lennar reporting after the close

U.S. equities rallied Wednesday, with the S&P 500 gaining 1.08% and the Nasdaq up 1.41%, as markets reacted positively to the FOMC’s decision to slow quantitative tightening (QT) and the unchanged rate outlook. The Fed left rates at 4.25-4.50%, with Powell downplaying inflation risks from tariffs and reinforcing that inflation expectations remain stable. The median dot plot still signals 50 bp of cuts in 2025, while growth forecasts were revised lower and inflation projections ticked higher.

Treasuries were firmer, with the yield curve steepening. The dollar gained 0.3%, gold was little changed, and Bitcoin surged 3.9%. WTI crude edged up 0.2% despite reports of stronger Russian crude exports. Mag 7 rebounded, with TSLA and NVDA leading after their recent underperformance.

Trade uncertainty remains a key overhang, though lack of new tariff headlines provided some relief. Trump-Putin ceasefire discussions on Ukraine continued, but details remain vague. Meanwhile, Congress is scrutinizing Biden’s energy policies, with Trump meeting with top U.S. energy executives to discuss his “energy dominance” agenda.

On the corporate front, TSLA secured approval in California for a ride-hailing permit, while GOOGL confirmed its $30B acquisition of cybersecurity firm Wiz. Boeing (BA) CFO signaled better-than-expected Q1 free cash flow, and SIG posted strong earnings despite soft FY guidance.

Sector Performance & Notable Corporate Developments

Consumer Discretionary (+1.90%)

- TSLA (+4.7%) – Secured California approval for passenger ride-hailing services, moving closer to its robotaxi ambitions. Also upgraded at Cantor Fitzgerald on valuation.

- SIG (+17.3%) – Q4 earnings, revenue, and comps beat, though FY26 revenue and EPS guidance missed. Strong growth across all categories but noted a more cautious consumer outlook.

- WSM (-3.5%) – Q4 earnings and revenue exceeded expectations, but FY26 EPS guidance fell short. Dividend raised 16%; company flagged inventory adjustments.

Technology (+1.42%)

- GOOGL (-) – Confirmed its $30B acquisition of cybersecurity startup Wiz, one of the largest cybersecurity deals ever.

- NVDA (+4.5%) – Rebounded after recent weakness, with CEO Huang downplaying tariff risks and citing efforts to localize manufacturing.

- ADSK (+3.2%) – Starboard Value planning a proxy fight, per Reuters.

- INTC (-6.9%) – Reports that TSMC board has not discussed acquiring Intel’s foundry division pressured shares.

Industrials (+1.29%)

- BA (+6.8%) – CFO noted Q1 free cash flow could be “several hundred million dollars” better than expected.

- Road/rail and freight stocks lagged, with concerns over higher fuel costs and potential tariff spillover.

Energy (+1.59%)

- BTU (+6.2%) – Gained after Trump authorized new coal production initiatives, calling for “energy dominance”.

- Crude prices little changed despite reports of strong Russian crude exports.

Financials (+1.04%)

- AFRM (+9.2%) – Upgraded to buy at Compass Point, arguing that recent WMT/Klarna partnership selloff was overdone.

- PGR (-3.5%) – February results showed y/y growth in auto policies but some retention slippage, weighing on shares.

Healthcare (+0.02%)

- HQY (-17.1%) – Q4 revenue beat, but cybersecurity-related service costs weighed on margins; FY26 EBITDA guidance underwhelmed.

- GILD (-2.5%) – Reports that HHS may implement “major” funding cuts to HIV prevention programs pressured shares.

Consumer Staples (+0.12%)

- GIS (-2.1%) – FQ3 revenue and organic growth missed; noted inventory headwinds and slowing snacking demand. FY25 guidance cut amid tariff uncertainty.

Materials (+0.34%)

- MOS (+2.8%) – Upgraded to overweight from equal weight at Barclays after positive analyst day takeaways.

Other Sectors

- Real Estate (+0.07%) and Utilities (+0.29%) were relative laggards.

Looking Ahead

Markets will digest the Fed’s dovish QT signal and trade policy uncertainty as the April 2 reciprocal tariff decision looms. Trump-Putin negotiations continue, and energy policy remains in focus following Trump’s meeting with industry executives. Corporate earnings slow down, but updates from key consumer and industrial names will be watched for demand trends.

Eco Data Releases | Thursday March 20th, 2025

S&P 500 Constituent Earnings Announcements | Thursday March 20th, 2025

Data sourced from FactSet Research Systems Inc.