March 24, 2025

S&P futures are up 1.1% Monday morning, near premarket highs, following a mostly higher finish for U.S. equities last week. The S&P 500 and Nasdaq both broke four-week losing streaks, despite ongoing underperformance from big tech. Treasuries are weaker with yields up 3–4 bps, while the dollar index is down 0.2%. Gold is up 0.4%, Bitcoin futures are up 4.6%, and WTI crude is up 0.7%.

Markets are reacting positively to weekend headlines suggesting Trump’s 2-Apr tariff announcement may be narrower than initially expected, possibly excluding certain countries and industries. This follows Trump’s Friday comments signaling flexibility on reciprocal tariffs. However, trade policy remains a key overhang, with ongoing uncertainty viewed as a risk to Q1 and 2025 earnings estimates. Stretched valuations are also flagged as a concern, though positioning and quarter-end rebalancing flows are seen as tailwinds for equities.

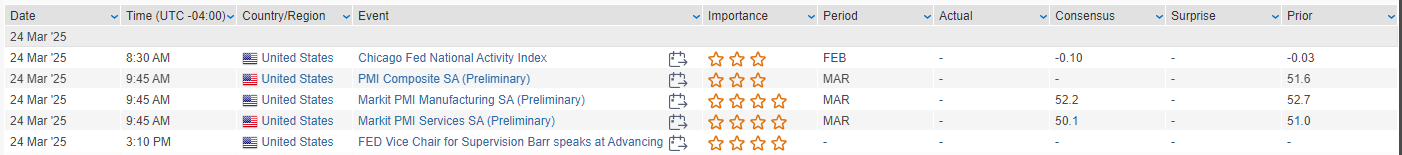

On the data front, flash PMIs for March are due this morning, with both manufacturing and services expected to remain in expansion. A busy macro week includes consumer confidence, new home sales, durable goods, final GDP, core PCE inflation, and multiple Fed speakers including Bostic, Barr, Williams, Kashkari, Musalem, and Barkin. The Treasury will auction $183B in 2-, 5-, and 7-year notes this week.

Corporate headlines are limited:

- META and OpenAI reportedly exploring AI partnerships with India’s Reliance Industries.

- Disney’s ‘Snow White’ remake underperforms at the box office after negative pre-release sentiment.

- KVUE said to be under activist pressure to pursue a sale or asset separation.

- AZEK to be acquired by James Hardie Industries in a ~$8.75B cash-and-stock deal.

- FNMA/FMCC in focus again amid reports of a potential executive order from the White House on housing privatization.

- RPD reportedly nearing settlement with activist investor Jana Partners

U.S. equities closed mostly higher on Friday, finishing near session highs in a quiet day for macro headlines. The S&P 500, Nasdaq, and Russell 2000 all posted weekly gains, breaking a four-week losing streak. While big tech rebounded modestly (aside from NVDA), cyclicals continued to show strength, particularly in areas like food, apparel, media, and financials. Underperformers included logistics, homebuilders, industrial metals, and several consumer discretionary subgroups.

The session saw little in the way of major developments, though Thursday’s after-hours earnings disappointments continued to weigh on sentiment. This added to existing concerns about a potential uptick in negative Q1 earnings preannouncements and the need for downward revisions to 2025 consensus estimates. The upcoming 2-Apr reciprocal tariff announcement remains a key macro overhang, though Trump said Friday there will be “flexibility” in how tariffs are implemented—offering some optimism for negotiated settlements.

On the flow side, several desks highlighted supportive dynamics, including continued CTA net short positioning and quarter-end rebalancing tailwinds. In addition, the latest flow data showed the largest weekly inflow into U.S. equities year-to-date, suggesting investors may be buying into the dip. Meanwhile, concerns over the growth slowdown were tempered somewhat by resilient hard economic data.

There were no major economic releases Friday, though Fed commentary resumed post-FOMC blackout. Chicago Fed’s Goolsbee stressed data dependence and said inflation and unemployment are both in uncomfortable zones, but not indicative of 1970s-style stagflation. NY Fed’s Williams echoed Powell’s tone, noting the Fed is well-positioned to adjust if needed and that inflation expectations remain anchored.

Looking ahead, next week is packed with data: flash PMIs on Monday; consumer confidence, Richmond Fed manufacturing, and new home sales on Tuesday; durable goods on Wednesday; final Q4 GDP and pending home sales on Thursday; and personal income/spending, core PCE, and final March University of Michigan sentiment on Friday. Treasury will also auction $183B in 2-, 5-, and 7-year notes throughout the week.

S&P 500 Sector Performance

- Outperformers: Communication Services +1.00%, Consumer Discretionary +0.63%, Technology +0.49%

- Underperformers: Real Estate –1.02%, Materials –1.00%, Utilities –0.66%, Energy –0.62%, Industrials –0.54%, Financials –0.39%, Health Care –0.30%, Consumer Staples –0.09%

Company-Specific News (by sector)

Information Technology

- Micron Technology (MU): Earnings and Q3 guidance beat, driven by HBM momentum and increased HBM TAM; however, soft gross margins and NAND pricing raised concerns. Stock also saw profit-taking after a strong YTD run.

- Super Micro Computer (SMCI): Upgraded to neutral from underweight at JPMorgan as financial uncertainty has passed; JPM noted upside from Blackwell server ramp.

Consumer Discretionary

- Nike (NKE): Q3 results beat, but Q4 guidance missed expectations due to restructuring and macro challenges. Analysts flagged markdown activity and potential tariff-related risks to margins.

- Lennar (LEN): Q1 EPS beat, but gross margin miss and Q2 GM guide disappointed. Company cited macro headwinds, including rate sensitivity and softening consumer confidence.

- Carvana (CVNA): Upgraded to overweight at Carvana; analyst cited used car market stability and opportunity for share gains.

- Cava Group (CAVA): Upgraded to overweight at JPMorgan, which sees significant expansion potential in underpenetrated U.S. markets.

Industrials

- FedEx (FDX): Mixed Q3; revenue beat driven by Ground, but EPS missed. FY guide cut more than expected due to weak U.S. industrial demand. Company highlighted cost-saving progress.

- Boeing (BA): Selected by the Trump administration for a next-gen fighter jet program worth over $20B, beating out Lockheed Martin.

- Lockheed Martin (LMT): Under pressure after losing out on the F-22 successor contract to Boeing.

Health Care

- Alnylam Pharmaceuticals (ALNY): FDA approved AMVUTTRA, the first treatment for ATTR-CM. Analysts see the news as a key inflection point for the company.

- Summit Therapeutics (SMMT): Initiated overweight at Cantor Fitzgerald; noted undervaluation and optimism around lung cancer drug ivonescimab.

- Valmont Industries (VMI): Downgraded to market perform at William Blair on tariff exposure and potential for weaker guidance.

Financials

- ProAssurance (PRA): Agreed to be acquired by The Doctors Co. for $25/share in a $1.3B cash deal, a 60% premium.

Consumer Staples

- Colgate-Palmolive (CL): Announced a $5B share repurchase program as part of ongoing capital return strategy.

Energy

- No notable movers reported.

Real Estate

- No notable movers reported.

Communication Services

- Planet Labs (PL): Missed on Q4 EPS; FY guide light, with macro and geopolitical headwinds flagged as near-term risks.

Eco Data Releases | Friday March 24th, 2025

S&P 500 Constituent Earnings Announcements | Friday March 24th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.