March 25, 2025

S&P futures are flat Tuesday morning, following Monday’s strong, broad-based rally that saw all major US indexes gain over 1.4%, the S&P 500 close above its 200-DMA, and ~85% of index constituents advance. High short interest, Mag 7, momentum, memes, and cyclicals led the way. However, low volumes and lingering skepticism about the upcoming April 2 tariff announcement being a true clearing event continue to temper enthusiasm. Tariffs remain a risk to Q1 and 2025 earnings estimates, while broader Trump 2.0 policy uncertainty remains a concern for both corporates and consumers.

Yields are up 2–3 bp across the curve, the dollar index is slightly higher, gold is up 0.4%, Bitcoin futures are down 1.1%, and WTI crude is up 0.5%.

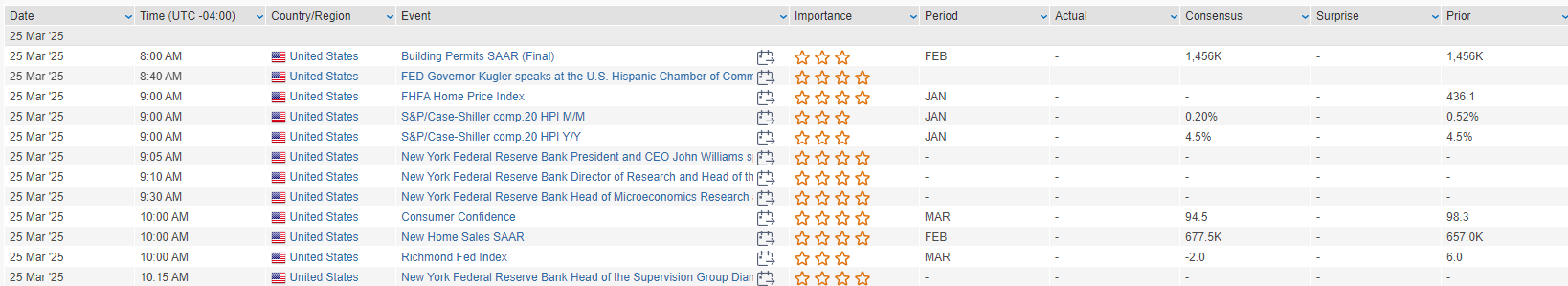

On the data front, today brings the Conference Board’s consumer confidence, Richmond Fed manufacturing, and new home sales. Fed’s Kugler and Williams are scheduled to speak, following Bostic’s hawkish comments Monday, where he projected only one rate cut this year. The Treasury kicks off $183B in issuance with $69B in 2-year notes today.

Key corporate updates:

- TSLA: EU sales fell again in February, down for a second consecutive month.

- BABA: Chairman warned of a potential bubble in AI data center spending.

- BA: Reportedly looking to withdraw its agreement to plead guilty in the 737 Max criminal case.

- CTAS: Ended acquisition talks with UNF, citing lack of meaningful engagement.

- CCI: Terminated CEO Steven Moskowitz; reaffirmed guidance following recent asset sales.

- SFD: Reported a solid earnings beat and announced a dividend.

- KBH: Missed on fiscal Q1 and cut FY25 guidance across the board, citing affordability issues and macro/geopolitical concerns.

U.S. equities closed sharply higher on Monday, with the S&P 500 and Nasdaq posting strong gains, continuing the momentum from last week’s rebound. The S&P is now ~6% off its February record high. The rally was led by the Mag 7 megacap group, marking its best session since January, with Tesla a standout performer. Broader gains were also supported by semiconductors, cruise lines, airlines, industrial metals, and financials, while defensives like utilities, consumer staples, and healthcare underperformed.

Bond yields rose with curve flattening; the 2Y yield moved back above 4% and the 10Y rose above 4.3%. The dollar index ticked up 0.2%. Gold slipped 0.2%, while Bitcoin futures jumped 5.1%, and WTI crude settled up 1.2%.

Markets were buoyed by trade headlines suggesting Trump’s 2-Apr reciprocal tariff announcement could be more targeted than feared, excluding some countries and sectors. While Trump hinted at more upcoming tariffs (on autos, chips, lumber, and pharma), the narrowed scope eased some pressure. However, uncertainty remains high, and the broader earnings outlook faces pressure from policy risk and still-stretched valuations. On the positive side, commentary on cleaner positioning, rebalancing flows, and potential rotation back into megacap growth helped underpin sentiment.

Economic data was mixed. The flash March PMIs showed strength in services, which hit a three-month high, while manufacturing slipped back into contraction. Notably, input costs surged, especially in manufacturing, though the report noted muted pass-through to selling prices. Fed’s Bostic trimmed his rate-cut forecast from two to one, while saying inflation will likely remain sideways. More Fed speak and key data points are due throughout the week, including consumer confidence, durable goods, GDP, core PCE, and $183B in Treasury issuance.

S&P 500 Sector Performance & Company Highlights

- Outperformers: Consumer Discretionary +4.07%, Communication Services +2.11%, Industrials +1.87%, Financials +1.79%

- Underperformers: Utilities +0.01%, Consumer Staples +0.66%, Health Care +0.76%, Energy +1.00%, Materials +1.24%, Real Estate +1.43%, Tech +1.71%

Information Technology

- Coherent rose after being upgraded to strong buy at Raymond James, which said market concerns were overblown and the optical telecom market is recovering.

- Pinterest was upgraded to buy at Guggenheim on expectations of accelerating monetization and healthy user growth.

- RPD reportedly reached a settlement with activist investor Jana Partners.

- META was in focus after reports it’s exploring a potential AI alliance with India’s Reliance Industries.

Consumer Discretionary

- Tesla surged, leading the Mag 7 group, as part of a broader megacap tech rally.

- Dutch Bros initiated at overweight at Morgan Stanley, citing unit growth potential and margin expansion.

- Nike underperformed on continued scrutiny after guiding Q4 revenue below expectations last week.

- Disney’s ‘Snow White’ remake disappointed at the box office following negative pre-release sentiment.

Financials

- Dun & Bradstreet agreed to be acquired by Clearlake Capital for $9.15/share in cash (~5% premium); deal includes a go-shop period and is expected to close in Q3.

- Fannie Mae and Freddie Mac rallied on reports the White House may issue an executive order directing a study of GSE privatization.

Industrials

- Boeing gained following reports it won the Air Force’s sixth-generation fighter jet program over Lockheed Martin; was also upgraded at Melius Research.

- FedEx bounced after a Jefferies upgrade, which highlighted attractive valuation and cost savings despite macro headwinds.

Health Care

- Alnylam Pharmaceuticals spiked after announcing FDA approval of AMVUTTRA for ATTR-CM, the first therapeutic for the condition.

- Lantheus to be acquired by Alcon in a newly announced M&A deal.

Real Estate

- No major updates.

Energy

- Trump extended Chevron’s deadline to halt operations in Venezuela.

- Trump also proposed a 25% tariff on countries purchasing oil from Venezuela.

Materials

- Nucor was upgraded to buy at UBS, which noted that tariff worries have weighed on the stock and steel pricing has improved.

- AZEK to be acquired by James Hardie Industries in an $8.75B cash-and-stock deal, valuing shares at ~$56.88—about 37% above the prior close.

- Valmont Industries downgraded at William Blair on tariff risk and outlook concerns.

- Embraer downgraded at Wolfe Research, citing full valuation and trade policy risk.

Communication Services

- OpenAI reportedly in talks for an AI alliance with Reliance Industries.

- Google’s acquisition of Wiz may signal a broader thaw in the tech M&A and IPO market.

Utilities

- No major developments.

Eco Data Releases | Tuesday March 25th, 2025

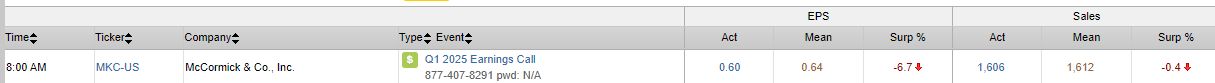

S&P 500 Constituent Earnings Announcements | Tuesday March 25th, 2025

Data sourced from FactSet Research Systems Inc.