March 26, 2025

S&P futures down 0.1% in Wednesday morning trading, following a mostly higher close for U.S. equities Tuesday, with the S&P posting a third straight gain. Leadership came from Mag 7, industrial metals, A&D, and banks, while pharma, retail, and parcel/logistics lagged. Notably, the equal-weight S&P underperformed, with ~55% of constituents declining.

Overnight, Asian markets were mostly higher, led by South Korea, Japan, and Australia, while mainland China lagged. Europe is weaker, down ~0.7%. Treasuries are slightly softer, yields up ~1 bp. Gold is down 0.1%, Bitcoin futures up 0.1%, and WTI crude up 0.6%. The Dollar Index is flat.

Macro headlines remain limited, with attention still centered on the 2-Apr reciprocal tariff announcement. While earlier reports suggested a narrower approach, recent commentary has been less positive, leading to skepticism about the potential for a “clearing event”. Ongoing Trump 2.0 policy uncertainty remains a major theme, though some progress in Washington toward a debt ceiling deal tied to reconciliation has been noted.

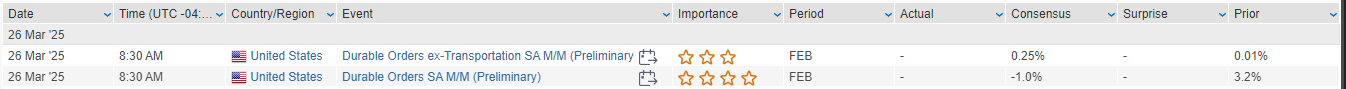

Today’s focus is February durable goods orders, expected to decline 1%, and core capital goods to come in flat. Fed’s Kashkari and Musalem also speak today. Treasury to auction $70B in 5-year notes. Later this week: final GDP, pending home sales (Thursday), core PCE inflation, and consumer sentiment (Friday).

Key corporate updates:

- DLTR confirmed sale of Family Dollar to a PE group for ~$1B.

- GME rallied post-earnings after adding Bitcoin to its treasury.

- WOR beat on revenue, EBITDA, and EPS; emphasized strong execution amid tariff uncertainty.

- HUMA down sharply after a discounted 25M secondary offering.

- NVDA faces a reported $17B annual risk from possible China chip restrictions.

- QCOM reportedly filed antitrust complaints against ARM abroad.

- BA fraud trial set for June 23.

U.S. equities ended slightly higher Tuesday in a subdued session, following Monday’s broad-based rally. The S&P 500 and Nasdaq extended their win streaks to three sessions, supported by improving sentiment around trade and positioning. However, gains were muted as investors continue to weigh the potential market impact of Trump’s April 2 reciprocal tariff announcement. Reports suggest a possible two-step rollout, with immediate tariffs imposed under emergency powers and longer-term actions under Section 301.

On the data front, consumer confidence dropped more than expected, marking the fourth straight monthly decline, while Richmond Fed manufacturing slipped into contraction. New home sales rose 1.8% in February, roughly in line with expectations.

Meanwhile, Fed commentary was cautious: Governor Kugler favored holding rates “for some time” as goods inflation lingers, echoing Bostic’s Monday comments reducing his rate-cut forecast to just one in 2025.

Treasuries strengthened, with the 2Y auction stopping through. The Dollar Index slipped –0.1%, Gold gained +0.3%, Bitcoin futures declined –0.5%, and WTI crude edged down –0.2%.

Sector Highlights & Stock Movers

Information Technology (S&P Tech +0.29%)

- NET (Cloudflare) +2.9%: Upgraded to Buy at BofA, which sees NET emerging as a leader in AI-as-a-service with strong network security traction.

- CRWD (CrowdStrike) +3.3%: Upgraded to Buy at BTIG, citing improved visibility post-IT outage and potential for reaccelerated growth in 2H26.

- MBLY (Mobileye) +8.7%: Surged after Volkswagen said it would use Mobileye’s L2+ ADAS in its new vehicle lineup.

Consumer Discretionary (S&P Cons. Disc. +0.98%)

- CVNA (Carvana) +3.8%: Upgraded to Overweight at Morgan Stanley; analysts cited strong execution, FCF generation, and growth in retail and fleet channels.

- LYFT (Lyft) +2.2%: Rose after activist Engine Capital disclosed a stake and began pushing for operational and strategic changes.

- KBH (KB Home) –5.2%: Declined after Q1 EPS miss and weaker guidance; flagged affordability and macro uncertainty.

- UNF (UniFirst) –14.3%: Dropped sharply as CTAS ended acquisition talks, citing inability to engage meaningfully on key terms.

Communication Services (S&P Comm. Svcs. +1.43%)

- DJT (Trump Media) +8.9%: Jumped after announcing a partnership with Crypto.com to launch Truth.Fi-branded ETFs.

- WYNN (Wynn Resorts) +1.4%: Gained after major shareholder Tilman Fertitta bought 1.7M additional shares.

Financials (S&P Financials +0.49%)

- No other notable gainers or decliners in financials reported.

Industrials (S&P Industrials +0.10%)

- BA (Boeing): In focus again after reports it is trying to withdraw from 737 Max plea deal; no price reaction noted.

- UPS (United Parcel Service) –5.1%: Downgraded at BofA; Q1 EPS forecast cut on softening demand tied to tariff risk and weather; noted volumes stalled in February–March.

- PNR (Pentair) +1.5%: Upgraded to Outperform at Baird on valuation, strong cycle dynamics, and margin-expansion potential.

Materials (S&P Materials +0.03%)

- No notable stock-specific movers in the sector, though the group was broadly flat amid copper tariff concerns and hot-rolled coil price rallies.

Health Care (S&P Healthcare –1.29%)

- No major individual stock news, but broader weakness in biotech and pharma weighed on the sector.

Real Estate (S&P Real Estate –1.22%) / Utilities (S&P Utilities –1.61%)

- CCI (Crown Castle) –3.7%: Fell after announcing CEO termination; interim leadership named, guidance reaffirmed.

Other Notables Across Sectors:

- OKLO (Oklo, Inc. – Industrials-adjacent) –6.4%: Reported wider Q4 loss and flagged material weakness in internal controls; planning to expand powerhouse capacity to 75MW.

- SFD (Smithfield Foods – Consumer Staples): EPS beat and dividend announcement seen as a bright spot.

- BABA (Alibaba – Comm. Svcs./Tech): Chairman warned of bubble in AI data center buildout, weighing on sentiment in China tech names

Eco Data Releases | Wednesday March 26th, 2025

S&P 500 Constituent Earnings Announcements | Wednesday March 26th, 2025

Data sourced from FactSet Research Systems Inc.