April 1, 2025

S&P futures are down 0.5% following a modest rebound in U.S. equities on Monday, which saw defensives outperform—consumer staples, energy, and financials led, while the Mag 7 continued to lag. Treasuries are firmer with yields down 1–5 bp, curve flattening. Dollar is off 0.1%, gold up 0.5%, bitcoin futures up 2.1%, and WTI crude slightly higher (+0.1%).

Markets remain in a holding pattern ahead of Trump’s “Liberation Day” reciprocal tariff announcement on Wednesday. While Trump says a plan is finalized, reports continue to suggest multiple options are in play, including a potential ~20% universal tariff. This uncertainty, along with concern about additional sector-specific levies, is keeping sentiment cautious. Reports also suggest renewed friction among congressional Republicans on reconciliation.

Key Economic Events This Week:

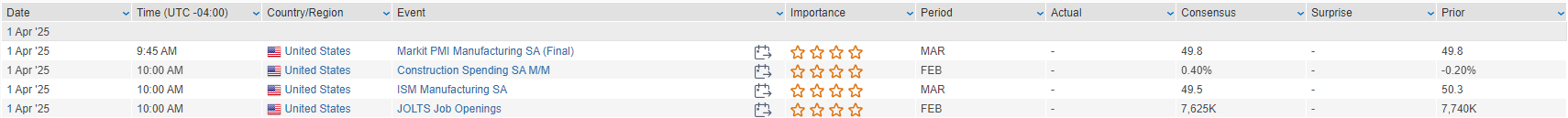

- Tuesday: ISM Manufacturing, final US manufacturing PMI, JOLTS job openings, construction spending, Richmond Fed’s Barkin (speaks today).

- Wednesday: ADP payrolls, factory orders, Fed’s Kugler, Trump’s tariff announcement.

- Thursday: ISM services, jobless claims, trade balance, Fed’s Jefferson & Cook.

- Friday: Nonfarm payrolls, Fed Chair Powell, Fed’s Barr & Waller.

Corporate Highlights:

- JNJ hit after court rejects its third attempt to use bankruptcy for talc litigation resolution.

- BA reportedly reduced 737 Max production pace due to wing system issues.

- BDX is in discussions with peers about selling its $21B life sciences unit (FT).

- WBD added an independent board member following activist pressure.

- PVH jumped on a strong Q4 beat, upbeat FY25 guidance, and a $500M accelerated buyback.

- PRGS rallied after Q1 beat, raised Q2 and FY25 guidance, with positive commentary on ShareFile integration.

U.S. equities finished mostly higher on Monday, rebounding from Friday’s sharp selloff that pushed the S&P 500 into correction territory and capped a volatile March. The S&P 500 gained 0.55%, while the Dow rallied 1%. However, the Nasdaq dipped 0.14% as big tech remained under pressure, notably from ongoing tariff fears and AI spending slowdown narratives. The Russell 2000 rose 0.56%, suggesting some rotation into smaller caps.

Markets opened cautiously amid a flurry of weekend headlines focused on President Trump’s trade policy and his reiteration of a “more onerous” approach to reciprocal tariffs expected to be unveiled on April 2. His remarks also raised concerns about Russia and Iran tensions. Despite the hawkish tone, markets found support from month- and quarter-end rebalancing flows, which helped lift cyclicals and defensives alike.

Economic data was mixed. The March Chicago PMI came in better than expected, reaching its highest level since November 2023, while the Dallas Fed Manufacturing Index tumbled to a post-July 2024 low with sentiment metrics pointing to growing uncertainty. Around 35% of Chicago PMI respondents said they are raising prices due to tariffs—highlighting growing inflation pass-through concerns.

In Fedspeak, NY Fed President Williams said the Fed can afford to wait on policy adjustments but acknowledged tariffs could impact inflation. Richmond Fed President Barkin emphasized caution and cited uncertainty around global trade policy. Market expectations now reflect ~75 bps of rate cuts for 2025, though longer-dated Treasuries are rallying faster than those expectations suggest.

Other themes included further scrutiny on AI spending (weighing on semis), consumer demand risks (especially in luxury goods), and geopolitical concerns (Panama Canal deal blocked by China, rising U.S.-Russia tensions).

Notable Stock Performance

Health Care (+0.90%)

CORT (+109.1%) surged after announcing that its Phase 3 ROSELLA trial met the primary endpoint for relacorilant in patients with platinum-resistant ovarian cancer.

PCVX (−45.6%) dropped sharply as Phase 2 VAX-24 infant data came in below analyst expectations.

MRNA (−8.9%) fell after the resignation of Dr. Peter Marks, the FDA’s top vaccine scientist, raising questions about vaccine oversight.

Financials (+1.25%)

COOP (+14.5%) rallied after Rocket Companies (RKT) announced a $9.4B all-stock acquisition of the mortgage lender, expected to close in Q4.

RKT (−7.5%) declined as investors weighed dilution risk and the execution burden tied to the COOP acquisition.

Consumer Staples (+1.63%)

CELH (+5.9%) climbed following an upgrade to Buy at Truist, which cited strong positioning in the women’s energy drink market post-Alani Nu acquisition.

Information Technology (+0.03%)

NVDA (−1.2%) edged lower after The Information reported that companies are expected to slow AI infrastructure spend and shift toward lower-cost, more efficient models.

Consumer Discretionary (−0.18%)

LULU (−14.2%) dropped after Q4 comps missed and FY guidance came in below expectations, with FX and tariff headwinds cited.

GOOS (−3.5%) was downgraded at Barclays on global macro concerns, seasonality risks, and expected tariff impacts.

TSLA (−1.7%) fell after Stifel cut its price target to $455 from $474, citing lower delivery growth expectations and ongoing sentiment risks related to Elon Musk.

Industrials (+0.64%)

No major corporate news, but the sector benefitted from defensive rotation and declining yields boosting transport and defense stocks.

Real Estate (+0.88%)

Gains were driven by lower long-end Treasury yields and quarter-end rebalancing flows, which favored yield-sensitive assets like REITs.

Energy (+1.07%)

Energy stocks rose with WTI crude prices climbing 3.1%, supported by geopolitical tensions and data showing U.S. oil production fell to an 11-month low in January.

Materials (+1.07%)

Strength in the sector was underpinned by gold’s 1.2% rally to a fresh record close, as investors sought inflation hedges amid tariff and macro uncertainty.

Utilities (+1.06%)

The sector saw gains from the combination of falling bond yields and investor rotation into defensive, rate-sensitive names.

Communication Services (+0.24%)

DIS remained under pressure as reports surfaced that the FCC is investigating the company’s DEI-related policies. Sector broadly underperformed amid caution around ad-spending and regulatory scrutiny.

Eco Data Releases | Tuesday April 1st, 2025

S&P 500 Constituent Earnings Announcements | Tuesday April 1st, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.