April 9, 2025

U.S. equity futures are lower this morning, with S&P 500 down 0.4% and Nasdaq off 0.6%, following a historic reversal Tuesday that saw the S&P drop over 1.5% after gaining more than 4% intraday. The index is now nearly 19% below its February high. Global markets remain pressured—Taiwan fell 6% and Japan nearly 4%, while China outperformed on policy support headlines. European markets are down over 2%.

Treasuries remain weak with the 10Y yield hovering near 4.50% after Tuesday’s sharp selloff; curve steepening continues. The dollar index is down 0.6%, gold is up 2.4%, and WTI crude is down 3.3%, extending losses to new multi-year lows. Bitcoin futures are slightly higher.

Market volatility is being driven by persistent tariff uncertainty, mixed White House messaging, and fears of a structural rebalancing in global trade. Companies are beginning to raise prices, and strategists are cutting earnings forecasts. Liquidity concerns are rising, especially in bonds, amid growing scrutiny of basis trades and Treasuries’ haven status.

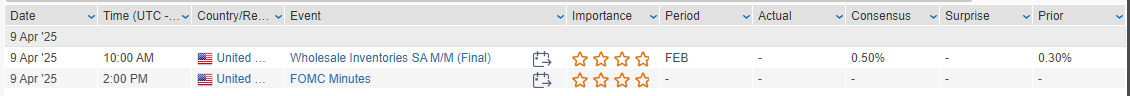

Key events today include February wholesale inventories, Richmond Fed President Barkin’s comments at 11:00 a.m. ET, and the March FOMC minutes at 2:00 p.m. The Treasury will auction $39B in 10-year notes—closely watched after a weak 3-year sale Tuesday.

Premarket Movers:

- BTU (+9.2%) – Said it is reviewing strategic options for recently acquired Anglo American coal assets.

- CALM (-2.3%) – Q3 EPS missed; announced $258M acquisition of Echo Lake Foods.

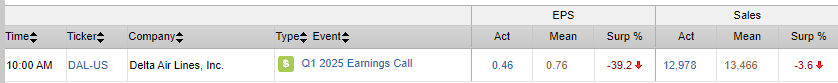

- DAL (-3.8%) – Q1 earnings in focus after preannouncement flagged macro and policy uncertainty headwinds.

- TRNO (-2.1%) – Reported decline in occupancy, though investment trends seen as solid.

- STZ (unch) – Reports earnings after the close.

U.S. equities extended their recent slide in another highly volatile session, Dow (0.84%), S&P 500 (1.57%), Nasdaq (2.15%), Russell 2000 (2.73%). The S&P 500 closed lower for the fourth straight session and at its lowest since February 2024, now down 19% from its February highs. The Nasdaq has declined 24% from its December peak. Market volatility was driven by the official confirmation that 104% tariffs on Chinese goods will take effect at 12:01 ET on April 9 after China failed to reverse its 34% retaliatory tariffs. China vowed to respond.

Though earlier headlines suggested openness to negotiation—with Trump referencing “positive” talks with South Korea and Treasury Secretary Bessent suggesting 70+ countries had reached out—the messaging remained mixed. Trump’s stance that “China badly wants a deal” but must act first added to confusion. Meanwhile, the White House reaffirmed the tariffs would go into effect as planned, overshadowing hopes for de-escalation.

NFIB small business sentiment dropped 3.3 points in March to 97.4, below its 51-year average, citing lower sales expectations amid policy uncertainty. The $58B Treasury auction of 3-year notes tailed, with further supply coming Wednesday ($39B in 10s) and Thursday ($22B in 30s). Treasuries saw a steepening curve; the 30Y yield spiked Monday and stayed elevated Tuesday.

Fed commentary continued to reflect concern over tariffs. Goolsbee noted the magnitude of tariffs poses inflation risk, while Daly warned of slowing progress on inflation. Kugler said inflation expectations have already ticked higher.

Company News by GICS Sector

Information Technology (Tech) (-2.17%)

- AVGO (+1.2%): Authorized a $10B share buyback, offering support amid sector-wide weakness.

- TSMC (TSM): Reportedly may pay $1B+ settlement to resolve a U.S. export control investigation (Reuters).

- AAPL (notable laggard): Continuing reports of ramped-up production shifts to India, which has lower tariffs than China.

Healthcare (+1.06%)

- CVS (+5.9%), HUM, UNH: Benefited from news of a meaningful increase in Medicare reimbursements for 2026. CVS also announced a CFO transition, reaffirming FY25 guidance.

- PCRX (+14.7%): Rallied on a favorable settlement with Fresenius over Exparel litigation, removing a key overhang.

Financials (+0.41%)

- VIRT (-6.6%): Downgraded to Underweight by Morgan Stanley; firm cited declining retail engagement and pressure on market-making revenue.

- Moneycenter banks and exchanges held up better on the day.

Industrials (+0.89%)

- GBX (-11.4%): Missed on FQ2 revenue and EPS; cut FY revenue guidance citing product mix concerns. Orders and deliveries also fell sequentially.

- RPM (-9.1%): Missed across all major FQ3 metrics and guided Q4 below consensus; blamed weather impacts and raw material inflation concerns.

- BA: Delivered 130 aircraft in Q1, its best quarterly delivery number in over a year.

Consumer Discretionary (-2.54%)

- SIG (-7.1%): Downgraded to Equal Weight at Wells Fargo, citing consumer sensitivity and macro headwinds.

- LEVI: Up on Monday after beating EPS and maintaining FY25 outlook; no major update today.

- PLAY: Q4 sales light, but company noted improving trends in March/April.

Energy (-2.48%)

- BTU (+9.2%): Surged on reports Trump will sign executive order to support coal use and production, citing AI-driven electricity demand.

- WTI crude fell 1.8% to close at a 3-year low, and continued selling after the close.

- Keystone pipeline shut down in North Dakota due to rupture (AP).

Materials (-2.96%)

- SHC (-3.6%): Subsidiary Sterigenics reached settlement on 97 ethylene oxide claims for ~$30.9M.

- Chemicals, industrial metals broadly underperformed with growth fears and tariff risk pressuring sentiment.

Real Estate (-2.46%)

- No major company-specific headlines, but sector broadly weaker alongside yield volatility and macro growth concerns.

Consumer Staples (+1.35%)

- Held up relatively well as defensive positioning continued. No major stock-specific headlines.

Utilities (+0.49%)

- Another relative outperformer on safe-haven rotation.

Communication Services (+1.25%)

- No standout single-name movers but sector benefitted from rotation into perceived higher-quality large caps amid volatility.

Eco Data Releases | Wednesday April 9th, 2025

S&P 500 Constituent Earnings Announcements | Wednesday April 9th, 2025

Data sourced from FactSet Research Systems Inc.