April 10, 2025

S&P futures down 1.6% in early trading, pulling back after Wednesday’s massive rally that saw the S&P 500 gain 9.5%—its best session since October 2008—and the Nasdaq 100 surge 12%, adding over $2T in market cap. Treasuries are firmer across the curve after a recent jump in yields. The dollar index is down 0.9%, gold is up 1.8%, Bitcoin futures down 1%, and WTI crude off 2.6%.

Markets are giving back some of yesterday’s rally, much of which was driven by oversold technicals, short-covering, and optimism following Trump’s 90-day pause on most reciprocal tariffs. However, trade policy volatility remains a key overhang, especially with the 10% universal tariff still in place and escalating U.S.-China tensions. Fiscal concerns are also resurfacing after House Speaker Johnson scrapped a planned vote on the Senate’s reconciliation bill due to internal GOP resistance. Meanwhile, Fed officials continue to push back on early rate cuts, citing risks to inflation expectations.

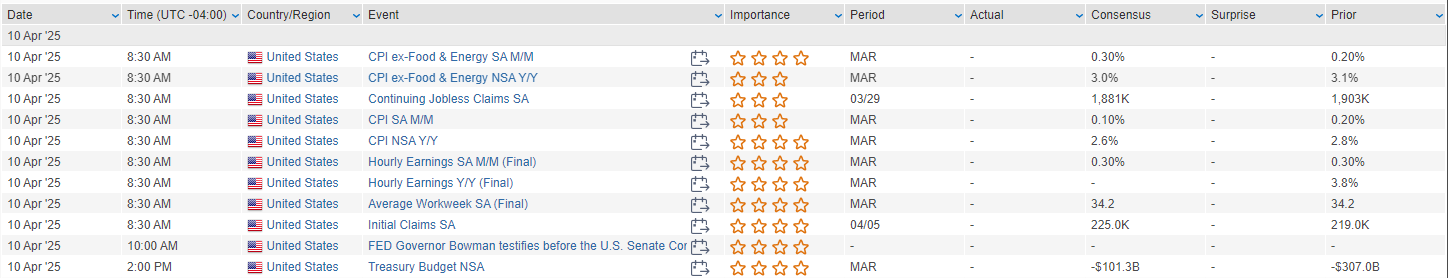

On the economic front, March CPI and weekly jobless claims are due this morning. Street expects headline CPI at +0.1% m/m and core CPI at +0.3% m/m, both slightly cooling y/y. Fedspeak will be heavy today with Logan, Schmid, Goolsbee, and Harker, plus Bowman’s confirmation hearing. Also in focus: a $22B 30-year Treasury auction. Friday brings March PPI and preliminary Michigan sentiment data, with Fed speakers Musalem and Williams also scheduled.

Corporate Highlights:

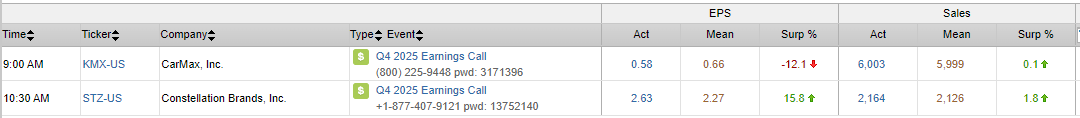

- KMX: EPS missed expectations.

- MSFT: Confirmed delays or pauses in AI data center projects.

- TSM: Q1 sales beat on AI/smartphone demand, though tariff frontloading flagged.

- COST: March comps +6.4%, beating expectations with strong traffic and online growth.

- STZ: Mixed Q4; F26–F28 beer guidance came in soft.

- X: Hit by Trump remarks opposing deal with Japan’s Nippon Steel.

- HOG: Major shareholder board rep resigns over management direction.

- MODG: Selling Jack Wolfskin to Anta Sports for $290M

U.S. equities staged a historic rally Wednesday (Dow +7.87%, S&P 500 +9.52%, Nasdaq +12.16%, Russell 2000 +8.66%), snapping a four-day losing streak with the S&P 500 posting its biggest single-day gain since October 2008 and the Nasdaq recording its second-best session ever. The VIX dropped below 35 after briefly touching 57 earlier in the week. Markets surged after President Trump announced a 90-day pause on higher reciprocal tariffs for 90 countries, excluding China, where tariff rates were raised to 125% effective immediately. Trump credited the pause to nations’ willingness to negotiate and their lack of retaliation, though analysts noted market turmoil likely played a role, highlighting the enduring presence of the “Trump put.”

Despite the rally, underlying risks remain: the 10% universal tariff is still in place, U.S.–China trade tensions are escalating, and inflation concerns continue to limit the Fed’s room to ease. Fed commentary underscored this, with Kashkari stating tariffs raise the bar for cuts, Musalem forecasting growth well below trend, and Barkin warning of rising prices and job losses by June.

Treasuries sold off sharply with the 2Y yield up 18 bps as bond markets digested trade headlines and supply pressure. However, today’s $39B 10Y auction was well received, contrasting with Tuesday’s weak 3Y sale. The dollar was flat, while gold rose 3%, Bitcoin jumped 7.9%, and oil rallied 4.7%. Copper surged 7%, helped by tariff-driven supply risk and AI infrastructure optimism.

On the global stage, the European Union retaliated with 10–25% tariffs on $23B of U.S. goods, effective mid-April. More rounds are planned through December, although EU officials signaled openness to suspending the tariffs if negotiations progress.

Company & Sector Highlights

Information Technology (Tech +14.15%)

- NVDA (+18.7%): Rallied after NPR reported the White House is walking back planned H20 AI chip export restrictions; Nvidia reportedly agreed to new U.S. AI investments.

- AVGO (+1.2%): Approved a $10B share buyback authorization.

Consumer Discretionary (Consumer Disc. +11.36%)

- DAL (+23.4%): Q1 EPS at high end of preannounced range; Q2 guide light, FY guide withdrawn due to tariff uncertainty, but profit still expected.

- WMT (+9.6%): Reaffirmed Q1 and FY26 guidance at analyst day; emphasized flexibility on pricing strategy amid tariffs.

- SMPL (+9.2%): Q2 revenue and EPS beat; GM expected to decline in H2 from higher input and tariff-related costs.

Financials (+7.59%)

- LNC (+14%): Announced $825M strategic investment from Bain Capital, including a 9.9% equity stake and long-term asset management partnership.

Materials (+8.63%)

- BTU (+8.9%): Said it is reviewing all options related to its pending acquisition of Anglo American’s steelmaking coal assets.

- NEOG (–28.7%): Missed on Q4 earnings and revenue, cut FY25 outlook, cited macro uncertainty and tariff effects; also announced CEO transition.

Healthcare (+4.34%)

- CVS, UNH, HUM (not listed but referenced): Boosted by news of higher Medicare reimbursement rates for 2026.

Industrials (+8.97%)

- TRNO: Reported occupancy decline but noted strong operating and investment metrics.

Consumer Staples (+4.21%)

- CALM: Q3 EPS missed, announced $258M acquisition of Echo Lake Foods.

- STZ: Scheduled to report earnings after the close.

Energy (+7.47%)

- WTI crude: Rose 4.7% to $63.50, bouncing from Tuesday’s selloff.

- Keystone Pipeline: Owner declared force majeure after oil spill.

Communication Services (+9.99%)

- No major single-stock headlines, though the sector benefited broadly from the tech-driven rebound.

Utilities (+3.91%)

- Underperformed in risk-on rally due to their defensive nature and rising bond yields pressuring yield-sensitive stocks.

Real Estate (+5.74%)

- Recovered with broader market; no major company-specific headlines.

Eco Data Releases | Thursday April 10th, 2025

S&P 500 Constituent Earnings Announcements | Thursday April 10th, 2025

Data sourced from FactSet Research Systems Inc.