April 16, 2025

S&P futures are down 0.5% in early Wednesday trading, though off the lows. This follows a mostly lower U.S. session Tuesday, with weakness across chemicals, food/beverage, apparel, and logistics. Banks, semis, and defensives held up better. Treasuries are firmer with curve steepening, the dollar index is down 0.6%, gold is up 2.5%, Bitcoin futures are down 0.3%, and WTI crude is up 1.1%.

Global markets are weaker across the board. Asian equities were mostly lower overnight, led by a nearly 2% drop in Hong Kong and a 1% decline in Japan. European markets are also under pressure, down around 0.8%, continuing the cautious tone amid ongoing trade tensions and macro headwinds.

Trade remains the key overhang. NVDA announced a $5.5B write-down tied to new U.S. export restrictions on its H20 AI chips, while AMD was also hit with fresh licensing requirements. Although the market had recently focused on potential tariff off-ramps (including the 90-day pause, electronics exemption, and Trump’s hints at auto tariff relief), the latest headlines reflect deepening U.S.-China tensions. A Bloomberg report said the Trump administration aims to use upcoming trade negotiations to isolate China’s economy in return for U.S. tariff reductions. However, China may be open to talks and has appointed a new trade envoy, providing a slight offset to the negative tone.

- ASML missed on bookings and cited heightened tariff-driven macro volatility

- UAL beat Q1 and reaffirmed FY25 EPS in a stable scenario; also provided recession scenario guidance

- JBHT topped estimates with strong Intermodal revenue, though noted continued uncertainty in TL freight

- OMC cut midpoint of its FY organic growth guide by 50 bps due to macro uncertainty

- META reportedly failed in efforts to get Trump to intervene in ongoing FTC antitrust case

- TSLA‘s Cybercab and Semi production may be delayed due to tariffs, according to Reuters

U.S. equities slipped Tuesday in a quiet session (Dow -0.38%, S&P 500 -0.17%, Nasdaq -0.05%, Russell 2000 +0.11%), unable to hold modest early gains. Defensive positioning remained a theme as concerns around trade and inflation lingered. Treasuries firmed again, extending Monday’s rally. The dollar gained 0.5%, gold rose 0.4%, Bitcoin futures fell 1.2%, and WTI crude eased 0.3%.

Markets remain focused on trade headlines. The White House formally launched national security probes into pharmaceuticals and semiconductors, paving the way for potential tariffs. While expected, the news came alongside signs of little progress in US-EU trade talks, raising concerns some tariffs on the bloc may remain in place. At the same time, some optimism persists around “off-ramps,” including exemptions and ongoing trade discussions with Japan and China. However, U.S.-China tensions escalated, with Beijing reportedly ordering airlines to halt BA aircraft deliveries and parts purchases from U.S. firms.

April’s Empire State manufacturing index came in at -8.1, better than expected but still negative. Price components rose for the fourth straight month, reaching two-year highs, and future expectations dropped sharply, hitting the second-lowest level in survey history. Import prices for March fell 0.1%, while export prices were flat—both softer than expected.

Fedspeak: No commentary during the session, though Fed Governor Cook was scheduled to speak late Tuesday. She previously noted inflation risks skewed to the upside but maintained a “patience” stance on policy.

Sector Performance (April 15, 2025)

- Outperformers: Tech (+0.34%), Real Estate (+0.23%), Financials (+0.23%), Utilities (+0.05%)

- Underperformers: Consumer Discretionary (-0.80%), Healthcare (-0.69%), Consumer Staples (-0.67%), Materials (-0.63%), Communication Services (-0.56%), Industrials (-0.53%)

Sector Highlights

Information Technology

- ERIC (+8.3%): Q1 EBITDA topped estimates on strong margins despite 100 bp tariff headwind; management noted no major inventory build ahead of tariffs.

- HPE (+5.1%): Elliott Management disclosed a ~$1.5B stake; exploring options to enhance shareholder value.

- AMD: Reportedly fielding revised offers for its AI server assembly plants.

- HUBS (+3.7%): Upgraded to Buy at UBS following a 35% pullback; cited conservative 2025 guide and macro upside potential.

- ALGM (-9.7%): ON withdrew takeover bid due to lack of engagement.

- MBLY (-4.5%): Downgraded to Equal Weight at Barclays amid auto sector pressure and tariff impact.

- XRAY (-4.1%): Downgraded at Morgan Stanley; cited slow innovation, share loss, and tariff overhang.

Communication Services

- NFLX (+4.8%): Reportedly targeting $1T market cap by 2030, aiming to double revenue and triple operating income.

- META, GOOGL: Ongoing regulatory scrutiny highlighted by NYT ahead of antitrust trials.

- OpenAI: Reportedly developing a social media platform to rival X.

Financials

- BAC (+3.7%): Q1 beat on revenue and EPS; NII better, Equities standout; Q4 NII guidance unchanged, viewed positively.

- C (+1.8%): Beat on earnings, better NII and fee income; credit softer, but services and markets performance solid.

- PNC: Slight beat on NII/NIM.

- GS (prior day): Beat on revenue with record Equities performance; announced $40B buyback.

Consumer Discretionary

- LOW: Acquiring Artisan Design Group for $1.325B.

- APLD (-35.9%): Revenue miss on cloud services disruption; margins below consensus.

- CROX (-1.9%): Internal memo flagged cost-cutting amid supply chain volatility.

Industrials

- BA (-2.4%): Beijing reportedly ordered airlines to halt new aircraft deliveries and parts purchases.

- CAT: CEO Jim Umpleby to be succeeded by COO Joe Creed; Umpleby will become Executive Chairman.

- RKLB (+10.1%): Selected for hypersonic test launches by U.S. and U.K. defense programs.

Health Care

- JNJ: Beat estimates; raised FY sales but held EPS flat due to $400M in tariff-related costs.

- AMGN: Ongoing antitrust suit related to biosimilar access.

- DVA (-3.0%): Hit by ransomware attack on April 12; operations impacted.

- UHS (-1.9%): Downgraded at Baird; cited policy overhang and limited near-term interest in the space.

Consumer Staples

- ACI (-7.6%): Q4 beat with pharmacy and digital strength, but FY25 EPS guidance below consensus.

- DOW (-4.1%): Downgraded to Underperform at BofA; flagged macro softness, trade risks, and margin pressure.

- PEP (-2.7%): Downgraded at BofA; said Frito-Lay growth to remain below trend, limited upside through 2026.

- COTY (-8.5%): Downgraded to Underperform at BofA; flagged weakening growth and consumer share losses.

Energy

- BP: CNBC noted as a potential takeover target.

- HWM (-2.4%): Downgraded at Wells Fargo on valuation concerns amid slower economic growth.

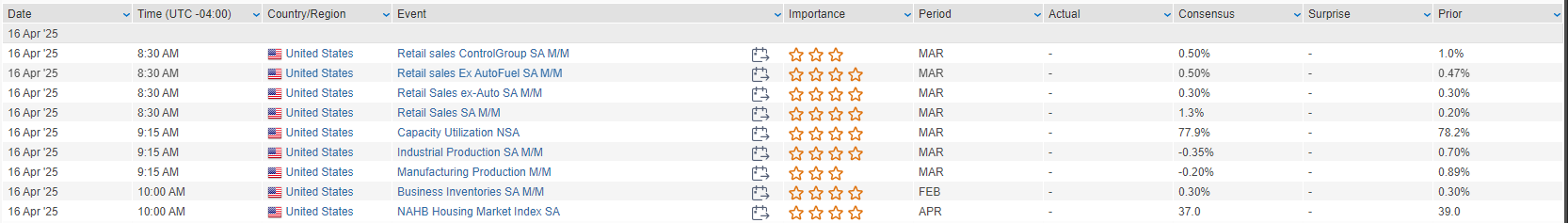

Eco Data Releases | Wednesday April 16th, 2025

S&P 500 Constituent Earnings Announcements | Wednesday April 16th, 2025

Data sourced from FactSet Research Systems Inc.