April 17, 2025

S&P futures are up 0.4% in early Thursday trading, off session highs. This follows a sharp selloff in U.S. equities on Wednesday, led by semis and select mega-cap tech, while defensives held up and the equal-weight S&P outperformed by ~100 bps. Treasury yields are up 2–3 bp, while the dollar index is up 0.1%. Gold is off 0.1% after Wednesday’s 3.5% surge. Bitcoin is flat, and WTI crude is up 1.2%.

Trade headlines remain the primary market catalyst. Sentiment got a slight boost from Trump’s post touting “big progress” in U.S.-Japan trade talks, though details remain sparse. Tech is getting a lift from TSM’s strong earnings and upbeat AI commentary, helping ease pressure after semis were hit by escalating U.S.-China trade tensions on Wednesday.

However, Fed independence concerns reemerged after Trump called on Powell to cut rates and hinted at replacing him. Combined with lighter volumes ahead of the long weekend and pervasive Trump 2.0 policy uncertainty, markets remain fragile. The Street is beginning to more aggressively trim earnings estimates, with guidance updates increasingly cautious.

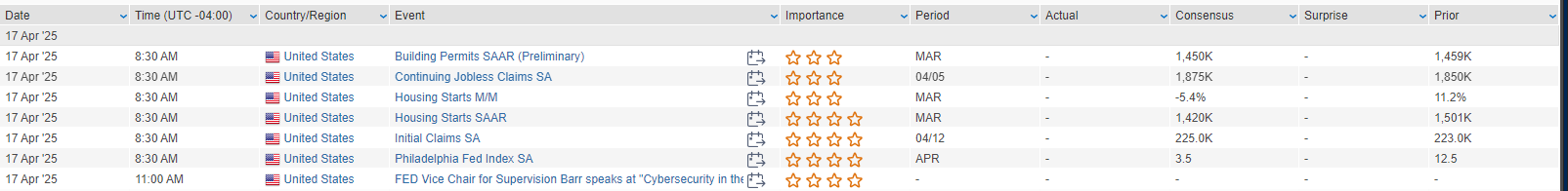

On today’s calendar: Initial jobless claims, March housing starts, and April’s Philly Fed manufacturing index. Fed Governor Barr speaks on cyber risk at 11:45 ET. President Trump meets Italian PM Meloni—his first face-to-face with a European leader since the tariff announcement. The ECB is expected to deliver another 25 bp rate cut this morning.

Corporate Highlights:

- TSM beat Q1, guided Q2 above, and left FY guidance unchanged despite tariff noise. AI demand remains strong.

- UNH missed and cut full-year guidance.

- CSX missed on EPS with network pressure cited, though demand commentary was more positive.

- DHI missed, citing a softer spring selling season and lowered FY guidance.

- SNA missed and flagged growing macro headwinds.

- AA posted better EBITDA but weaker FCF, with tariff risks under focus.

- REXR beat on Q1, reaffirmed FY25 FFO guide on strong leasing.

- SLG beat on FFO with improved leasing takeaways.

- F said it may need to raise prices without tariff relief.

- PINS reportedly explored a major acquisition to boost ad revenue, per The Information.

U.S. equities closed lower on Wednesday (Dow -1.73% | S&P 500 -2.24% | Nasdaq -3.07% | Russell 2000 -1.03%), with the S&P 500 and Nasdaq dragged by weakness in big tech, notably NVDA. The equal-weight S&P significantly outperformed the cap-weighted version. Sector laggards included semis, software, media, trucking, and asset managers, while energy, REITs, managed care, and precious metals miners outperformed.

Trade tensions with China were the dominant macro concern. New U.S. export restrictions on AI chips resulted in a $5.5B write-down from NVDA, while AMD also warned of an $800M charge. Reports also detailed the White House’s broader strategy to isolate China’s economy via a new wave of tariffs and trade deals. Meanwhile, Beijing reportedly halted BA deliveries and is slashing U.S. imports. On a more positive note, China signaled conditional openness to resuming trade talks and named a new envoy.

Fed Chair Powell reiterated that recent tariffs are “significantly larger than expected” and will likely push inflation higher and growth lower. Still, he maintained the Fed is in a position to wait for more clarity. Other Fed speakers echoed caution, with Cleveland’s Hammack backing a steady-rate stance amid tariff uncertainty.

On the data front, March retail sales rose 1.4% m/m, ahead of expectations, aided by auto strength likely tied to pre-tariff demand. However, control group sales were slightly below consensus. Industrial production fell more than expected, while the NAHB Housing Market Index beat but showed weaker sales expectations.

Treasuries strengthened further with curve steepening. The dollar index fell 0.9%, gold surged 3.3% to new highs, Bitcoin futures rose 0.5%, and WTI crude climbed 1.8%.

Sector Highlights

Technology (-3.94%) was the worst-performing sector, as new U.S. export restrictions hammered semis and AI names. Consumer Discretionary (-2.69%) and Communication Services (-2.48%) followed, driven by weakness in large-cap tech, media, and advertising names. On the flip side, Energy (+0.80%) led the gains amid rising crude prices and optimism around global demand resilience. Utilities (+0.93%), Healthcare (+1.00%), and Consumer Staples (+1.15%) also outperformed in a defensive rotation, supported by falling yields. Financials (+1.57%) were a bright spot as bank earnings continued to surprise positively. Industrials (+1.38%) fared relatively well despite weakness in transport, while Real Estate (-0.16%) and Materials (-0.77%) were mixed, with precious metals strength helping offset some broader macro pressure.

Information Technology

- NVDA -6.9%: Announced up to a $5.5B write-down related to U.S. export restrictions on H20 AI chips.

- AMD -7.4%: Said new U.S. export curbs could lead to ~$800M in charges for MI308 products.

- ASML -7.1%: Beat on Q1 EPS and revenue, but bookings missed by ~30% and Q2 guidance was soft; flagged tariff-related macro headwinds.

Financials

- IBKR -9.0%: Missed on EPS and revenue; higher comp expenses and lower NII weighed. Announced 4:1 stock split, hiked dividend.

- TRV +1.1%: Q1 beat with better-than-expected combined ratio despite elevated catastrophe losses; raised dividend.

- BAC +3.7%, C +1.8% (prior day): Continued tailwind from positive earnings and loan growth.

Industrials

- JBHT -7.7%: Q1 beat, but commentary around freight recovery uncertainty and contract losses weighed on sentiment.

- LMT +1.6%: Upgraded to Overweight at Morgan Stanley; cited strong demand and potential for $1T U.S. defense budget.

- BA -2.4% (prior day): Under pressure from reports China ordered airlines to halt Boeing deliveries and parts purchases.

Healthcare

- ABT +2.8%: Q1 EPS beat; reaffirmed FY25 guidance; strong performance from Medical Devices, but Covid testing and China sales soft.

- HTZ +56.4%: Soared after Pershing Square disclosed a new 12.7M share position.

- XRAY -4.1% (prior day): Downgraded at Morgan Stanley due to macro, innovation concerns, and tariff uncertainty.

Consumer Discretionary

- OMC -7.3%: Cut FY organic growth guidance; cited client delays and macro uncertainties.

- TSLA – reported: Cybercab and Semi truck production at risk due to tariffs; California registrations -15% y/y.

- LYFT – minor move: Acquired European mobility app FreeNow for ~$197M.

- GO +5.3%: Upgraded at Jefferies; cited economic resilience and operational improvements.

Consumer Staples

- PEP -2.7% (prior day): Downgraded at BofA; cited slowing Frito-Lay growth and limited upside to EPS through 2026.

Energy

- No major stock-specific standouts, though sector outperformed broadly (+0.80%) on continued oil strength.

- Macro: U.S. crude stocks rose despite high exports; China increasingly shifting to Canadian imports due to U.S. tensions.

Communication Services

- META -0.8% (implied): Press highlighted failed attempt by Zuckerberg to get Trump to intervene in FTC antitrust case.

- NFLX +4.8% (prior day): Reportedly targeting $1T market cap, tripling operating income by 2030.

- OMC -7.3%: Public relations revenue soft due to cuts from government clients.

Eco Data Releases | Thursday April 17th, 2025

S&P 500 Constituent Earnings Announcements | Thursday April 17th, 2025

Data sourced from FactSet Research Systems Inc.