April 23, 2025

S&P futures +2.1% in early trading following Tuesday’s strong rally where all major U.S. indexes rose at least 2.5%, with ~98% of S&P 500 stocks and all 11 sectors finishing higher. The Mag 7 snapped a five-day losing streak, and high-short-interest and cyclical names led the move. Asian and European equities followed through with strong gains overnight. Treasuries are mostly firmer with a curve-flattening move. Dollar little changed. Gold down 2%. Bitcoin futures up 3.3%. WTI crude up 1.6%.

Macro Drivers

Markets are rebounding on easing Fed fears and softer trade tone from President Trump. On Tuesday evening, Trump said he does not plan to fire Fed Chair Powell, blaming media speculation, though he reiterated his preference for rate cuts. He also suggested tariffs on China would come down significantly if a deal is reached, and emphasized a cooperative approach in upcoming Beijing talks.

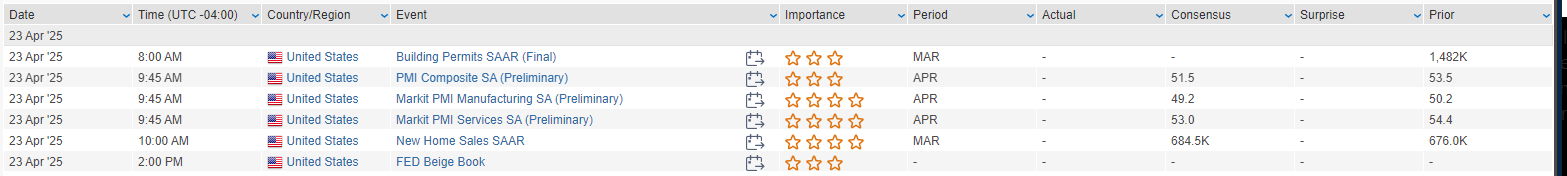

Earnings remain in focus with some Q1 uncertainty still present, but many companies have highlighted tariff mitigation measures that support full-year guidance. Today’s macro highlights include April flash PMIs and the Fed’s Beige Book. A full slate of Fedspeak is expected from Kugler, Goolsbee, Musalem, and Waller. The Treasury will auction $70B in 5-year notes after a soft 2-year auction on Tuesday.

Looking ahead, Thursday features durable goods, jobless claims, existing home sales, and more Treasury supply. Friday brings final University of Michigan sentiment and inflation expectations. U.S.–Japan trade talks also continue this week.

Company News

- TSLA: Q1 results weak but largely anticipated; stock up on reiterated Robotaxi/affordable vehicle timelines. Musk said he’ll reduce time at DOGE starting in May.

- SAP: Surged on a strong Current Cloud Backlog beat; FY guidance unchanged.

- ISRG: Strong procedure growth; flagged margin headwinds from tariffs.

- BMY: Declined after disappointing Phase 3 trial data for an antipsychotic treatment.

- INTC: Reportedly preparing 20%+ workforce reduction.

- COF: Beat on lighter provisions; PPNR light on higher expenses.

- VRT: Rallied on upbeat AI infrastructure demand signals.

- STLD: Record steel shipments highlighted.

- PKG: Q1 beat but Q2 guide light, citing trade uncertainty.

- ENPH: Pressured amid IRA repeal risks.

- MANH: Beat and said it hasn’t seen softening services demand.

- WFRD: Q1 modestly better, but FY guidance lowered on macro outlook

U.S. equities staged a strong rebound on Tuesday (Dow +2.66%, S&P 500 +2.51%, Nasdaq +2.71%, Russell 2000 +2.71%), with broad-based gains and the S&P 500 snapping a three-out-of-four session losing streak. The rally was powered by signs of potential trade progress, stabilizing long-end rates, and improving sentiment around earnings resilience despite the tariff overhang. All three major indexes rose more than 2.5%, while gains were particularly robust in financials, consumer discretionary, and communication services.

Momentum was helped by a Politico report suggesting the White House is nearing general trade agreements with Japan and India, albeit light on specifics. Treasury Secretary Bessent added fuel to the rally with comments in a closed-door session suggesting the tariff standoff with China is unsustainable and that de-escalation is expected, although formal negotiations have yet to begin. His remarks come after weeks of escalating U.S.-China trade tensions and fears of a prolonged Cold War–style decoupling.

Despite macro positives, the April Richmond Fed Manufacturing Index missed expectations, with declines in new orders and shipments, and rising price pressures—supporting growing stagflation concerns. Fedspeak included cautious remarks from Minneapolis Fed’s Kashkari and Richmond’s Barkin, both noting risks around inflation expectations becoming unanchored.

Other macro focal points this week include Wednesday’s flash PMIs, the Fed Beige Book, and Thursday’s durable goods orders and existing home sales. Friday rounds out the week with the final University of Michigan consumer sentiment and inflation expectations data.

Sector Highlights & Notable Earnings

Information Technology

- GE (+6.1%): Beat on Q1 EPS; revenue slightly light but reaffirmed FY guidance including tariff headwinds. Cost controls and commercial-services backlog noted as offsets.

- CALX (+13.1%): Q1 beat and better Q2 guide; $100M buyback announced. Strong BXP customer adoption highlighted.

- HXL (-4.3%): Q1 miss and cut FY25 guidance, citing commercial aerospace delays and potential tariff drag.

Financials

- IVZ (+8.3%): Q1 beat with strategic partnership and $1B repurchase from MassMutual. Dividend raised.

- HBAN, KEY (not listed today but previously positive on guidance)

- ZION (-1.1%): Missed on PPNR; flagged weaker loan demand and higher expenses.

- DFS (+3.6%): Continued positive sentiment after COF received final regulatory approvals for acquisition.

Industrials

- MMM (+8.1%): Q1 beat on margins; reiterated FY EPS guidance and added $1B to buyback. Mitigation plans for tariffs in place.

- RTX (-9.8%): Despite Q1 beat and reaffirmed guide, stock sold off on warning of potential $850M tariff hit.

- PHM (+8.4%): Q1 beat; FY guide trimmed slightly, but order trends improved intra-quarter on lower rates.

- HRI (-8.2%): Missed on EBITDA; flagged macro-sensitive project delays, though FY guide maintained.

Consumer Discretionary

- FSLR (+10.5%): Solar stocks surged after U.S. announced duties on imports from SE Asia.

- BHC (+10%): Carl Icahn boosted stake to ~34% via equity swap deals.

- TSLA (-5.8%): Pressured after Reuters reported delay to cheaper Model Y and slower Cybertruck production.

- ETSY (+3.1%): Disclosed agreement to sell Reverb Holdings (terms undisclosed).

- WMG (-4.8%): Downgraded at Morgan Stanley, citing overly optimistic growth assumptions.

- AMZN (-3.1%): Downgraded at Raymond James; tariff risks and investment headwinds flagged.

Healthcare

- LLY (unch): Earlier news of oral GLP-1 progress continues to underpin stock.

- DHR (+3.8%): Q1 beat; core bioprocessing and diagnostics cited as strengths.

- DGX (+6.8%): Beat and raised cash flow guidance; demand rebound noted.

- MEDP (-2.3%): Q1 bookings missed, though FY25 revenue guide raised. $1B buyback authorized.

Communication Services

- NFLX (+1.5%): Beat on Q1; no material tariff impact to date. Macro resilience and ad ramp among positives.

- GOOGL (not listed but previously flagged): Facing antitrust scrutiny after DoJ lawsuit over ad tech.

Energy

- DVN (+5.8%): Announced business optimization plan with $1B pre-tax FCF improvement target by 2026.

- HAL (-5.6%): Missed on margins and FCF despite in-line EPS; U.S. Land activity and Gulf completions down sharply.

Eco Data Releases | Wednesday April 23rd, 2025

S&P 500 Constituent Earnings Announcements | Wednesday April 23rd, 2025

Data sourced from FactSet Research Systems Inc.