April 24, 2025

S&P futures down 0.3% Thursday morning, off earlier lows, following a strong two-day rally that saw the S&P 500 notch its first back-to-back 1%+ gains since the election. Wednesday’s strength was led by the Mag 7, shorted names, and retail favorites. Treasuries are firmer (yields down 2–3bp), the dollar index is off 0.6%, gold up 1.6%, Bitcoin futures down 1.4%, and WTI crude up 0.5%.

Markets are slightly defensive again as tariff and Fed concerns reemerge. China said there are no active trade talks and called for the U.S. to scrap unilateral tariffs as a precondition. Reports also suggest China is preparing for a long-term standoff, even as auto parts tariff relief circulates. On the Fed, Trump said he may call Chair Powell to push for rate cuts. Meanwhile, tax policy debates are flaring up again, with both Trump and Speaker Johnson opposing higher taxes on $1M+ earners, potentially complicating budget reconciliation efforts.

Earnings remain mixed.

- CMG flagged weaker consumer spending, with comps unexpectedly down.

- TXN beat and guided up, citing an industrial recovery.

- NOW saw strong cRPO growth and gave a conservative but stable guide.

- IBM fell on soft software growth and consulting signings.

- LRCX beat and raised guidance, reiterated it’s outpacing peers.

- ORLY beat on comps but saw margin pressure from investment.

- URI left its guide unchanged and announced a $1.5B buyback.

- LUV scrapped guidance and reduced capacity outlook.

- WHR reiterated guidance and highlighted margin expansion despite macro uncertainty.

- RHI dropped sharply on a miss and weak guidance, citing elongated hiring cycles and project delays.

On the data front, this morning includes weekly jobless claims, March durable goods, and existing home sales. Fed’s Kashkari speaks after the close. Treasury will sell $44B of 7-year notes, following a strong 5-year auction. Also, U.S.–Japan trade talks continue today, with Friday bringing the final April University of Michigan sentiment and inflation expectations.

U.S. equities extended their strong rebound Wednesday, marking a second straight day of gains across all major indexes. The S&P 500 rose 1.67%, led by tech and consumer discretionary names, while the Nasdaq climbed 2.50%, snapping a five-day losing streak. Market breadth was strong, with nearly 98% of S&P 500 components finishing higher. The Mag 7 led gains, with TSLA a standout. Short covering and renewed risk-on sentiment helped power the move.

Global markets were buoyed by President Trump’s post-close comments Tuesday, where he confirmed he has no plans to fire Fed Chair Powell and signaled that tariffs on China could be reduced substantially if a deal is reached (though not to zero). A Wednesday morning report added that the White House is weighing a cut to current 145% China tariffs by more than 50%, further fueling hopes of de-escalation. However, officials emphasized any changes would be part of a broader negotiation, not unilateral moves.

Economic data was mixed. The April flash composite PMI came in weaker than expected at 51.2, with services slowing and manufacturing surprising to the upside at 50.7. Business sentiment remains soft, with tariffs and macro uncertainty weighing on the outlook. March new home sales printed well ahead of expectations at a 724K SAAR, the strongest since July 2023. The Fed’s Beige Book described economic activity as “little changed,” but flagged broad-based concerns over trade policy and persistent price pressures.

The dollar rallied 0.9%, marking its strongest day of 2025 so far. Treasuries were mixed with a curve-flattening move, and the 10Y yield held steady near 4.56%. Gold slumped 3.7%, while Bitcoin futures jumped 2%, pushing back above $92K. Crude oil fell 2.2% following headlines that some OPEC+ members are considering accelerating output increases.

Company Highlights by Sector

Information Technology (XLK +2.92%)

- SAP (+7.6%) rallied on strong cloud backlog (+29%) and reaffirmed FY guidance despite tariff headwinds.

- VRT (+8.5%) beat on revenue and EPS; management cited strong AI-related demand and improved backlog.

- APH (+8.2%) exceeded expectations on strength in IT datacom; Q2 guide also came in above consensus.

- MANH (+5.9%) reported upside surprise across metrics; emphasized resilient services demand and raised guidance.

- INTC (+5.4%) advanced on reports of a planned 20%+ workforce reduction and trade de-escalation hopes.

Consumer Discretionary (XLY +2.76%)

- TSLA (+5.3%) bounced despite weak Q1 results; investors focused on Robotaxi/affordable EV timeline and Musk’s plan to reduce government work commitments.

- PM (+2.3%) rose after volume growth beat expectations; smoke-free products and ZYN volumes cited as drivers.

- FUBO (-2.8%) fell on reports the DOJ is probing Disney’s deal with Hulu over competition concerns.

Healthcare (XLV +0.54%)

- ISRG (+1.9%) beat across the board and raised FY procedural growth guidance.

- BSX (+4.0%) reported strong Cardiology segment growth; Q2 guide raised.

- BMY (-2.6%) declined after disappointing Phase 3 trial data for schizophrenia drug Cobenfy.

Industrials (XLI +1.25%)

- BA (+6.0%) beat expectations despite continued challenges in China and regulatory hurdles; analysts viewed results as “better than feared.”

- STLD (+4.3%) rose on record Q1 steel shipments and positive backlog momentum.

- GEV (+3.1%) saw strength in Power segment orders and reaffirmed FY guidance.

- OTIS (-6.7%) lagged on weak China sales; raised FY revenue but maintained EPS outlook.

Financials (XLF +1.18%)

- COF (+3.6%) beat on EPS; credit quality improved, and management reiterated positive outlook post-Discover merger.

- MBLY (+9.5%) upgraded to neutral at BNP; viewed as less exposed to tariffs given fabless model.

- PEGA (+28.8%) surged after delivering strong Q1 results, record FCF, and upbeat GenAI commentary.

Energy (XLE -0.27%)

- ENPH (-15.6%) plunged on soft Q2 guidance and margin compression from tariffs and policy uncertainty.

- HAL (-5.6%) missed on EBITDA and North American revenue; analysts flagged margin softness.

- DVN (+5.8%) gained after announcing a $1B optimization plan aimed at FCF improvements.

Materials (XLB +0.02%)

- PKG (+0.2%) Q1 beat but Q2 guidance light, citing global trade tensions.

- LII (-9.0%) despite EPS beat, flagged weak Building Climate segment and tariff impact.

- AVY (-2.6%) EPS miss and weak materials volume drove decline.

Communication Services (XLC +2.27%)

- DIS (flat) in focus amid DOJ probe of FUBO-Hulu merger.

- CHKP (-3.8%) beat but guided Q2 revenue slightly below consensus; mixed analyst takeaways.

Consumer Staples (XLP -0.42%)

- KMB (-1.5%) declined on lighter-than-expected revenue and cautious comments on supply chain pressures.

- PM (+2.3%) outperformed on strong volume growth and raised guidance.

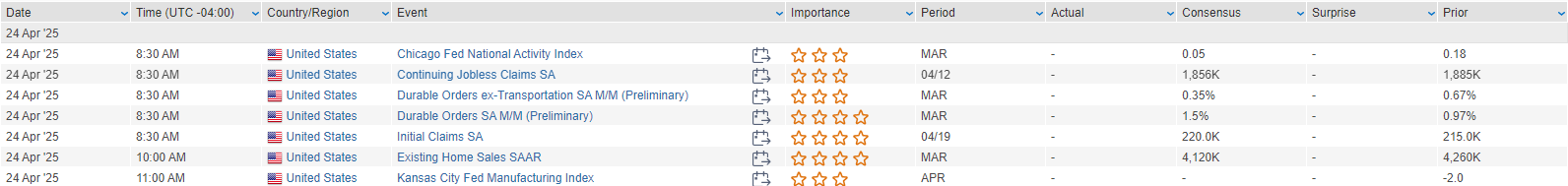

Eco Data Releases | Thursday April 24th, 2025

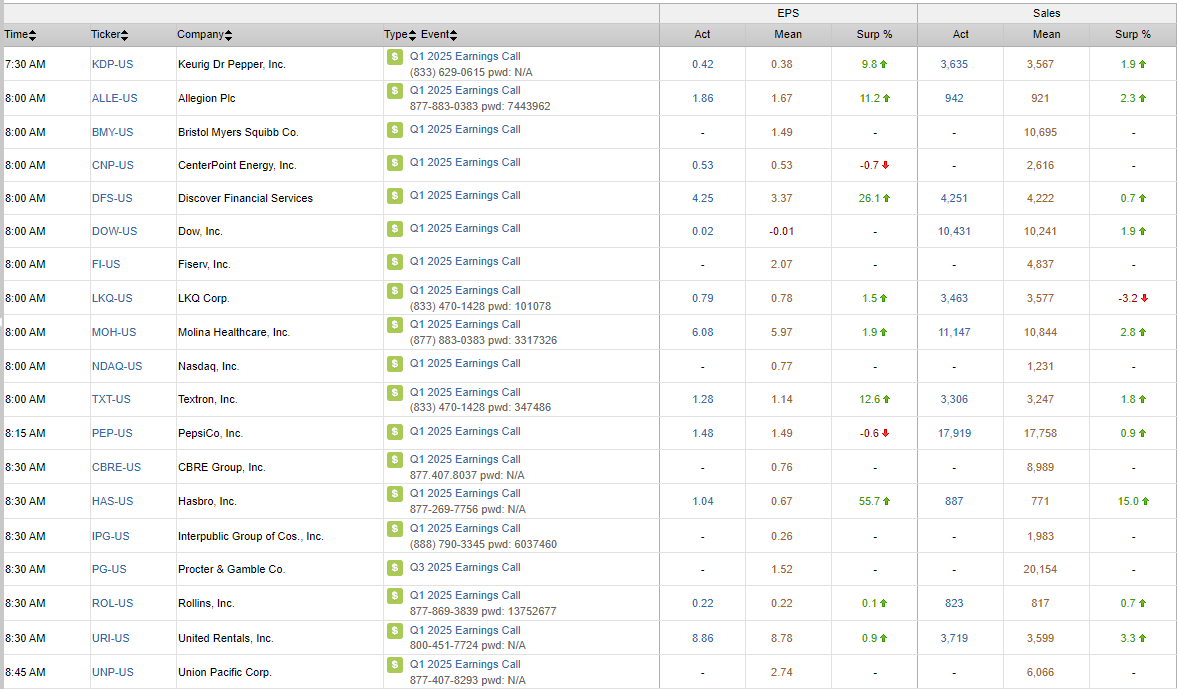

S&P 500 Constituent Earnings Announcements | Thursday April 24th, 2025

Data sourced from FactSet Research Systems Inc.