April 29, 2025

S&P Futures are up 0.2% in early trading following a choppy but positive Monday session. The S&P 500 notched its fifth straight daily gain — its longest winning streak of the year — despite an earlier intraday decline of around 1%. Asian markets mostly advanced overnight, led by Australia, South Korea, and Taiwan, while Greater China was softer. European markets are little changed. Treasuries are slightly weaker, with yields up 2-3 basis points, after five days of stronger moves that pushed 10-year yields to three-week lows. Meanwhile, the dollar index is up 0.2%, gold is down 0.7%, Bitcoin futures are up 0.5%, and WTI crude is down 1.4%.

The major macro headline today revolves around tariff relief for autos and auto parts. The move, aimed at de-escalating trade tensions, was widely expected but still leaves the broader auto sector facing significant headwinds. Otherwise, trade news remains fairly quiet with continued U.S. official commentary about progress in negotiations, but no real evidence yet of a thaw with China. Markets remain largely in waiting mode ahead of a flood of earnings reports and macroeconomic data, including updates from four of the Mag 7 tech names. Investors are focused on heightened macro uncertainty and corporate tariff mitigation efforts. On the fiscal side, Bessent set a July 4 target to pass the reconciliation bill, while Johnson is pushing for Memorial Day and the Senate seems to be looking toward August. The Fed is currently in its quiet period ahead of next week’s policy meeting.

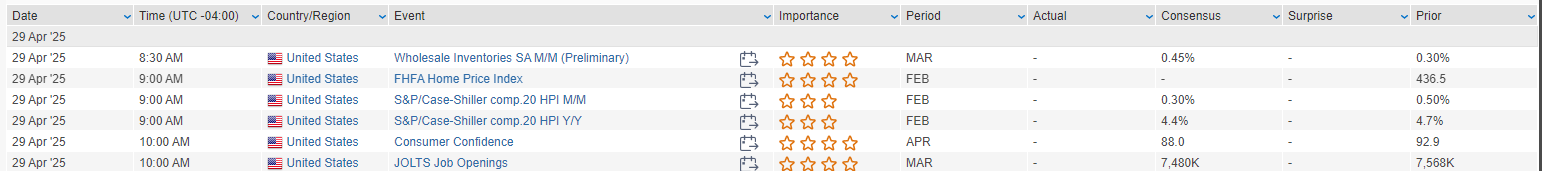

Today’s U.S. economic calendar features a number of key releases, including the trade balance, wholesale inventories, FHFA house price index, Case-Shiller 20-city home price index, JOLTS job openings, and Conference Board consumer confidence. The latter is expected to draw special attention following recent sharp declines. Later this week, eyes will be on core PCE inflation, ADP private payrolls, the first look at Q1 GDP (Wednesday), the ISM manufacturing index (Thursday), and the April employment report (Friday). Street consensus currently forecasts ~130K jobs added in April, with an unemployment rate holding steady at 4.2% and average hourly earnings rising 0.3% month-over-month.

Company-specific news:

- WM missed on free cash flow, volumes slightly below guidance, but reaffirmed full-year outlook.

- CDNS reported Q1 revenue in line, EPS better than expected; raised full-year guidance; no change in customer behavior trends noted.

- NXPI posted slightly better Q1 results; Q2 guide ahead at midpoint; announced CEO plans to retire at end of 2025.

- NUE beat low expectations and delivered a positive tone on Q2 outlook.

- SBAC raised FY guidance and launched a new $1.5B buyback program after noting improved U.S. activity levels.

- FFIV posted mixed results with upside in Systems but weakness in Software.

- UHS noted light behavioral health volumes (weather-related) but strong acute care performance and solid expense control.

- CR beat Q1 expectations and reaffirmed FY guidance, though flagged tariff uncertainty as a drag on raising forecasts further.

- WWD raised the lower end of its full-year sales and EPS outlook.

- CCK jumped after a sizable Q1 EPS beat and upward FY guidance revision, citing strong demand trends.

- SANM slipped on a weaker-than-expected fiscal Q3 guidance.

- AMKR traded higher after offering a stronger Q2 revenue outlook.

U.S. equities finished mostly higher in a choppy Monday session (Dow +0.28%, S&P 500 +0.06%, Nasdaq -0.10%, Russell 2000 +0.41%), closing well off their midday lows. Breadth was positive, with the equal-weight S&P outperforming the cap-weighted index. Treasuries firmed with a steepening curve, the 30-year yield falling below 4.70%. The dollar index was down 0.5%, gold rose 1.5%, Bitcoin futures slipped 0.6%, and WTI crude settled down 1.5%.

Markets remained in a holding pattern ahead of a busy week packed with macro data and earnings. Tech weakness was notable, particularly NVDA, amid new competition concerns from China. Lower yields and a weaker dollar helped sentiment, but ongoing trade uncertainty — particularly US-China relations — stayed in focus. Headlines over the weekend highlighted looming supply chain shocks tied to tariffs, with early signs of disruptions beginning to appear at U.S. ports. Earnings reports continue to reflect heightened macro uncertainty and tariff mitigation strategies. Quiet on the Fed front, though potential Powell successor Warsh criticized the central bank’s “drift” leading to policy missteps. Fiscal negotiations in Washington also drew attention.

The April Dallas Fed Index missed badly, falling to its lowest level since May 2020 and flagging rising price pressures and tariff-related uncertainty. Treasury borrowing estimates surged to $514B for Q2, up sharply from prior forecasts, ahead of Wednesday’s quarterly refunding announcement.

Major macro data releases coming up this week include JOLTS job openings and consumer confidence (Tuesday), first read of Q1 GDP and March core PCE (Wednesday), ISM manufacturing (Thursday), and April nonfarm payrolls (Friday), with forecasts calling for ~130K job growth and steady unemployment at 4.2%.

At the sector level, Utilities (+0.70%), Real Estate (+0.68%), and Energy (+0.63%) outperformed on Monday, while Tech (-0.30%), Consumer Staples (-0.15%), and Consumer Discretionary (-0.09%) lagged.

Company-Specific News by GICS Sector

Information Technology

- NVDA (-2.1%): Fell on news Huawei is testing a potential AI chip competitor (Ascend 910D) to Nvidia’s H100 product.

- ZS (+2.0%): Upgraded to outperform at BNP Paribas Exane on expectations for accelerating top-line growth and improved sales productivity.

- CGNX (+2.9%): Upgraded to buy at TD Cowen, citing overly negative sentiment and potential for near-term strategic shifts.

Communication Services

- GOOGL (+1.7%): Beat on Q1 revenue and operating income, highlighted AI-driven engagement gains and authorized a $70B buyback.

- CHTR (+11.4%): Beat on Q1 earnings and revenue, driven by residential performance; free cash flow surged due to lower capital expenditures.

Health Care

- ADMA (+12.1%): Jumped after FDA approval of a production yield enhancement process.

- CGON (+25.0%): Gained on positive trial data for its bladder cancer treatment.

- AVTR (-3.4%): Downgraded by multiple analysts following Friday’s revenue miss and CEO resignation.

- SMMT (+2.8%): Analysts defended shares after Friday’s selloff, citing optimism over upcoming China approval data.

- PODD (not in notable movers): Appointed a new CEO and said it would raise FY guidance.

Consumer Discretionary

- DPZ (flat): EPS beat, but revenue missed; U.S. comps below consensus.

- PTON (+4.9%): Upgraded to buy at Truist Securities citing improving fundamentals and balance sheet.

- ONON (+3.5%): Upgraded to buy at Citi on strong brand momentum and limited China sourcing exposure.

- SKX (-5.4%): Pulled FY25 guidance on global trade uncertainty despite largely in-line Q1.

Industrials

- BA (+2.4%): Upgraded to outperform at Wolfe Research citing improvement in operational execution.

- PLUG (+25.7%): Surged after guiding Q1 revenue slightly ahead of consensus and securing $525M in new financing.

- SAIA (-3.5%): Downgraded to neutral at BofA after a Q1 miss, with concerns about rising competition and weak seasonal trends.

Financials

- BKU (-2.3%): Q1 beat helped by lower provision expenses, but NII/NIM and fee income missed; analysts flagged loan attrition concerns.

Materials

- EMN (-6.2%): Revenue miss in Q1; warned about late-quarter demand softness tied to tariffs and recession fears.

Energy

- (No notable movers today)

Real Estate

- DLR (+4.0%): Q1 core FFO beat estimates; management cited strong renewal pricing trends across both enterprise and hyperscale segments.

Eco Data Releases | Tuesday April 29th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday April 29th, 2025

Data sourced from FactSet Research Systems Inc.