May 9, 2025

S&P futures up 0.1% after U.S. equities closed higher Thursday but off intraday highs. Major indexes are on track to finish the week narrowly mixed, with industrials leading and healthcare, energy, and communication services under pressure. Asian markets were mixed (Japan and Taiwan up; China and South Korea lagged), while Europe opened ~0.3% higher. Treasuries are firmer with yields down ~2 bp at the front end. Dollar down 0.2%, gold up 0.7%, Bitcoin flat, and WTI crude up 1.6%.

Macro focus remains on trade. Weekend U.S.–China talks in Switzerland continue to fuel hopes for tariff de-escalation, which has driven recent market gains. However, concerns are emerging that much of the good news may already be priced in, especially with the S&P 500 trading at 21x forward earnings and 2025–26 LDD% growth still expected. Fed easing bets have been scaled back amid “wait-and-see” policy stance, while fiscal uncertainty grows around the GOP reconciliation bill.

No major economic data today, but a full day of Fed commentary ahead from Williams, Kugler, Goolsbee, and Waller, with messaging expected to mirror Wednesday’s FOMC focus on patience and the risk of soft data translating to weaker hard data. Next week’s key releases include CPI, retail sales, industrial production, and housing data.

Notable Corporate Highlights

- NVDA: Will release a new version of its H20 chip to comply with U.S. export restrictions.

- TSMC: April revenue surged nearly 50%.

- BP: Reportedly attracting takeover interest (FT).

- MCK: Beat EPS, raised long-term Pharma margin outlook, will spin off Med-Surg business.

- MNST: Missed; blamed distributor de-stocking; gross margins benefited from pricing.

- NET: Gains on strategic deal momentum.

- HUBS: Q1 beat, but FY guidance unchanged.

- DKNG: Missed and cut FY guide, though commentary constructive.

- TTD: Jumped on Q1 beat, citing success from platform upgrades.

- MCHP: Called the bottom, highlighted stronger April bookings.

- EXPE: Missed on bookings, cut FY outlook.

- TOST: Beat; well-received amid macro headwinds in the restaurant space.

- AFRM: Down despite largely positive earnings takeaways.

- PINS: Rose on better-than-expected guidance.

- AKAM: Fell on soft results in Security and Compute segments.

- PODD: Rallied on strength in new patient starts.

- ILMN: Lowered FY guidance due to China weakness and tariff concerns.

- LYFT: Beat across metrics and announced $750M buyback.

- POST: Beat and raised; Foodservice segment the highlight.

U.S. equities closed higher Thursday (Dow +0.62%, S&P 500 +0.58%, Nasdaq +1.07%, Russell 2000 +1.85%), continuing the week’s rally, though stocks faded from session highs amid late-day softness. Gains were led by cyclicals including tech, energy, and industrials, with support from improving trade sentiment and macro data surprises.

Trade optimism remained the key catalyst. The U.S. and U.K. announced a new trade framework, while Trump reiterated that China “very much wants to make a deal” and that the 145% tariff rate could be reduced to 50–54% as early as next week. He hinted at a possible conversation with Xi Jinping depending on how this weekend’s high-level U.S.-China talks in Switzerland proceed. This narrative continues to support re-risking across equities, particularly names with tariff exposure. Systematic strategy re-leveraging, resilient retail buying, and resumed corporate buybacks have added further technical tailwinds.

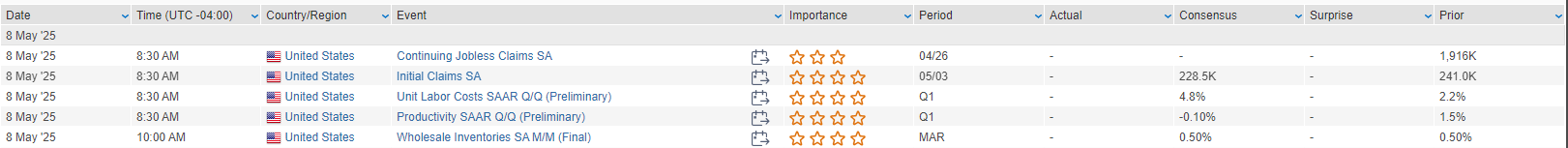

Economic data was mixed. Initial jobless claims fell 13K to 228K, in line with expectations, while continuing claims rose to 1.879M, slightly above forecasts. Q1 productivity contracted more than expected—the first negative print since Q1 2022—while unit labor costs surged to their highest level since Q1 2024. The April New York Fed Survey of Consumer Expectations showed 1-year inflation expectations unchanged at 3.6%, while 3-year expectations rose to the highest since July 2022 and 5-year expectations ticked lower. The Treasury’s $25B 30-year bond auction tailed by 0.7 bp. Overseas, the Bank of England cut its base rate by 25 bp to 4.25%, though the vote was split three ways. No major U.S. data is scheduled for Friday, though Fed speakers Williams, Kugler, Goolsbee, and Waller are set to speak.

Fed commentary remains cautious. Policymakers emphasized “waiting” and navigating uncertainty around both sides of the dual mandate, with increasing market focus on a potential rate cut by September.

Company-Specific News by GICS Sector

Information Technology

- AXON +14.1%: Beat and raised FY25 guidance; noted a modest 50 bps EBITDA headwind from tariffs.

- APP +11.9%: Q1 beat; advertising revenue +16% q/q, Q2 guide ahead.

- EPAM +12.9%: Q1 beat, raised FY25 guidance, announced CEO transition.

- ARM –6.2%: Q1 fine, but Q1 guide disappointed; no FY guide due to tariff-related demand uncertainty.

- FTNT –8.4%: Beat on revenue, but services revenue missed; no FY raise; Street saw results as underwhelming.

Consumer Discretionary

- CVNA +10.2%: Beat across the board; guided to sequential retail growth in Q2 and long-term 13.5% EBITDA margin.

- PZZA +15.9%: Q1 EPS in line; reaffirmed FY25 guide; strength in international comps.

- TPR +3.7%: Big beat; raised FY guide; said tariffs expected to have immaterial impact.

- CROX +9.8%: Q1 beat but pulled FY guidance due to uncertainty around trade.

- DNUT –24.7%: Missed; pulled guidance; paused McDonald’s rollout; ended dividend.

- PTON –6.7%: Lowered app subscriber guidance; tariff impacts cited in Q4 GM cut.

Industrials

- RUN +15%: Q1 beat; warned of rising 2H tariff costs but reaffirmed 2025 cash generation target.

- SN +12.9%: Beat and raised; cited supplier diversification as key tariff mitigation.

- OXY +6.2%: Beat on lower costs; trimmed capex guidance.

- CLF –15.8%: EBITDA loss and FCF miss; company announced restructuring.

- G –15.2%: Lowered FY guide; flagged large-deal delays and tariff uncertainties.

- WBD +5.3%: Beat; may consider splitting the company per CNBC; streaming subs grew.

Financials

- COIN +5.1%: Acquiring Deribit for ~$2.9B to expand into crypto derivatives.

- LZ +23.6%: Beat; strength in subscriptions; reaffirmed FY25 guide despite business formation slowdown.

Health Care

- XRAY +16.3%: Strong beat; reaffirmed guide; said outlook includes tariff impact.

- KVUE +4.1%: Reaffirmed organic growth; lowered EPS margin guide on tariff pressure.

- HBI +4.1%: Beat and reaffirmed FY guide; now includes expected tariff impact.

Materials

- NTR –: Missed on phosphate/retail weakness.

- TAP –4.5%: Missed and lowered FY outlook; flagged macro and competitive headwinds.

Communication Services

- GOOGL +1.9%: Rebounded after Wednesday’s drop; reaffirmed growth in search queries across Apple platforms.

- CART –6.1%: Fell on CEO departure news.

Real Estate, Energy, Utilities

- VAC: Beat and raised.

- GT: Sales light, no additional update.

- MUSA –12.3%: Missed on fuel performance; weather and holiday headwinds noted.

Eco Data Releases | Friday May 9th, 2025

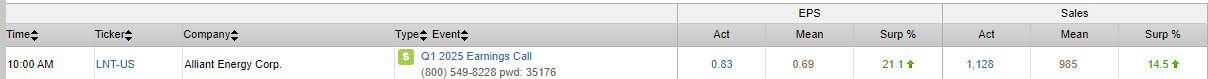

S&P 500 Constituent Earnings Announcements | Friday May 9th, 2025

Data sourced from FactSet Research Systems Inc.