May 14, 2025

S&P futures are slightly lower following Tuesday’s gains, where cyclicals and the “Magnificent 7” tech names outperformed, and defensives lagged. The S&P is now positive YTD, up 18% since its April 8 low. Asian markets were mixed overnight, with Hong Kong leading, while European markets opened down ~0.7% on weaker earnings. Treasuries are firmer with a steepening curve, while the dollar index is off 0.6%, gold down 0.4%, Bitcoin futures down 1.3%, and WTI crude down 0.8%.

Macro headlines remain limited. The White House hinted at another potential trade deal following Trump’s overseas trip. Markets are pricing in 50 bp of Fed rate cuts this year following Tuesday’s cooler CPI print.

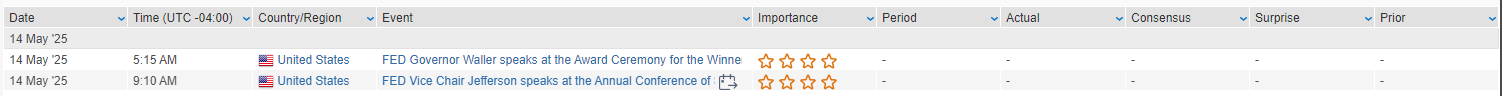

Key Events:

- Fed speakers Waller, Jefferson, and Daly are scheduled.

- Upcoming: Empire Manufacturing, retail sales, and Fed Chair Powell’s policy framework review speech on Thursday.

Corporate Highlights:

- ALC down after a Q1 miss and FY guidance cut, citing weaker U.S. implantables demand.

- AEO preannounced Q1 sales near expectations but cut FY guidance, citing high promotions and a $75M inventory write-down.

- GRAL Q1 missed on revenue and EBITDA but reiterated slower cash burn guidance.

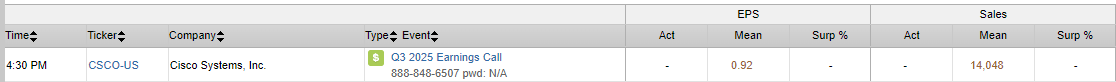

- Key reports ahead: CSCO (today), WMT and DE (Thursday morning), AMAT (Thursday afternoon).

U.S. equities closed mostly higher Tuesday, though off their intraday peaks. The S&P 500 rose 0.72%, the Nasdaq surged 1.61%, and the Dow gained 0.64%, while the Russell 2000 edged up 0.49%. The S&P is now positive year-to-date, sitting ~4% below its February 19 record. Treasuries weakened with a steepening yield curve, the dollar index fell 0.8%, gold climbed 0.6%, Bitcoin futures advanced 3.2%, and WTI crude rose 2.8%.

Economic data drove optimism, with April’s CPI coming in cooler than expected. Core CPI rose 0.2% month-over-month (vs. 0.3% consensus), while the annual core rate held steady at 2.8%, marking its lowest level since February 2021. Shelter costs accounted for half of the monthly increase. Economists noted limited immediate tariff effects, though goods inflation is expected to rise in coming months. NFIB Small Business Optimism fell to 95.8 in April, below its long-term average, citing labor quality as the top issue and inflation slipping to third place.

The market narrative remains focused on easing U.S.-China trade tensions following Monday’s tariff de-escalation, driving upward revisions in earnings and growth forecasts. While some concerns remain over trade strategy volatility and elevated effective tariff rates, analysts flagged potential for extended market upside aided by systematic re-leveraging and corporate buybacks.

Sector Performance:

- Outperformers: Technology (+2.25%), Consumer Discretionary (+1.41%), Energy (+1.32%), Communication Services (+1.26%)

- Underperformers: Healthcare (-2.97%), Real Estate (-1.30%), Consumer Staples (-1.24%), Materials (-0.52%), Utilities (-0.08%), Financials (+0.38%), Industrials (+0.72%)

Company-Specific Highlights

Information Technology

- NVIDIA (NVDA): Gained 5.6% after announcing a strategic partnership with Saudi Arabia’s Public Investment Fund to build AI factories.

- Power Integrations (POWI): Fell 6.2% despite announcing a $50M buyback. Q1 results were in line, though shares have surged 31% over the past month.

Consumer Discretionary

- Amazon (AMZN): Reportedly finalized a deal with FedEx (FDX) to act as a third-party delivery provider.

- Callaway Brands (MODG): Dropped 17.1% despite Q1 earnings and revenue beats, as the company trimmed Topgolf expectations due to softer consumer demand.

Healthcare

- UnitedHealth Group (UNH): Sank 17.8% as CEO Andrew Witty stepped down. Guidance was suspended, citing rising medical costs.

- Arrowhead Pharmaceuticals (ARWR): Gained 9.4% after beating revenue expectations and updating its obesity drug pipeline.

Industrials

- Boeing (BA): Added 2.5% after reports that China resumed accepting its aircraft deliveries.

- Caterpillar (CAT): Rose 2.9% after a Baird upgrade, citing improved orders and easing tariff pressures.

Energy

- First Solar (FSLR): Jumped 22.6% after Wolfe Research upgraded the stock, highlighting benefits from the Inflation Reduction Act and anti-China sentiment.

- Enphase Energy (ENPH): Dropped 4.8% as Barclays downgraded it, citing risks around the potential repeal of tax credits.

Communication Services

- Sea Limited (SE): Climbed 8.2% with a significant Q1 EBITDA beat and improving profitability across all business units.

- Tencent Music Entertainment (TME): Posted a 2.9% gain after a slight Q1 revenue and EPS beat.

Consumer Staples

- Halozyme Therapeutics (HALO): Plummeted 24.6% after Leerink Partners downgraded the stock, citing reduced licensing opportunities.

Financials

- Coinbase (COIN): Surged 24% on news it will join the S&P 500, replacing Discover Financial.

- Hertz Global (HTZ): Declined 17.1% after missing Q1 revenue expectations amid reduced fleet capacity and moderating demand.

Materials

- On Holding (ONON): Rallied 11.8% on better-than-expected Q1 results and raised 2025 revenue guidance.

Real Estate

- Simon Property Group (SPG): Fell 1.3% despite reaffirming FY guidance, with headline FFO slightly light but real estate FFO exceeding expectations

Eco Data Releases | Wednesday May 14th, 2025

S&P 500 Constituent Earnings Announcements | Wednesday May 14th, 2025

Data sourced from Factset Research Systems Inc.