May 22, 2025

S&P futures are up 0.1% in Thursday morning trading after Wednesday’s broad selloff, which saw major indexes decline by over 1.4%. Financials, managed care, rate-sensitive sectors, and retail favorites were among the hardest hit. Asian markets closed lower, led by declines in South Korea and Hong Kong, while European equities are down nearly 1%. Treasuries are slightly firmer after Wednesday’s rate surge pushed 10-year yields above 4.50% and 30-year yields through 5%. The dollar index has gained 0.2%, recovering slightly from its prior session’s 0.5% decline. Commodities show mixed movement, with gold down 0.2%, Bitcoin futures up 2.1%, and WTI crude off 1.5% amid OPEC+ production-related concerns.

Key Themes:

Rate stabilization is a key focus following Wednesday’s sharp increase in bond yields, triggered by a weak 20-year note auction. Oil prices are under pressure due to reports that OPEC+ is considering a production increase in July. The dollar’s rebound is another focal point, with Treasury Secretary Bessent and Japan’s Finance Minister reaffirming that FX levels should remain market-determined. Deficit concerns continue to loom large as House Republicans prepare to approve a reconciliation bill this morning, following concessions to secure support from holdouts.

Economic Calendar:

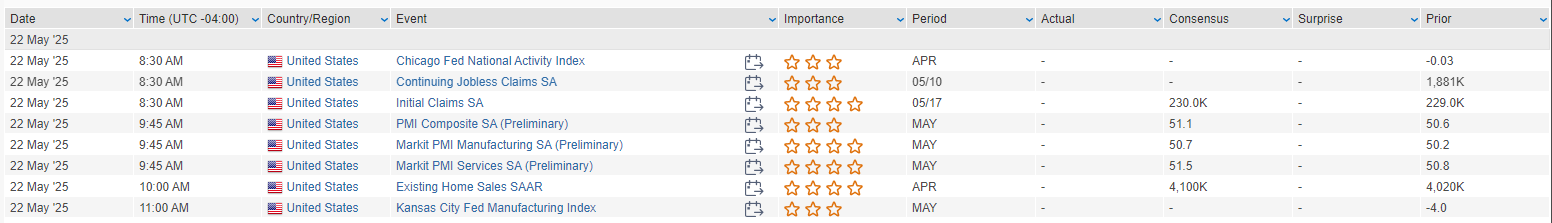

Today’s data includes initial jobless claims, forecasted near last week’s 229K, and flash PMI readings, with manufacturing expected at 49.8 and services at 51.1. Existing home sales are projected to rise 2.7% in April after March’s 6% drop. NY Fed President Williams will speak at 2 PM ET. Tomorrow’s schedule includes new home sales data and comments from Fed officials Musalem, Schmid, and Cook.

Corporate News:

- AT&T (T): Buying Mass Markets fiber assets from Lumen (LUMN) for $5.75B in cash.

- Honeywell (HON): Acquiring Johnson Matthey’s Catalyst Technologies business for £1.8B.

- Nike (NKE): Raising prices due to tariffs and resuming sales on Amazon (AMZN).

- Snowflake (SNOW): Beat earnings and raised guidance; strong product revenue growth and bookings noted.

- Zoom (ZM): Q1 beat with FY26 guidance raised; flagged longer deal cycles in the enterprise segment.

- Urban Outfitters (URBN): Shares up on strong Q1 results; momentum expected to continue into Q2.

- Pitney Bowes (PBI): Appointed a new CEO and announced a strategic review.

- Medicare Audits: Humana (HUM), CVS, and UnitedHealth (UNH) face scrutiny as CMS expands MA plan audits.

- Trump: Considering public listings for Fannie Mae (FNMA) and Freddie Mac (FMCC).

U.S. equities closed broadly lower Wednesday, with the S&P 500 experiencing its worst day since April 21 and logging its first back-to-back decline since May 6. The Dow (-1.91%), S&P 500 (-1.61%), Nasdaq (-1.41%), and Russell 2000 (-2.80%) all ended in negative territory. Equal-weighted indices reflected broader weakness, with the RSP index dropping over 2%. Notable laggards included managed care, banks, asset managers, airlines, and homebuilders.

Treasuries faced pressure amid a bearish steepening of the yield curve. The 10-year yield climbed back above 4.50%, and the 30-year yield rose above 5%, exacerbated by a weak 20-year note auction that tailed by 1.2 basis points. The U.S. dollar index dropped 0.5%, while gold gained 0.9%. Bitcoin futures rose 1.1%, and WTI crude ended 0.7% lower despite geopolitical concerns surrounding Israel and Iran.

Investor sentiment was dampened by the rising deficit concerns linked to GOP reconciliation bill progress and global bond yield pressures. Meanwhile, upbeat AI headlines from select companies (GOOGL, SMCI, BIDU) failed to offset broader market weakness.

Corporate News by GICS Sector:

Communication Services:

- Alphabet (GOOGL): Rose 2.8% on positive Google I/O takeaways, with analysts highlighting strength in AI and search technology.

- Baidu (BIDU): Supported by robust AI Cloud revenue growth.

Consumer Discretionary:

- VF Corp (VFC): Dropped 15.9% following a weak Q1 operating income guide despite meeting sales expectations. Vans and Americas revenue declines were particularly concerning.

- Target (TGT): Down 5.2% on Q1 misses and reduced FY guidance, citing margin headwinds and supply chain challenges.

- Carter’s (CRI): Fell 12.6% after slashing its dividend by ~69%, signaling strategic shifts under new CEO leadership.

- Canada Goose (GOOS): Soared 19.5% after FQ4 earnings beat estimates, driven by strong DTC sales and growth in Asia-Pacific regions

Consumer Staples:

- Kraft Heinz (KHC): Evaluating strategic transactions to unlock shareholder value.

Energy:

- Phillips 66 (PSX): Announced changes to its board after a shareholder agreement with Elliott Investment Management.

Financials:

- UnitedHealth Group (UNH): Declined 5.8% after allegations regarding secret bonuses to nursing homes, which the company denied.

Health Care:

- Palo Alto Networks (PANW): Dropped 6.8% as FQ3 and FQ4 guidance met expectations but raised concerns over weak subscription revenue and new ARR growth.

Industrials:

- IDEX Corp (IEX): Down 3.8% following the resignation of CFO Abhishek Khandelwal.

- Dycom Industries (DY): Surged 15.7% on Q1 earnings and revenue beats, bolstered by record backlog and raised FY guidance.

Information Technology:

- Wolfspeed (WOLF): Plummeted 59.3% amid reports of a potential bankruptcy filing.

- Apple (AAPL): Fell 2.3% on news that Jony Ive will assume creative and design control at OpenAI following a $6.5 billion acquisition of his startup.

Eco Data Releases | Thursday May 22nd, 2025

S&P 500 Constituent Earnings Announcements | Thursday May 22nd, 2025

Data sourced from FactSet Research Systems Inc.