February 21, 2025

S&P futures are little changed after U.S. equities fell Thursday, with staples retailers, banks, credit cards, machinery, airlines, trucking, chemicals, cybersecurity, and apparel retail among the weakest sectors. Momentum factor unwind was in focus. Asian markets rallied, with Hong Kong up nearly 4% on tech strength, while European markets gained ~0.2%. Treasuries firmed slightly, while the dollar index rose 0.3%. Gold fell 0.4%, Bitcoin futures gained 0.5%, and WTI crude declined 0.9%.

Market volatility could be elevated today due to options expiry, which often leads to increased trading activity and positioning adjustments. Broader uncertainty persists around tariffs, taxes, and geopolitics, with investors closely watching developments on trade policy and potential regulatory changes.

Earnings continue to be a bright spot, with solid results and margin expansion, though concerns over weaker guidance and stretched valuations are drawing greater scrutiny. The overall growth outlook remains strong, but Q1 estimates have moderated, and progress on disinflation remains disappointing, keeping inflation risks in focus. Meanwhile, corporate buybacks remain elevated, though there are signs that retail investor momentum may be fading, which could impact near-term market dynamics.

On the economic front, key reports scheduled for today include February flash PMIs, final Michigan consumer sentiment, and January existing home sales. Consumer sentiment is likely to attract attention after a preliminary reading fell to a seven-month low, with inflation expectations jumping to 4.3% from 3.3%, signaling potential concerns about price pressures. Additionally, Fed Vice Chair Jefferson is set to speak today, following earlier remarks emphasizing that the Fed has time to assess its next rate move, given economic resilience and uneven progress toward the 2% inflation target

Company News

- Booking Holdings (BKNG) +: Q4 beat expectations on strong travel demand.

- MercadoLibre (MELI) +: Standout quarter with strong growth in Brazil and Argentina.

- XYZ -: Dropped on soft Q1 guidance.

- Live Nation (LYV) +: Upbeat demand and pipeline commentary.

- Insulet (PODD) -: Declined on conservative guidance.

- Sprouts Farmers Market (SFM) ~: Beat and guided above, but expectations were high.

- Akamai (AKAM) -: Pressured by weaker guidance.

- Rivian (RIVN) -: Beat on cost control, but guidance disappointed.

- Texas Roadhouse (TXRH) ~: Beat estimates, but flagged soft start to the year and commodity pressures.

- Dropbox (DBX) -: Weak after mixed Q4 and negative growth outlook.

- Glaukos (GKOS) -: Fell as iDose upside underwhelmed expectations.

- Floor & Decor (FND) +: Results and guidance better than feared, cost control a bright spot.

- Allison Transmission (ALSN) +: Raised dividend and boosted buyback by $1B.

- Celsius Holdings (CELH) +: Surged on strong beat and acquisition of Alani Nu.

- Five9 (FIVN) +: Highlighted large deal momentum and AI tailwind

U.S. equities declined Thursday, with all major indices finishing lower but off session lows. The Dow fell 1.01% (-394 points), the S&P 500 lost 0.43% (-22 points), the Nasdaq dropped 0.47% (-69 points), and the Russell 2000 declined 0.91% (-19 points). While markets have trended lower this week, the S&P 500 remains near flat week-to-date after hitting a record high on Wednesday. Weakness was driven by consumer staples retailers (Walmart), banks, credit cards, EVs, machinery, airlines, trucking, chemicals, cybersecurity, and entertainment, while energy, pharma/biotech, homebuilders, department stores, food, household products, and tobacco stocks outperformed.

Treasuries firmed, with some curve flattening following Wednesday’s yield decline. The dollar index fell 0.8%, driven by yen strength, while gold gained 0.7% and Bitcoin futures climbed 2.7%. WTI crude settled 0.5% higher but finished below intraday highs.

On the policy front, Trump expanded tariffs to include lumber and forest products but also hinted at a potential broad trade deal with China, which could include increased U.S. purchases, investment, and nuclear security discussions. Meanwhile, the EU trade commissioner noted progress in negotiations with the U.S.. In Washington, government shutdown risks continue to rise ahead of the March 14 deadline, as GOP divisions over reconciliation efforts persist. Treasury Secretary Bessent downplayed the likelihood of shifting toward issuing longer-term debt in the near future.

Geopolitical tensions remain elevated, with Trump-Zelensky relations under strain. A joint press conference between Zelensky and U.S. envoy Kellogg was canceled, though Zelensky stated that discussions were productive. Market sentiment was also weighed down by fading retail investor momentum, stretched systematic positioning, and options expiry.

On the economic front, initial jobless claims came in at 219K, slightly above expectations (216K) and higher than the previous week’s 214K. However, continuing claims fell to 1.869M, slightly better than expected. The Philadelphia Fed Manufacturing Index dropped to 18.1 from January’s 44.3, though it remained in expansion territory. Notably, the survey’s price indices surged to their highest levels in over two years, reflecting persistent inflationary pressures. In terms of Fedspeak, officials remained cautious and data-dependent. Chicago Fed President Goolsbee noted that upcoming PCE inflation data may not be as concerning as January’s CPI report, while Atlanta Fed President Bostic reaffirmed that quantitative tightening (QT) is not just about debt ceiling concerns but about avoiding an overshoot in reserve reductions. St. Louis Fed President Musalem warned that the risk of inflation expectations becoming unanchored is greater than the risk of substantial labor market weakness.

Investors now turn their focus to key economic data scheduled for Friday, including February flash PMIs, final University of Michigan consumer sentiment (and inflation expectations), and January existing home sales.

Company News by Sector

Consumer Staples (-0.96%)

- Walmart (WMT) -6.5%: Q4 beat underwhelmed due to high expectations; FY26 guidance came in below consensus. Management highlighted no fundamental shift in consumer spending trends but cited headwinds from the VIZIO acquisition and leap year effect.

Consumer Discretionary (-1.10%)

- Shake Shack (SHAK) +11.1%: Q4 margins improved, supported by a new labor scheduling system; FY25 revenue guidance midpoints ahead of expectations.

- Birkenstock (BIRK) -1.2%: Q1 EBITDA and revenue beat, but DTC sales underwhelmed; FY outlook reaffirmed despite a strong start to the year.

- Royal Caribbean (RCL) -7.6%: Fell after Commerce Secretary Lutnick claimed cruise lines avoid paying U.S. taxes.

Energy (+0.97%)

- Sector outperformed, driven by higher crude prices; no major stock-specific news.

Financials (-1.55%)

- Trupanion (TRUP) -25.5%: Q4 earnings missed expectations, with subscriber growth concerns and high acquisition costs weighing on sentiment.

- DaVita (DVA) -5.8%: Declined after Berkshire Hathaway disclosed a 720K-share sale, following a prior reduction on February 14.

Industrials (-0.68%)

- Lamar Advertising (LAMR) -7.3%: Q4 EBITDA and revenue missed, while FY25 AFFO guidance fell below consensus estimates.

Information Technology (-0.06%)

- Amplitude (AMPL) +21.9%: Q4 beat on earnings, revenue, and margins, driven by strong enterprise customer growth and ARR expansion.

- Clearwater Analytics (CWAN) +10.7%: Q4 ARR growth and retention rates exceeded expectations; Q1 and FY25 revenue guidance ahead of consensus.

- EPAM Systems (EPAM) -12.8%: Q4 earnings and revenue beat, but FY25 guidance disappointed.

Healthcare (+0.55%)

- Bausch Health (BHC) +10.3%: Q4 net income, revenue, and cash flow topped expectations; FY25 guidance midpoints ahead of estimates.

- Baxter International (BAX) +8.5%: Q4 earnings, revenue, and margins beat expectations, with Hurricane Helene impact less severe than feared.

- Repligen (RGEN) +7.9%: Q4 EPS beat, revenue in line; FY25 guidance consistent with consensus.

- Exact Sciences (EXAS) -1.9%: Q4 EBITDA and revenue exceeded expectations, but FY25 guidance underwhelmed analysts.

Real Estate (+0.69%)

- Host Hotels & Resorts (HST) -1.9%: Q4 earnings beat estimates, but 2025 guidance fell short due to rising labor costs from new union contracts.

Communication Services (-0.68%)

- Alibaba (BABA) +8.1%: Q3 revenue and net profit topped estimates; Cloud business up 13% y/y, with AI products seeing triple-digit growth for the sixth straight quarter.

Materials (-0.26%)

- CF Industries (CF) -: Q4 results were light, but expectations were low, softening the impact.

Eco Data Releases | Friday February 21st, 2025

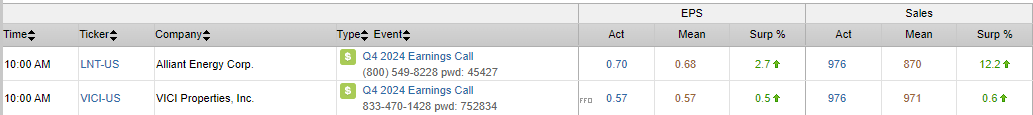

S&P 500 Constituent Earnings Announcements | Friday February 21st, 2025

Data sourced from FactSet Research Systems Inc.