June 5, 2025

S&P futures are up 0.1% Thursday morning after a mixed session Wednesday. Housing, semis, and high short interest names outperformed, while dollar stores, E&Ps, and regional banks lagged. Asian markets were mostly higher overnight, led by South Korea and Hong Kong. Europe is up ~0.4%. Treasuries are mixed after Wednesday’s sharp rally (yields down 8–9 bps). Dollar index is flat. Gold is up 0.6%, Bitcoin futures are down 0.3%, and WTI crude is up 0.5%.

Markets remain in wait-and-see mode ahead of AVGO earnings after the close and Friday’s May jobs report (NFP est. +125K, unemployment 4.2%, avg. hourly earnings +0.3% m/m). No major macro catalysts today, though focus remains on U.S. policy risks: fiscal concerns tied to reconciliation bill negotiations, China’s rare-earth leverage in trade disputes, and Section 899 tax headwinds. Fed rate cut expectations rose to ~60 bps for 2025 following weak data on Wednesday. Outside the U.S., the ECB is expected to deliver its eighth rate cut, bringing total easing to 200 bps.

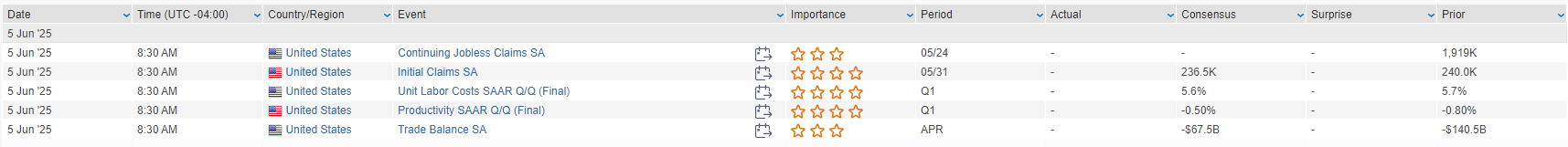

Today’s U.S. economic data includes the trade balance, final Q1 productivity and unit labor cost revisions, and jobless claims. Fed speakers include Kugler, Harker, and Schmid. President Trump meets with German Chancellor Merz at the White House.

Corporate Highlights:

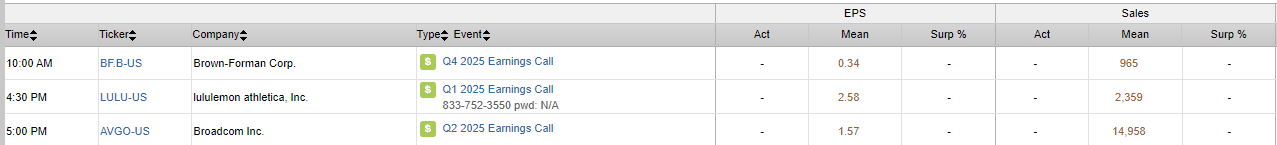

- AVGO reports after the close with elevated expectations.

- AMZN is developing humanoid robot software aimed at replacing delivery workers.

- COST reported May U.S. comp sales up 5.5%, a deceleration but still solid.

- PG plans to cut 15% of global non-manufacturing workforce over two years.

- KMB is nearing a $3.5B sale of its international tissue business.

- MDB beat Q1, raised Q2 and FY guidance, and expanded its buyback; Voyager traction and customer adds praised.

- FIVE beat, guided Q2 above consensus, raised FY guidance; cited strong execution and inventory management.

- PVH beat but issued weak Q2 and FY EPS guidance, citing tariff headwinds.

- VRNT surged on a strong Q1 driven by accelerated AI adoption.

- PL beat, posted positive FCF for the first time, and raised FY guidance.

U.S. equities ended mixed in a quiet but choppy Wednesday session (Dow -0.22%, S&P 500 +0.01%, Nasdaq +0.32%, Russell 2000 -0.21%). The S&P 500 eked out a small gain, marking its third consecutive advance and closing up 19.8% from the April 8 post–Liberation Day low. Treasuries rallied sharply with long-end yields down 10–11 bps following weaker-than-expected economic data. The dollar index fell 0.4%, gold rose 0.7%, and WTI crude reversed early gains to settle down 0.9% amid recycled headlines about Saudi Arabia potentially seeking bigger OPEC+ hikes.

The focus remained on macro data and rate policy. May ADP private payrolls came in well below expectations at +37K (vs. +130K est), the weakest reading since March 2023. April was revised slightly lower to +60K. While wage growth was steady, the report showed broad hiring softness. Later in the morning, May ISM Services unexpectedly contracted, falling to 49.9—the lowest since June 2024. New orders dropped sharply, and prices paid jumped to their highest level since November 2022, reinforcing stagflation concerns. The Fed’s Beige Book echoed recent caution, noting slight economic deterioration, weaker labor demand, and widespread business uncertainty.

President Trump reiterated his call for rate cuts after the ADP miss, though Fed commentary remained measured. Bostic and Cook offered no new policy signals. Meanwhile, markets await confirmation of a Trump-Xi call later this week as trade headlines remain front and center. U.S. Trade Rep Greer noted “constructive” progress in talks with the EU, though major sticking points on non-tariff barriers remain.

Separately, the CBO projected that the GOP reconciliation bill would add $2.42T to the deficit over the next decade. The agency also estimated that existing tariffs could shrink deficits by $2.8T over time, highlighting the fiscal stakes of current trade policy.

S&P 500 Sector Performance:

Outperformers: Communication Services (+1.37%), Materials (+0.35%), Real Estate (+0.34%), Technology (+0.23%), Healthcare (+0.22%), Industrials (+0.09%)

Underperformers: Energy (-1.89%), Utilities (-1.70%), Consumer Staples (-0.59%), Financials (-0.56%), Consumer Discretionary (-0.23%)

Company Highlights

Technology

CRWD -5.8% – CrowdStrike posted in-line Q1 revenue but guided Q2 below expectations. FY guidance was unchanged, and elevated expectations weighed. Multiple downgrades followed. Positives included ARR beat, Falcon Flex traction, and a new $1B buyback.

LITE +3.4% – Lumentum rose after preannouncing better Q4 revenue and EPS.

ASAN -20.5% – Asana beat on EPS but guided FY revenue lower on deal delays and downgrade pressure in U.S. enterprise. Margin outperformance and AI Studio growth were silver linings.

Communication Services

META – Continued to rally on AI strength and positive sentiment around long-term energy agreements.

T -2.2% – AT&T declined following a report hackers leaked data on 88M customers, including decrypted Social Security numbers.

Healthcare

GWRE +16.4% – Guidewire Software beat across the board and raised full-year guidance. Analysts cited strength in Tier 1 insurer wins and growing cloud momentum.

HQY +9.0% – HealthEquity beat on revenue and EPS, raised guidance, and highlighted margin improvement tied to fraud control measures.

Industrials

GTLS -9.5%, FLS – Chart Industries fell after announcing an all-stock merger with Flowserve. The $19B enterprise value deal is expected to be accretive post-close.

THO +4.3% – Thor Industries beat on Q3 results and reaffirmed FY guidance, but flagged cautious consumer sentiment as a headwind.

Old Dominion Freight – Reported continued softness in May, with revenue per day falling 5.8% y/y.

Consumer Staples

DLTR -8.4% – Dollar Tree beat Q1 comps and EPS but issued a mixed Q2 guide and unchanged FY revenue outlook. The stock fell after Tuesday’s rally, which was fueled by DG’s strong results.

POST – Announced acquisition of 8th Avenue Food & Provisions for ~$880M.

Financials

WFC – Rose earlier in the session on formal removal of its Fed-imposed asset cap from 2018.

BLK – Gained after Texas removed the firm from its ESG-restriction list following changes in its investing approach.

Energy

CEG -4.3% – Constellation Energy downgraded at Citi on valuation. Analysts said the META deal already added ~$12/share of value.

Crude – Inventories fell by 4.3M barrels last week, but crude prices dropped as Saudi Arabia was reported to be pushing for larger output increases

Eco Data Releases | Thursday June 5th, 2025

S&P 500 Constituent Earnings Announcements | Thursday June 5th, 2025

Data sourced from FactSet Research Systems Inc.