June 12, 2025

&P 500 futures are down 0.5% after Wednesday’s decline, which saw broad weakness in industrial metals, regional banks, and airlines. Energy, quantum computing, and nuclear names outperformed. Treasuries are firmer, with yields down 2–3 bp across the curve. The dollar remains under pressure (DXY -0.7%), while gold is up 1.1%, Bitcoin futures down 1.2%, and WTI crude down 1.5% after Wednesday’s 5% rally.

Trade and geopolitics remain front and center. Trump said the U.S. will soon send tariff letters to trading partners, setting unilateral rates following the July 9 expiry of the reciprocal reprieve. While suggesting there’s room for deadline flexibility, he downplayed the need for delay. Tensions have shifted toward export controls. In the Middle East, reports indicate Israel may be weighing military action against Iran, prompting recent U.S. embassy drawdowns and family member departures.

Dollar weakness continues to draw attention amid policy uncertainty and deficit concerns; DXY is down nearly 10% YTD.

On the economic front, May PPI and initial jobless claims are due this morning. Consensus expects headline PPI +0.2% m/m (vs -0.5% prior) and core PPI +0.3% (vs -0.4%). Claims are seen rising to 247K from last week’s 241K. The $22B 30-year bond auction follows Wednesday’s solid 10-year sale. GOP Senators Thune and Crapo meet with Trump today on the reconciliation bill. Friday brings University of Michigan sentiment and inflation expectations.

Corporate Highlights

- Oracle (ORCL): Shares up after raising FY26 guidance; expects total revenue growth of 40% and Cloud IaaS growth of 70%, with RPO to more than double.

- Boeing (BA): Under pressure following a crash involving a 787-8 Dreamliner.

- CoreWeave (CRWV): Selected to supply computing power for Google’s new cloud partnership with OpenAI.

- Dana (DAN): Selling Off-Highway business to Allison Transmission (ALSN) for $2.7B.

- Applied Optoelectronics (AAOI): Rallied on first volume shipment of data center transceivers.

- Oxford Industries (OXM): Q1 results in line but guidance cut on tariff concerns; seen as soft overall.

- Calavo Growers (CVGW): Received unsolicited takeover proposal.

U.S. equities finished modestly lower on Wednesday, with the S&P 500 down 0.27%, Nasdaq -0.50%, Russell 2000 -0.38%, and the Dow flat. Stocks came off their worst levels late in the day but reversed earlier gains amid cautious geopolitical and trade developments. The market tone turned defensive in the afternoon, driven by reports of U.S. embassy evacuation plans tied to heightened tensions with Iran and uncertainty around the trade policy outlook.

Trade remained a dominant theme. The U.S. and China formalized a framework to implement last month’s Geneva de-escalation, agreeing to ease select export controls, including a six-month relaxation on rare earths for U.S. firms. Treasury Secretary Bessent emphasized a willingness to extend the July 9 tariff deadline for partners negotiating in good faith. The U.S. is also reportedly close to a deal with Mexico to partially exempt its steel from the newly imposed 50% tariff. Separately, a court ruling upheld Trump’s IEEPA-based tariffs for now.

Inflation data came in cooler than expected, driving a bullish steepening in the Treasury curve. May headline CPI rose just 0.1% m/m, below consensus and April’s 0.2% increase, taking the y/y rate to 2.4%. Core CPI also rose 0.1% m/m, below the 0.3% expected, pushing the y/y figure to 2.8%. Declines in airline fares, car prices, and apparel helped offset tariff-related pressures. Yields fell 7–8 bp at the front end. The $39B 10-year Treasury auction cleared 0.7 bp through, helping support demand. Looking ahead, the $22B 30-year bond auction is Thursday, along with PPI and jobless claims. On Friday, markets will digest University of Michigan sentiment and inflation expectations data.

In Washington, Bessent testified before the House, warning that the debt ceiling x-date could fall in mid-to-late summer. Senate GOP leaders are also expected to meet with Trump to discuss progress on the reconciliation bill.

Energy (+1.49%) was the top-performing sector, driven by a 4.9% jump in WTI crude prices amid Middle East tension headlines. Utilities (+0.04%), Healthcare (+0.04%), and Industrials (+0.03%) were marginally higher. Financials ended flat. On the downside, Consumer Discretionary (-1.02%), Materials (-0.98%), and Communication Services (-0.58%) led the underperformers, followed by Real Estate (-0.54%), Consumer Staples (-0.38%), and Technology (-0.28%) as investors rotated into defensives and rate-sensitive names.

Company-Specific Highlights

- Tesla (TSLA): CEO Musk reiterated regret over last week’s comments about Trump and delayed the anticipated robotaxi unveiling to June 22.

- Oracle (ORCL): Reported earnings after the close.

- Lockheed Martin (LMT) -4.3%: Pressured after Bloomberg reported the USAF cut its FY26 F-35 request to 24, down from the previously forecast 48.

- Starbucks (SBUX): CEO noted strong interest in selling a minority stake in the company’s China business.

- General Mills (GIS): Reportedly considering the sale of its Häagen-Dazs stores in China.

- Reddit (RDDT) -1.8%: Chief Product Officer Pali Bhat is departing, according to The Verge.

- Papa John’s (PZZA) +7.5%: Reportedly received a joint acquisition bid from Irth Capital and Apollo.

Earnings and Post-Earnings Movers:

- Dave & Buster’s (PLAY) +17.7%: Q1 revenue and comps better than feared; strong commentary around turnaround momentum.

- Chewy (CHWY) -11.0%: Q1 revenue and EBITDA beat; active customers ahead, but net sales per customer missed; high expectations noted as a headwind.

- GitLab (GTLB) -10.6%: Narrow top-line beat and in-line guide seen as underwhelming; positive takeaways on SaaS shift and bookings.

- Stitch Fix (SFIX) -10.5%: Beat earnings and revenue, raised FY guide, but stock sold off after recent rally and cautious commentary.

- GameStop (GME) -5.3%: Q1 mixed; better EPS/EBITDA, but revenue missed; analysts focused on limited core upside and speculative Bitcoin positioning.

- American Superconductor (AMSC): Fell on secondary offering announcement.

- Shutterstock (SSTK) & Getty Images (GETY): Both rose after shareholders approved their proposed merger.

- J.Jill (JILL): Pulled full-year guidance, joining a growing list of retailers citing macro uncertainty.

Notable Thematic Movers:

- Oklo (OKLO) +29.5%: Rallied after receiving a U.S. notice of intent to award for its Aurora nuclear powerhouse project in Alaska.

- Quantum Computing (QUBT) +25.4%: Spiked after Nvidia CEO Jensen Huang said the industry is nearing an inflection point.

- SailPoint (SAIL) +14.7%: Beat Q1 and raised FY guidance; highlighted strong ARR growth and enterprise adoption.

- First Solar (FSLR) +2.0%: Upgraded to Buy at Jefferies citing long-term ASP growth and tailwinds from U.S. solar policy shifts.

- Cleveland-Cliffs (CLF) -8.1%: Weighed down by reports of potential tariff relief for Mexican steel imports.

- MP Materials (MP) -5.8%: Declined on news that U.S.-China talks would expand rare-earth export licenses.

Eco Data Releases | Thursday June 12th, 2025

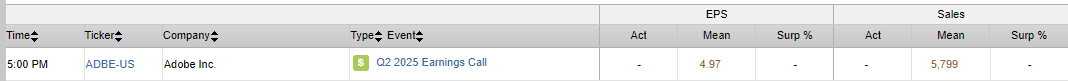

S&P 500 Constituent Earnings Announcements | Thursday June 12th, 2025

Data sourced from FactSet Research Systems Inc.