June 17, 2025

S&P futures are down 0.6% Tuesday morning after U.S. equities closed higher Monday, led by gains in momentum stocks, semis, travel & leisure, and media. Asian markets were mixed overnight, while Europe is trading lower, down over 1%. Treasuries are firmer with yields 2–3 bp lower. The dollar is up 0.2%, gold is down 0.5%, bitcoin futures are off 2.3%, and WTI crude is up 1.4% after Monday’s 1.7% decline.

Middle East tensions have reemerged as a market headwind. Trump warned U.S. citizens to evacuate Tehran, while the White House faces pressure to either back Israeli strikes on Iranian nuclear sites or push diplomacy. Trump has reportedly encouraged VP Vance and envoy Witkoff to pursue talks. Despite the rhetoric, oil exports remain undisturbed.

On the policy front, attention remains on the evolving Senate reconciliation bill, though legislative progress is still uncertain. Trade developments were limited, with Trump criticizing the EU’s stance and no breakthrough in U.S.-Japan talks at the G7.

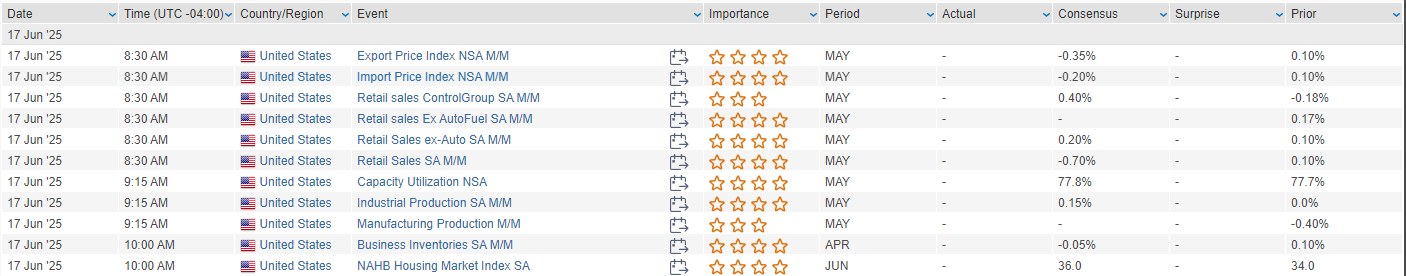

A busy U.S. economic calendar includes May retail sales (expected -0.6% headline, +0.3% core), industrial production, and the NAHB housing index. Housing starts, jobless claims, and the June FOMC meeting with updated SEP and Powell’s press conference are due Wednesday. Markets are closed Thursday for Juneteenth, and Friday brings the Philly Fed survey.

Corporate news was light. Amazon will extend Prime Day to four days (July 8–11). Reports point to rising tensions between Microsoft and OpenAI. Meta is advancing AI-generated ad efforts, while Eli Lilly is reportedly in advanced talks to buy Verve Therapeutics for up to $1.3B. Lennar’s Q2 results were mixed but viewed as better than feared, with margins in line.

U.S. equities rallied on Monday, with the S&P 500 gaining 0.94%, the Nasdaq up 1.52%, and all major indexes advancing after last week’s decline. The rebound was fueled by easing geopolitical concerns, solid gains in big tech, and continued optimism around earnings and positioning. Risk sentiment improved as President Trump said Iran is showing interest in de-escalation, even as Israel vowed to continue its military campaign. Crude prices retreated 1.7% after a 13% surge last week, helping ease inflation fears as oil production remains unaffected and the Strait of Hormuz remains open. Treasuries weakened with a steepening curve, and the dollar index rose 0.2%. Gold fell 1% while bitcoin futures gained 3.7%.

The June Empire State Manufacturing Survey posted a surprise drop to -16, missing expectations of -5.5, with declines in new orders and shipments but the first positive employment reading since January. Inflation indicators were mixed, with prices paid decelerating but prices received rising. Market participants now await key data and events, including Tuesday’s retail sales, industrial production, import prices, and the NAHB housing index, followed by Wednesday’s FOMC decision, updated Summary of Economic Projections (SEP), and Powell press conference.

Company News by GICS Sector

Information Technology

- AMD (+8.8%) rose after a CNBC reporter cited rumors of a major GPU win at AWS, though unconfirmed.

- CSCO (+2.2%) was upgraded to Buy at Deutsche Bank, which cited AI tailwinds and better growth visibility.

- WIX (+5.1%) gained on a Wells Fargo upgrade to Overweight, with positive commentary on product updates and FY26 pricing power.

- PRO (-3.6%) was downgraded at Baird due to concerns over executive changes and execution risk.

Communication Services

- META (+2.9%) announced plans to monetize WhatsApp with ads and subscriptions; also launching channel features.

- GOOGL was the focus of a weekend financial cover story on how AI is reshaping search; analysts noted strength from cloud and autonomous investments.

- ROKU (+10.4%) surged after announcing a partnership with AMZN to create the largest authenticated CTV footprint in the U.S.

- SATS (+49.1%) spiked after reports Trump is intervening in its spectrum license dispute with the FCC.

Consumer Discretionary

- AMZN rose on news of its partnership with Roku.

- MGM (+8.1%) raised FY net revenue guidance for BetMGM to at least $2.6B with EBITDA expected to exceed $100M.

- VSCO (+2.4%) gained after activist investor Barington Capital disclosed a nearly 13% stake and plans to push for strategic changes and board reform.

- RH continued to benefit from last week’s earnings and reaffirmed FY guidance.

- FRPT (-2.5%) was initiated at Sell by UBS, which warned of weak purchase trends and overoptimistic consensus forecasts.

Financials

- Investment banks and fund managers performed well as part of the broader rally in financials.

Health Care

- SRPT (-42.1%) plunged after disclosing a second death related to its gene therapy for muscular dystrophy.

- INCY (+5.1%) rallied on positive clinical data for its mutCALR antibody and an upgrade to Buy at Stifel.

- SAGE (+35.4%) agreed to be acquired by Supernus Pharmaceuticals (SUPN) in a deal valued up to $795M.

Industrials

- X (+5.1%) gained after Trump issued an executive order approving its $14B+ acquisition by Nippon Steel and referenced a “golden share” for U.S. government oversight.

- AMWD (-1.8%) fell after announcing the resignation of its CFO, with the CEO stepping in as interim.

- JCI (+2.5%) rose after announcing a $9B share repurchase program.

Energy

- Energy names underperformed as crude fell 1.7%, giving back some of last week’s rally. Despite heightened geopolitical risks, supply disruptions have not materialized

Eco Data Releases | Tuesday June 17th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday June 17th, 2025

Data sourced from FactSet Research Systems Inc.