June 20, 2025

S&P futures are down 0.3% Friday morning after a mixed and choppy U.S. session Wednesday, which saw strength in banks, crypto, cruise lines, and building materials, while payments, energy, athletic apparel, and chemicals lagged. Asian markets were narrowly mixed overnight, though Hong Kong gained over 1%. European markets are higher, up ~0.8%. Treasuries are weaker with yields up 1–2 bp. The dollar index is down 0.3%, gold off 1%, Bitcoin futures up 1.6%, and WTI crude up 0.6%.

Geopolitics remain in focus, with President Trump stating he’ll decide within two weeks whether to strike Iran, despite reports suggesting he already approved attack plans. Trade headlines were quiet, though U.S.-auto sector tensions persist. Reconciliation negotiations continue to stall over Medicaid cuts, SALT, and clean energy credits. Fed rate cut pressure from the White House remains a talking point. In Japan, hotter inflation and larger-than-expected JGB issuance cuts grabbed attention.

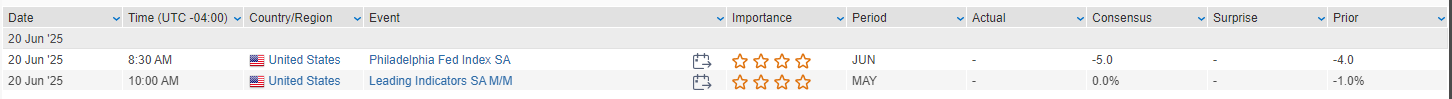

Today’s U.S. calendar features the Philly Fed manufacturing index. Next week includes flash PMIs, home sales, consumer confidence, durable goods, final Q1 GDP, and the core PCE inflation report. Chair Powell gives his semi-annual testimony Tuesday and Wednesday. Fed bank stress test results and significant Treasury supply are also on tap.

Corporate news was limited:

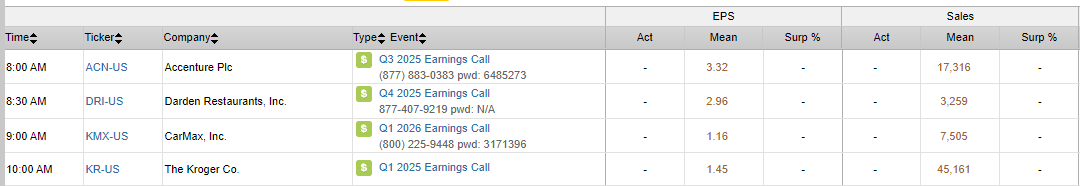

- ACN, DRI, KMX, and KR report earnings today.

- HD reportedly submitted a competing bid for GMS, which recently received a ~$5B offer from QXO.

- PARA is said to be delaying a $35M Trump-related settlement.

- WOR announced the $93M acquisition of Elgen Manufacturing.

- REGN and SNY’s Dupixent received FDA approval for treating bullous pemphigoid

(reprinted from June 19)

U.S. equities finished narrowly mixed in volatile Wednesday trading (Dow -0.10%, S&P 500 -0.03%, Nasdaq +0.13%, Russell 2000 +0.52%), lacking a strong directional driver. Market participants continued to monitor developments in the Middle East, where tensions between Israel and Iran remained high. President Trump did not add much new commentary following Tuesday’s hawkish rhetoric. WTI crude rose 0.3% amid geopolitical volatility, while gold closed fractionally higher and Bitcoin futures declined 0.8%. Treasuries were little changed and the dollar index edged up 0.1%.

As expected, the Fed left its policy rate unchanged at 4.25–4.50%. The updated Summary of Economic Projections maintained expectations for two rate cuts in 2025, while projections for 2026 and 2027 shifted more hawkish. The Fed lowered its 2025 GDP forecast to 1.4% from 1.7%, raised the inflation forecast to 3.0% from 2.7%, and nudged up the unemployment rate outlook to 4.5%. Chair Powell acknowledged heightened uncertainty tied to tariffs and inflation dynamics. Following the announcement, futures markets priced in a 71% chance of a rate cut in September, up from 60% prior.

Economic data offered a mixed picture. Initial jobless claims held steady at 245K, while continuing claims ticked down slightly. However, May housing starts dropped 9.8% month-over-month to the lowest level since May 2020, and building permits also missed expectations. The weak housing data followed Tuesday’s softer NAHB sentiment reading, further reinforcing concerns about the sector. U.S. markets will be closed Thursday for the Juneteenth holiday, with the Philly Fed manufacturing survey due Friday.

S&P 500 Sector Performance

Outperformers: Technology +0.36%, Utilities +0.25%, Real Estate +0.14%, Financials +0.01%

Underperformers: Energy -0.68%, Communication Services -0.67%, Materials -0.33%, Industrials -0.25%, Healthcare -0.18%, Consumer Discretionary -0.18%, Consumer Staples -0.10%

Information Technology

- MRVL gained 7.1% following positive takeaways from its Custom AI Investor Event, which included an upward revision to its CY28 data center TAM and higher growth expectations across switching, interconnect, and storage.

- ADI rose 1.0% after being upgraded to Overweight at Cantor Fitzgerald, which cited industrial exposure and high-quality assets as positives heading into an early-cycle recovery.

Financials

- NUE advanced 3.3% after guiding Q2 EPS ahead of consensus, citing strength in steel mills and stable steel-product pricing and volumes.

- UBS declined 2.6% after a downgrade to Underweight at Morgan Stanley, which cited capital headwinds from new regulatory proposals and reduced buyback forecasts from FY26 onward.

Communication Services

- COIN jumped 16.3% after the Senate passed the GENIUS Act, which would create a regulatory framework for stablecoins. The company also introduced Coinbase Payments for commerce platforms.

- CRCL surged 33.8% on the same legislative news, as the bill now moves to the House for further action.

- LYFT fell 1.7% following news that Waymo applied for an autonomous driving permit in New York City, raising competition concerns.

Consumer Discretionary

- AMZN gained modestly as it outlined plans to produce 10,000 robotaxis annually, aiming to challenge Waymo’s lead in the autonomous vehicle space.

- LULU slipped 1.7% after announcing a cut of 150 corporate roles following a strategic review.

Industrials

- ASTS rallied 10.6% on news of a partnership with Vodafone Idea to expand mobile connectivity in remote parts of India.

- STLD dropped 2.3% after guiding Q2 EPS about 26% below consensus, citing compressed metal spreads and weaker realized pricing.

Materials

- ZTS fell 4.1% after a downgrade to Hold at Stifel, which cited increasing competitive pressures and expected revenue deceleration.

- KFY rose 6.5% on an earnings and revenue beat, driven by strength in Executive Search, though partially offset by softer consulting performance. Forward guidance midpoints were ahead of consensus.

- BMEA plunged 34.1% after raising $40M through a stock and warrant offering despite reporting encouraging preclinical results for its oral GLP-1 candidate BMF-650.

Energy

- PAA climbed 3.8% after announcing the $3.75B cash sale of its Canadian NGL business to KEY.CN, a move welcomed by the Street as a shift toward a crude-focused strategy.

Real Estate

- Sector eked out a 0.14% gain with no notable stock-specific developments.

Utilities

- Utilities gained 0.25% in a defensive bid amid continued geopolitical risks, with no major company-specific news.

Consumer Staples

- HAS cut approximately 3% of its workforce (~150 employees), citing higher input costs stemming from tariffs.

Healthcare

- BMEA‘s stock sale and drop also featured prominently in the healthcare space, though otherwise the sector saw limited activity.

Eco Data Releases | Friday June 20th, 2025

S&P 500 Constituent Earnings Announcements | Friday June 20th, 2025

Data sourced from FactSet Research Systems Inc.