June 25, 2025

S&P futures are flat Wednesday morning, following Tuesday’s broad rally that pushed all major indexes up over 1%. The S&P 500 is now less than 1% from its mid-February record, while the Nasdaq 100 hit a new all-time high. Outperformers included crowded shorts, semis, cyclicals, cruise lines, banks, builders, and China ADRs. Overnight, Asian markets were mostly higher with Greater China leading gains, while Europe opened mixed. Treasuries were steady to slightly firmer at the long end. The dollar index rose 0.2%, gold edged up 0.1%, Bitcoin futures rose 0.9%, and WTI crude rebounded 0.8% after a sharp 13% decline to start the week.

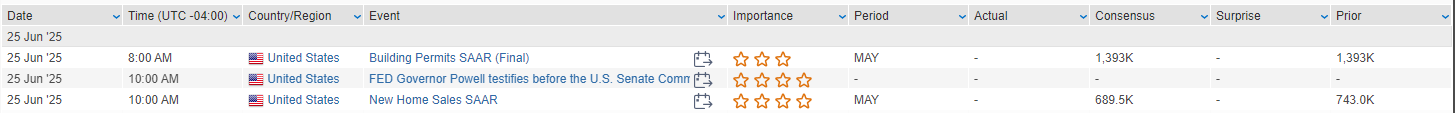

No major catalysts in play. The Trump-brokered Israel-Iran ceasefire is holding, with the White House now optimistic about longer-term diplomatic progress. Focus has shifted to the reconciliation bill and the 9-Jul reciprocal tariff deadline. Senate votes may begin later this week, though pushback from fiscal hawks and House moderates continues. Market expectations for ~60 bp of rate cuts this year remain supported by recent dovish Fedspeak from Waller and Bowman and softening data. Powell speaks again today following Tuesday’s reiteration that the Fed is well-positioned to remain patient. Only U.S. data point today is May new home sales. Treasury supply in focus with a $70B 5-year auction.

Corporate Highlights:

- FDX: Q4 beat on revenue and freight margins, but Q1 EPS guidance 9% below consensus; no FY outlook due to macro uncertainty.

- TSLA: EU registrations fell 40.5% in May.

- AVAV: Q4 topped expectations on strength in Loitering Munitions; management downplayed backlog concerns.

- GBCI: To acquire GNTY in an all-stock deal valued over $475M.

- MIR: Announced digital innovation partnership with Westinghouse for nuclear instrumentation.

- WOR: Jumped on strong Q4 EBITDA beat driven by Consumer and Building Products.

- OUT: Disclosed plans to reduce workforce by 6%.

- BB: Beat and raised full-year revenue and EBITDA guidance

U.S. equities ended higher Tuesday, extending Monday’s gains and bringing the S&P 500 within 1% of its 19-Feb record close, while the Nasdaq is now 1.3% below its December peak. Risk-on sentiment was driven by easing geopolitical concerns after a ceasefire between Israel and Iran appeared to hold. President Trump criticized both parties for strikes following the announcement but did not walk back the ceasefire’s validity. Meanwhile, dovish monetary policy commentary from Fed Governors Waller and Bowman continued to underpin investor sentiment. Chair Powell began his semiannual Congressional testimony, reiterating a cautious approach to rate cuts while acknowledging potential inflationary effects of tariffs. However, several Fed officials, including Bostic, Hammack, Williams, and Collins, leaned more hawkish, suggesting policy may remain restrictive for some time.

On the data front, Conference Board consumer confidence missed expectations, falling to 93.0, its lowest since March, while the labor market differential narrowed and inflation expectations eased to 6.0%. The Richmond Fed manufacturing index came in at -7, better than consensus, while the April FHFA home price index declined for the first time since August 2022. Treasuries rallied across the curve, with yields down 4–5 bp. The dollar index fell 0.5%, gold declined 1.8%, and Bitcoin futures rose 2.1%. WTI crude slid 6.0%, bringing its weekly loss to ~13%, erasing geopolitical risk premiums.

S&P 500 Sector Performance

- Outperformers: Tech +1.61%, Financials +1.50%, Communication Services +1.39%, Healthcare +1.19%

- Underperformers: Energy -1.51%, Consumer Staples -0.03%, Utilities +0.39%, Real Estate +0.41%, Consumer Discretionary +0.71%, Materials +0.75%, Industrials +0.86%

Information Technology

- SNOW +4.4%: Assumed Overweight at Morgan Stanley on valuation and optimism around growth under its new CEO.

- SNX +7.3%: Beat on Q2 earnings and revenue; cited strength in IT distribution and Hyperscaler momentum; raised Q3 guidance.

Financials

- MA +2.8%: Announced partnership with FI to support mainstream stablecoin adoption.

- UPST +9.8%: Assumed Overweight at Piper Sandler; bullish on AI-driven lending model.

Communication Services

- GOOGL: In focus as EU regulators evaluate tighter rules around search dominance.

Consumer Discretionary

- CCL +6.9%: Q2 beat with record net yields and strong demand; raised FY EPS and yield guidance.

- AAP -7.1%: Downgraded to Sell at Goldman Sachs on market share loss concerns.

- RH -1.2%: Downgraded to Sell on housing market pressures and delayed brand rollout.

Healthcare

- EXEL +5.4%: Upgraded to Overweight at Stephens; favorable FDA prospects for zanzalintinib and strong Cabometyx performance.

Industrials

- UBER +7.5%: Began offering Waymo robotaxi service in Atlanta; no human supervision required.

- LYFT +6.1%: Upgraded to Buy at TD Cowen, cited strong growth potential beyond top 25 markets.

Energy

- SM -2.3%: Downgraded to Underperform at Raymond James on oil price and inventory concerns.

Consumer Staples

- DG -1.4%: Downgraded to Neutral at Goldman Sachs on valuation concerns.

Eco Data Releases | Wednesday June 25th, 2025

S&P 500 Constituent Earnings Announcements | Wednesday June 25th, 2025

Data sourced from FactSet Research Systems Inc.