June 26, 2025

S&P futures rose 0.3% Thursday morning following a mixed-to-lower Wednesday session, where tech and AI outperformance contrasted with weak market breadth—about 75% of S&P 500 components declined. Asian markets were mixed, led by Japan and Taiwan, while Hong Kong lagged. Europe edged higher. Treasuries were flat to slightly firmer. The dollar slipped 0.5%, gold rose 0.3%, Bitcoin futures dipped 0.4%, and WTI crude was little changed.

Macro headlines remained light. Market focus turned to reports that Trump may announce a Fed Chair pick as early as this summer, well ahead of the usual transition timeline, continuing his criticism of Powell. This has raised concerns about Fed independence. The reconciliation bill remains in focus with Senate Republicans aiming to vote this weekend, though Medicaid and SALT deductions remain key obstacles. Meanwhile, the White House continues to hint at trade deal progress, including efforts to make the “revenge tax” irrelevant. On the flow side, month- and quarter-end equity selling remains a key market dynamic.

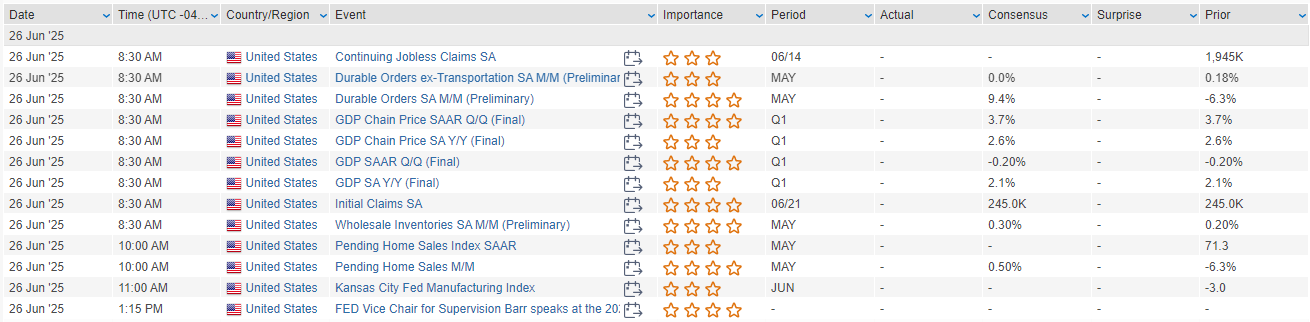

Today’s economic calendar includes Q1 GDP (final), durable goods, jobless claims (expected at 245K), and pending home sales. Fedspeak features Barkin, Hammack, and Barr. Treasury auctions continue with $44B in 7-year notes following a soft 5-year sale. On Friday, markets will digest personal income/spending data (with core PCE) and final June sentiment readings, alongside Fed bank stress test results.

Corporate Highlights

- MU beat and raised, offering upbeat commentary on DRAM and HBM, reinforcing AI momentum.

- MSFT and OpenAI reportedly at odds over the definition of artificial general intelligence.

- JEF missed on Q2 EPS, citing early-quarter policy uncertainty, though guidance was constructive.

- FUL beat and raised guidance.

- SCS posted a strong Q1 citing demand from large corporate, government, and healthcare clients; Q2 guidance was slightly soft.

- MLKN surged after a solid Q4 beat and noted broad-based order growth and positive business trends.

U.S. equities were mostly lower on Wednesday in a directionless session marked by tech and AI outperformance. The Dow slipped 0.25% while the S&P 500 closed flat and the Nasdaq added 0.31%. The Russell 2000 fell 1.16%, with weak breadth dragging equal-weight S&P performance behind cap-weighted by ~70 bp. Gains in large-cap tech offset weakness in defensives, cyclicals, and China-linked names. Treasuries were mostly firmer with a modest curve steepening. The dollar index fell 0.2%, gold rose 0.4%, Bitcoin futures gained 2%, and WTI crude climbed 0.9% after earlier losses of ~13% to start the week.

The macro narrative remained quiet. With the Israel-Iran ceasefire holding and no material oil infrastructure disruption, investor focus turned to the Republican reconciliation bill and the upcoming 9-Jul reciprocal tariff deadline. Passage of the bill is expected, though ongoing friction among fiscal hawks and moderate Republicans may generate volatility. The White House has hinted at trade deal announcements, while speculation grows that select tariffs may be delayed. Meanwhile, Fed policy remains in focus amid contrasting signals: Powell reiterated a patient stance in his second day of Congressional testimony, while Waller and Bowman have raised the possibility of a July rate cut. May new home sales missed expectations, falling to the lowest level since October 2023. The Fed also proposed expected changes to SLR rules and completed a well-received $70B 5-year note auction ahead of Thursday’s $50B 7-year sale.

S&P 500 Sector Performance

- Outperformers: Technology +1.18%, Communication Services +0.51%, Healthcare +0.09%

- Underperformers: Real Estate –2.46%, Consumer Staples –1.39%, Utilities –1.37%, Consumer Discretionary –1.13%, Industrials –0.93%, Materials –0.79%, Energy –0.43%, Financials –0.38%

Information Technology

- +12.5% BB (BlackBerry): Beat on Q1 EPS and revenue; raised FY guidance despite soft margin. Cited strong secure comms demand and momentum in auto tech.

- +3.1% COIN (Coinbase): Up after Bernstein raised its price target, citing growth levers and regulatory tailwinds.

- +1.2% NVDA (Nvidia): Continued rally, hitting another record high as AI demand sustains.

- -3.0% WPP (WPP Group): Downgraded to underweight; sector faces AI disruption and low organic growth.

Communication Services

- +0.3% GOOGL (Alphabet): Outperformed as big tech extended gains.

- +7.3% BMBL (Bumble): Raised Q2 outlook, announced 30% workforce reduction to achieve $40M in annual savings.

Consumer Discretionary

- +1.6% BP (BP): Shares rose on a Reuters report that Shell was in early-stage takeover talks, which Shell later denied.

- TSLA (Tesla): May EU registrations fell for a fifth straight month at a rate of -40.5%; shares underperformed.

- -1.2% ULTA (Ulta Beauty): CFO resignation weighed on shares; FY25 guidance reaffirmed.

- -5.1% GIS (General Mills): Missed on revenue and organic growth; noted tough consumer backdrop.

Industrials

- +21.6% AVAV (AeroVironment): Posted a strong Q4 on defense demand; guided FY26 revenue and EBITDA above consensus.

- -3.3% FDX (FedEx): Q4 beat overshadowed by weak Q1 guidance and macro concerns; uncertainty around tariffs limits visibility.

- MIR: Announced nuclear tech partnership with Westinghouse. +2%

- WOR (Worthington Enterprises): Strong Q4 driven by consumer and building products; acquisitions and cost control highlighted.

Financials

- -9.4% PAYX (Paychex): Q4 revenue missed; margins compressed amid rising costs. Full-year outlook fell short.

- GBCI/GNTY: Glacier Bancorp to acquire Guaranty Bancshares in a $475M+ all-stock deal.

Energy

- +1.6% BP: (see above)

- Crude inventories fell 5.8M barrels last week, easing supply concerns.

- Shell takeover rumors denied; energy names still lagged despite oil’s modest bounce.

Other Notables

- OUT: Said it will cut 6% of workforce.

- RBRK: To acquire AI startup Predibase for $100–500M, per CNBC.

Eco Data Releases | Thursday June 26th, 2025

S&P 500 Constituent Earnings Announcements | Thursday June 26th, 2025

Data sourced from FactSet Research Systems Inc.