July 3, 2025

U.S. equity futures are little changed Thursday morning as investors head into the Independence Day holiday. Wednesday’s gains were driven by strength in select big tech names and Southeast Asia-exposed stocks, including athletic apparel and home furnishings. The major indexes are on pace for strong gains in the shortened trading week. Treasuries are firmer across the curve, with long-end yields edging down, while the dollar is modestly higher. Gold is down 0.1%, Bitcoin futures are up 0.4%, and WTI crude is off 0.4% after a sharp midweek rally.

The main focus overnight was the final push for President Trump’s “Big, Beautiful Bill” in the House. After intense behind-the-scenes lobbying, several GOP holdouts supported a procedural motion, setting up a final vote this morning. If passed, the bill could be signed by Trump on his long-preferred July 4 deadline. Elsewhere, trade headlines were limited, though markets are still digesting Trump’s Wednesday announcement of a Vietnam trade deal, which includes a 40% tariff on transshipped goods. China responded with warnings of potential retaliation if the agreement harms its economic interests. Meanwhile, the U.S. eased export restrictions on chip-design software, aligning with the Geneva trade agreement and easing some sector-specific tensions.

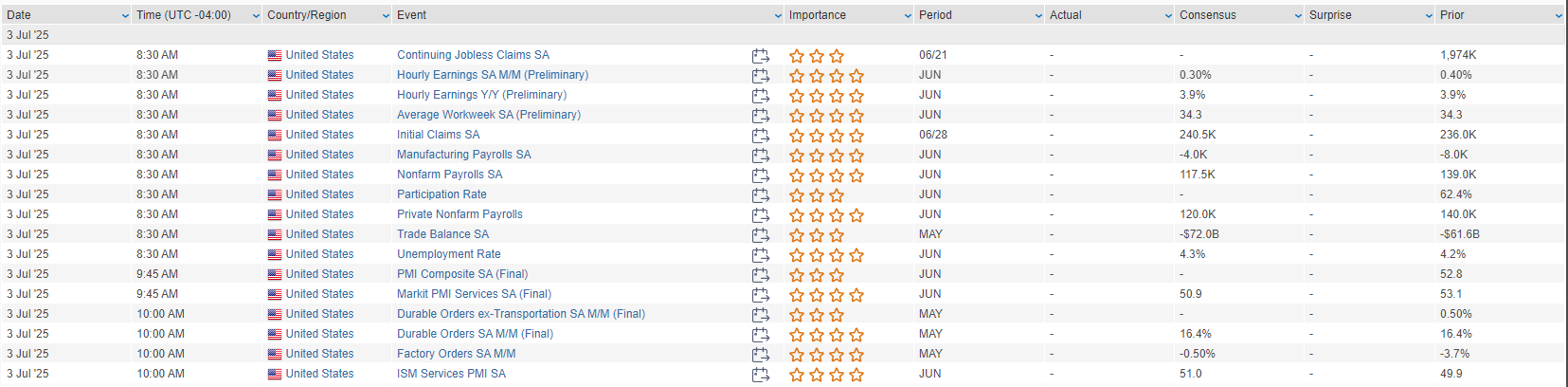

All eyes today are on the June nonfarm payrolls report, with consensus expecting a gain of 188K jobs, up from May’s 139K. However, downside risks remain elevated following Wednesday’s surprise ADP payrolls contraction. Weekly jobless claims and the ISM services index are also on the calendar. Globally, China’s Caixin services PMI fell to a nine-month low, signaling slower expansion. Japan’s final PMI was slightly revised up, and Australia reported a smaller-than-expected trade surplus. Market activity is expected to taper heading into next week, though the June FOMC minutes on Wednesday will be a key event.

- CDNS, SNPS: Shares higher after the U.S. lifted export curbs on chip-design software sales to China.

- DDOG: Will be added to the S&P 500 on July 9, replacing HPE following its acquisition of Juniper Networks.

- LCID: Reported Q2 deliveries slightly below consensus; kept full-year production guidance unchanged.

- FIZZ: Posted in-line EPS, with better-than-expected revenue.

- TRIP: Starboard Value disclosed a >9% stake in the company, per Reuters

U.S. equities finished mostly higher Wednesday (Dow -0.02%, S&P 500 +0.47%, Nasdaq +0.94%, Russell 2000 +1.31%}, with broad-based gains led by small-caps and cyclicals. The S&P 500 and Nasdaq set new record closes, building on strength in semiconductors, energy, and industrial metals. Market breadth was solid, though momentum factors lagged again as traders rotated further out of Q2’s high-performing tech names.

Treasuries weakened with a steepening yield curve; long-end yields rose 4–5bp. The dollar was little changed overall but strengthened notably against the British pound amid rising U.K. political uncertainty. Gold edged up 0.3%, while Bitcoin surged 4.0%, climbing back above $110K. WTI crude gained 3.1% as OPEC-led supply data and geopolitical risks supported prices.

On the economic front, June ADP private payrolls fell 33K, missing consensus for a 115K gain and marking the first negative print since March 2023. Losses were concentrated in professional and business services, education, and healthcare. The report added to concerns ahead of Thursday’s nonfarm payrolls, where expectations are already modest (+115K). Previews continue to highlight downside risks to both the headline figure and unemployment rate (seen ticking up to 4.3%).

In Washington, President Trump’s “Big Beautiful Bill” advanced to the House after passing the Senate Tuesday, but GOP divisions and procedural hurdles threaten his goal of securing passage by July 4. House Republican Thomas Massie claimed he has enough votes to block the measure. On the trade front, Trump announced a deal with Vietnam, including a 20% blanket tariff and 40% rate on transshipped goods. Vietnam will drop all tariffs on U.S. imports. Talks with Japan and the EU remain strained, with Trump reiterating his hard line and threatening unilateral tariff imposition if no deal is reached by the July 9 deadline.

Company-Specific Highlights by GICS Sector

Information Technology (+1.30%)

- MSFT: Reportedly scaling back AI chip ambitions due to delays; also planning to lay off 9,000 workers (<4% of workforce).

- INTC -4.3%: Reuters reported CEO considering expensive pivot away from the 18A process; possible multibillion-dollar write-off risk.

- ADBE -3.5%: Downgraded to Sell at Rothschild & Co Redburn; cited rising competition in creative software from generative AI.

Consumer Discretionary (+0.76%)

- TSLA +5.0%: Q2 deliveries of 384K came in near expectations; China sales rose 0.8% y/y—first growth in nine months.

- NKE, WSM: Gained on Vietnam tariff deal; Vietnam-related macro baskets outperformed.

- RIVN -4.5%: Missed on Q2 production; deliveries in line. Received $1B investment tranche from Volkswagen.

- ROST +1.2%: Upgraded to Buy at Jefferies; noted valuation gap, improving comps and margin upside.

Energy (+1.70%)

- Sector outperformed alongside WTI’s 3.1% rally.

- Crude oil inventories rose by 3.8M barrels last week; OPEC production rose 360K bpd in June.

- Dallas Fed survey showed modest contraction in Q2 oil and gas activity.

Healthcare (-0.97%)

- CNC -40.4%: Withdrew FY25 guidance citing materially inconsistent risk adjustment data from Wakely.

- UNF -10.2%: Beat on EPS, but revenue and margins disappointed. Core laundry segment underperformed; FY revenue guide bracketed consensus.

Materials (+1.33%)

- GBX +21.1%: Beat on FQ3 EPS, revenue, and margins; raised FY margin guidance amid strong fleet utilization and recurring revenue growth.

Consumer Staples (-0.01%)

- STZ +4.5%: Q1 earnings and revenue came in light, but company reaffirmed FY EPS guidance and emphasized beer segment strength despite weaker demand and higher aluminum tariffs.

Financials (-0.09%)

- JPM, BAC, WFC, C: Announced new buybacks and dividend hikes following successful Fed stress tests.

Communication Services (+0.07%)

- PARA: Settled lawsuit with Trump over a 60 Minutes interview for $16M.

- GOOGL: Submitted new antitrust proposal to EU regulators to avoid fines.

- AMZN: Expected to surpass $21B in gross merchandise volume on Prime Day; no major stock movement reported.

Industrials (+0.10%)

- No standout movers despite strong sectoral breadth and gains in airlines, metals, and homebuilders.

Utilities (-0.87%), Real Estate (+0.16%)

- Both sectors lagged in a risk-on session with rising yields and renewed cyclicals leadership.

Eco Data Releases | Thursday July 3rd, 2025

S&P 500 Constituent Earnings Announcements | Thursday July 3rd, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.