July 8, 2025

S&P futures are little changed following Monday’s broad decline, which saw all major U.S. indexes fall between 0.8–0.9%. Losses were led by small caps, semiconductors, housing names, and high short-interest stocks. Tesla was a notable drag on the mega-cap tech cohort. Asian markets traded mostly higher overnight, with South Korea and Hong Kong outperforming, while European equities are narrowly mixed. Treasuries are weaker again, with yields rising ~3 bp on the long end. The dollar index is down 0.2%, with the Australian dollar leading gains after the RBA unexpectedly held rates steady. Gold is off 0.2%, Bitcoin futures are up 0.6%, and WTI crude is down 0.8%.

Tariff policy remains front and center, overtaking fiscal headlines after last week’s passage of the Republican reconciliation bill. Despite a flurry of tariff announcements—including on Japan and South Korea—risk sentiment remains relatively steady, aided by a delay in implementation until August 1 and Trump’s suggestion that further delays or moderated terms are possible. Negotiations are ongoing and may yield less severe outcomes, with the White House hinting that additional trade deals could be announced later this week.

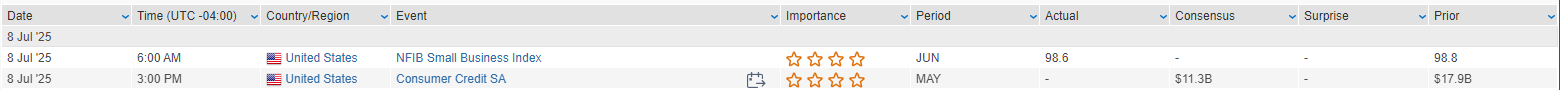

The U.S. economic calendar is light today, featuring the June NFIB Small Business Optimism Index, expected to ease slightly to 98.6 from May’s 98.8. May’s reading had snapped a four-month downtrend, helped by improved expectations for business conditions and sales. The New York Fed’s one-year inflation expectations are also due, with the prior release showing broad-based declines in inflation outlooks. Meanwhile, Treasury supply is in focus with a $58B auction of 3-year notes scheduled for today.

Stock-Specific News

- META: Hired a top AI models executive from AAPL, intensifying the competition for AI talent.

- TSLA: Facing renewed scrutiny over Elon Musk’s political activity; Washington Post highlighted pressure on the board to separate Musk from partisan issues.

- XOM: Q2 earnings considerations filed in 8-K suggest potential upside to consensus EPS, driven by stronger-than-expected upstream performance.

- CVX: Reportedly preparing to accelerate closure of its acquisition of HES.

- MMSI: Named Martha Aronson as new CEO (effective October 3) and guided Q2 revenue above consensus expectations.

- ENPH, RUN, SEDG: Trading lower after Trump called for stricter enforcement of clean energy rules, creating concern around regulatory risk

U.S. equities declined Monday (Dow -0.94%, S&P 500 -0.79%, Nasdaq -0.92%, Russell 2000 -1.55%), reversing some of last week’s strength as broad-based selling weighed on all major indexes. Weakness was especially pronounced in small-caps and tech, while recent outperformers such as semiconductors, airlines, and banks gave up ground. The decline came amid technical overbought conditions and renewed tariff uncertainty, with the S&P 500 and Nasdaq both pulling back from record highs set late last week.

The major macro focus was trade. President Trump formally began issuing tariff letters to nations without finalized trade agreements, starting with Japan and South Korea, each now facing a 25% base tariff effective August 1. Additional countries including South Africa and Malaysia are also on the list. White House advisor Leavitt confirmed that more letters will be sent throughout the week and that the previous July 9 deadline is now extended to August 1, allowing additional time to finalize deals. Trump also reiterated a threat to impose an additional 10% tariff on countries embracing BRICS-aligned “anti-American” policies.

Despite heightened headline risk, market reaction was relatively measured, with analysts noting that investors appear increasingly desensitized to tariff-related volatility. Meanwhile, the Treasury curve steepened with long-end yields rising 4–5 basis points. The dollar gained 0.3%, especially strong against the yen, while gold ended fractionally lower. Bitcoin futures fell 1.7%, and WTI crude rose 1.4%, defying the weekend’s larger-than-expected OPEC+ production hike.

It was a quiet day otherwise on the economic and policy front. There were no major data releases or Fedspeak, though markets are looking ahead to Wednesday’s release of the June 17–18 FOMC minutes and $119B in Treasury auctions this week. Globally, China-EU tensions escalated after Beijing blocked EU firms from medical device procurement. In Europe, German industrial production was better than expected, while UK hiring intentions hit a 13-year low.

Highlights by GICS Sector

Information Technology (-0.81%)

- WNS +14.3%: To be acquired by Capgemini for $3.3B in cash ($76.50/share), a ~17% premium.

- CRWD -1.7%: Downgraded to Neutral at Piper Sandler on valuation, despite positive outlook for execution and TAM growth.

- ORCL -2.1%: Reportedly offering up to 75% discounts on database and cloud services to the U.S. government to remain competitive.

- PLAB -4.8%: Chairman sold 29,500 shares at $20.20 average.

Consumer Discretionary (-1.26%)

- TSLA -6.8%: Declined after Trump criticized Musk’s “America Party” and reports of market share losses in China.

- STLA -5.0%: Downgraded to Neutral at BofA; concerns cited over European EV positioning and soft 1H/2H earnings outlook.

- MGM -1.5%: Initiated at Sell by Goldman Sachs; cited macro sensitivity, lease burden, and limited asset flexibility.

Communication Services (-0.89%)

- RKLB +9.0%: Higher as investors speculated on benefit from continued Trump-Musk tensions; viewed as a SpaceX competitor.

- APGE -17.3%: Phase 2 trial met primary endpoint, but safety/durability concerns weighed on sentiment.

Industrials (-0.34%)

- RGLD -6.4%: To acquire Horizon Copper and Sandstorm Gold in a $3.7B equity deal; deals reflect sizable premiums.

- CRWV -3.3%: Announced $9B all-stock acquisition of Core Scientific; seen as a strategic expansion in AI infrastructure.

- CORZ -17.6%: To be acquired by CoreWeave for $20.40/share; transaction expected to close in Q4 2025.

Health Care (-0.87%)

- MOH: Lower after preliminary Q2 results missed expectations; comes after CNC pulled guidance last week.

- PAHC +6.8%: Upgraded to Overweight at JPMorgan; cited strong integration of Zoetis’ feed additive business.

Financials (-0.95%)

- No notable gainers or decliners reported outside broad sector underperformance.

Energy (-1.00%)

- RUN +5.8%: Upgraded to Outperform at BNP Paribas; cited tailwinds from the OBBB Act securing tax credits.

- GEO +4.5%: Gained alongside CXW after OBBBA increased ICE/detention funding.

Utilities (+0.17%)

- PEG +1.4%: Upgraded to Buy at UBS; highlighted strong utility performance and value unlock potential through nuclear contracts.

Consumer Staples (+0.11%), Real Estate (-0.81%), Materials (-1.04%)

Eco Data Releases | Tuesday July 8th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday July 8th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.