Equities roared on Tuesday with the major US indices all up > 1.00%. The Nasdaq Composite paced the majors adding 2.43% while the S&P 500 gained 1.68% and the Dow up 1.04%. At the sector level XLY (Discretionary) joined XLK (Info Tech) in leading the tape with both up >2.00%. The Energy Sector was the lone negative on the day with XLE off 0.97%, a sharp reversal from the day before. Strong gains followed softer than expected inflation data from the PPI report with wholesale inflation up 2.3% yoy cooling from June’s figures. The buying front-runs Wednesday’s CPI print which investors are clearly expecting to come in light, keeping dovish policy on the agenda in the 2nd half of the year and making a potential September rate cut more likely.

Accordingly, interest rates were lower across the curve with the Yield on the US 10yr Treasury settling at 3.84% while the yield on the 2yr fell to 3.92%. Crude and Commodities prices weakened on Tuesday with the WTI Crude Continuous contract rolling over from near term overbought conditions we highlighted in yesterday’s note. Commodities prices more broadly were weaker, and the Bloomberg Commodities Index price remains anchored to a key support level at 95.

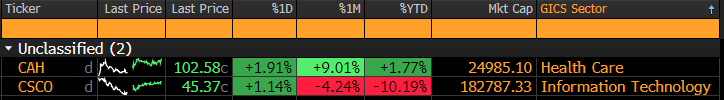

A light earnings calendar on Wednesday with CAH and CSCO reporting. All eyes will be on the CPI report which hits before the bell at 8:30AM.

The S&P 500 Index is approaching our key threshold for bullish reversal with resistance at the 5450-5507 range. Price closed at the 5434 level on Tuesday.

Eco Data Releases | Wednesday August 14th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 08/14/2024 07:00 | MBA Mortgage Applications | 9-Aug | — | — | 6.90% | — |

| 08/14/2024 08:30 | CPI MoM | Jul | 0.20% | — | -0.10% | — |

| 08/14/2024 08:30 | CPI Ex Food and Energy MoM | Jul | 0.20% | — | 0.10% | — |

| 08/14/2024 08:30 | CPI YoY | Jul | 3.00% | — | 3.00% | — |

| 08/14/2024 08:30 | CPI Ex Food and Energy YoY | Jul | 3.20% | — | 3.30% | — |

| 08/14/2024 08:30 | CPI Index NSA | Jul | 314.765 | — | 314.175 | — |

| 08/14/2024 08:30 | CPI Core Index SA | Jul | 318.958 | — | 318.346 | — |

| 08/14/2024 08:30 | Real Avg Hourly Earning YoY | Jul | — | — | 0.80% | — |

| 08/14/2024 08:30 | Real Avg Weekly Earnings YoY | Jul | — | — | 0.60% | 0.50% |

S&P 500 Constituent Earnings Announcements by GICS Sector | Wednesday August 14th, 2024

Worldwide Wednesday

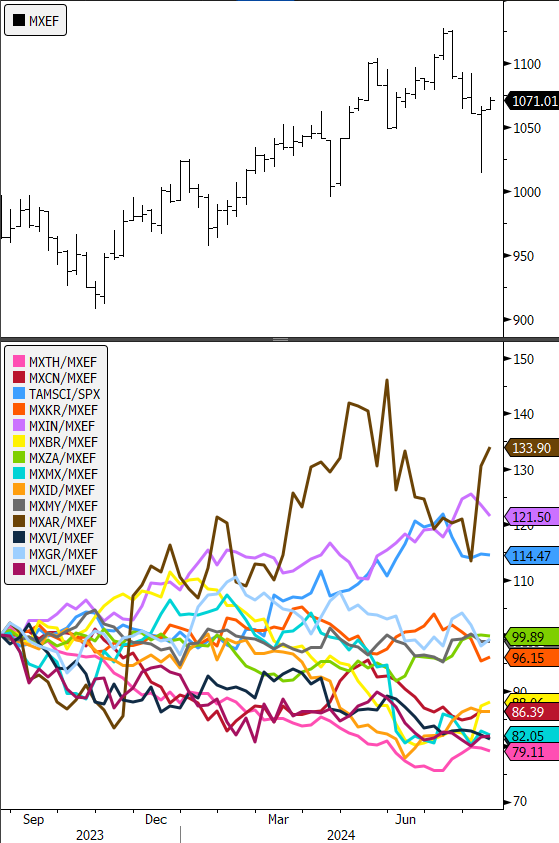

Ex-US equities continue to go nowhere fast. Neither the MSCI EAFE nor the EM Index in aggregate has outperformed the MSCI ACWI (All Country World Index) for any sustained period in 2024. Drilling into the EM Index in the chart below we see the best exposures have been Argentina, India and Taiwan. Argentina shares have reversed higher after a period of correction over the summer. That remains one of the few geographies that has us interested as a US focused investor.

- Panel 1: MSCI Emerging Markets Index (MXEF)

- Panel 2: MSCI Country Constituents Relative to MXEF

Data sourced from Bloomberg