Equities pushed higher after the CPI printed a 2-handle. The 2.9% reading on the year over year CPI report led to the Dow adding 0.61%, the S&P 500 0.38% and the Nasdaq 0.03%. At the sector level, Financials led, adding 1.22% followed by the Energy and Info Tech. Sectors. Laggards included Comm. Services, Discretionary and Utilities which all finished negative on the day.

From a tactical trading perspective, the SPX is nearing our bullish reversal signals with 5500 a key level to watch for a bullish upside break out.

Commodities prices continued to go nowhere with the Bloomberg Commodities Index off 0.14% while the WTI Crude contract was up 0.44% to $77.32. In the Treasury market, the Yield on the 10yr moved lower to 3.83% while the 2yr Yield climbed to 3.95%. Both are near lows for the year.

The macro picture continues to reflect a “risk-off” tone with commodities prices near support and buyers not showing any enthusiasm at those levels despite cooling inflation data. Our historical studies show min vol. sectors generally benefit when interest rates move lower, and commodities prices are falling. The other side of the coin is the uptrend in equities which is still intact despite being challenged at the beginning of the month. We are close to a potential pivot.

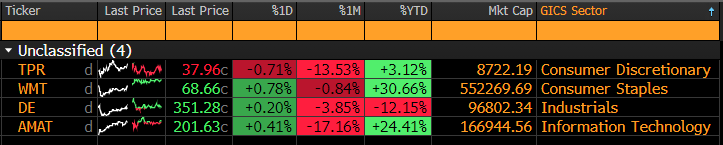

The deluge of economic data continues Thursday with Initial and Continuing Jobless Claims, Industrial Production, Capacity Utilization and several other releases hitting in the morning. The earnings calendar for the S&P 500 features 4 companies reporting including WMT, DE and AMAT.

Eco Data Releases | Thursday August 15th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 08/15/2024 08:30 | Empire Manufacturing | Aug | -6 | — | -6.6 | — |

| 08/15/2024 08:30 | Retail Sales Advance MoM | Jul | 0.40% | — | 0.00% | — |

| 08/15/2024 08:30 | Retail Sales Ex Auto MoM | Jul | 0.10% | — | 0.40% | — |

| 08/15/2024 08:30 | Retail Sales Ex Auto and Gas | Jul | 0.20% | — | 0.80% | — |

| 08/15/2024 08:30 | Retail Sales Control Group | Jul | 0.10% | — | 0.90% | — |

| 08/15/2024 08:30 | Philadelphia Fed Business Outlook | Aug | 5.2 | — | 13.9 | — |

| 08/15/2024 08:30 | Initial Jobless Claims | 10-Aug | 235k | — | 233k | — |

| 08/15/2024 08:30 | Continuing Claims | 3-Aug | 1870k | — | 1875k | — |

| 08/15/2024 08:30 | Import Price Index MoM | Jul | -0.10% | — | 0.00% | — |

| 08/15/2024 08:30 | Import Price Index ex Petroleum MoM | Jul | 0.10% | — | 0.20% | — |

| 08/15/2024 08:30 | Import Price Index YoY | Jul | 1.50% | — | 1.60% | — |

| 08/15/2024 08:30 | Export Price Index MoM | Jul | 0.00% | — | -0.50% | — |

| 08/15/2024 08:30 | Export Price Index YoY | Jul | 0.10% | — | 0.70% | — |

| 08/15/2024 09:15 | Industrial Production MoM | Jul | -0.30% | — | 0.60% | — |

| 08/15/2024 09:15 | Capacity Utilization | Jul | 78.50% | — | 78.80% | — |

| 08/15/2024 09:15 | Manufacturing (SIC) Production | Jul | -0.30% | — | 0.40% | — |

| 08/15/2024 10:00 | Business Inventories | Jun | 0.30% | — | 0.50% | — |

| 08/15/2024 10:00 | NAHB Housing Market Index | Aug | 43 | — | 42 | — |

| 08/15/2024 16:00 | Total Net TIC Flows | Jun | — | — | $15.8b | — |

| 08/15/2024 16:00 | Net Long-term TIC Flows | Jun | — | — | -$54.6b | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Thursday August 15th, 2024

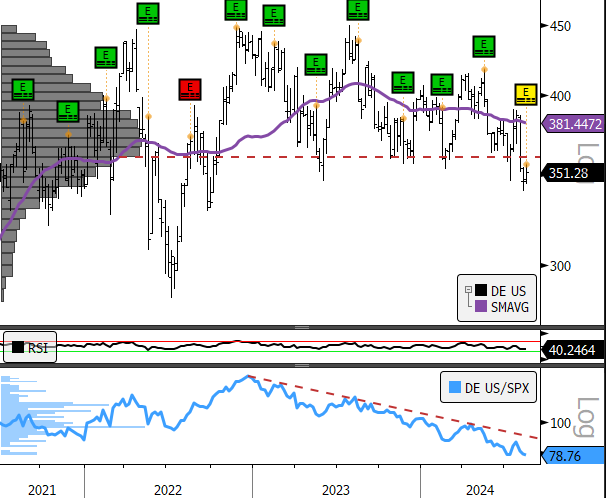

WMT looks pretty strong to us. AMAT may retrace further, but the Semiconductor outperformance trend has been strong enough that a buyer will likely show up at some point in 2024. DE is the company reporting tomorrow that looks to be in the most trouble. We are happy to front run policy easing, but the one thing that stands out to us in the macro and fundamental data is the cost pressures that have accumulated onto the manufacturing sector and the consumer. WMT benefits in that case because of trade downs, but TPR, which has been very weak since March does not. We wonder if rates will reset lower in time to salve these issues.

- DE 3yr, weekly (200-day m.a. | Relative to S&P 500)

- Price is through horizontal support at $360 and looks distributional. If earnings can’t move the needle from this multi-timeframe oversold condition, that’s a problem

Data sourced from Bloomberg