Equities continued a sharp near-term slide on Friday with the major indices all off >1.5% with the Nasdaq giving up 2.43% and the S&P 500 off 1.84%. Futures opened the Sunday evening session negative as Oil prices rise.

Unsurprisingly the VIX spiked to above 20 for the first time since April and low volatility, high yielding sectors of the S&P 500 outperformed on the week.

Commodities and Crude prices have bounced at support, but it is too early to tell if they will embark on an upside thrust. Interest rates keep making new multi-month lows with the 10yr Yield now at 3.79%. Equities will continue to seek equilibrium between expectations of policy accommodation and deteriorating economic data. For most of the year, bad news was good news in hopes the Fed would take rates lower, now its gut check time for all involved.

ISM Surveys, Composite PMI and Senior Loan Officers Survey are on tap for Monday along with earnings from a handful of companies.

We’re expecting a somewhat bumpy August given the negative seasonals, the recent breakdown in equities and the change in sentiment regarding the Mag7. We would caution against overmuch despair as we’ve had a strong year in the equity market to date, and historically there is often a reset or shake-out in presidential years. We do think the longer-term bull market still has ramp, but in near-term we want to take some risk off the table and add exposure to Staples and Utilities.

Eco Data Releases | Monday August 5th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 08/05/2024 09:45 | S&P Global US Services PMI | Jul F | 56 | — | 56 | — |

| 08/05/2024 09:45 | S&P Global US Composite PMI | Jul F | — | — | 55 | — |

| 08/05/2024 10:00 | ISM Services Index | Jul | 51 | — | 48.8 | — |

| 08/05/2024 10:00 | ISM Services Prices Paid | Jul | — | — | 56.3 | — |

| 08/05/2024 10:00 | ISM Services Employment | Jul | — | — | 46.1 | — |

| 08/05/2024 10:00 | ISM Services New Orders | Jul | — | — | 47.3 | — |

| 08/05/2024 14:00 | Senior Loan Officer Opinion Survey on Bank Lending Practices |

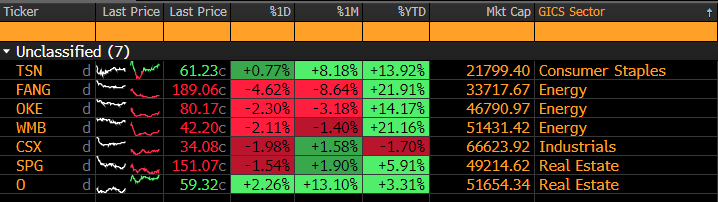

S&P 500 Constituent Earnings Announcements by GICS Sector | Monday August 5th, 2024

Sources: Bloomberg