S&P futures were little changed Tuesday morning after US equities mostly declined on Monday, driven by unwinding recent winners. NVDA (-2.6%) weighed on sentiment due to China regulatory scrutiny, while cautious sell-side commentary pressured media stocks. Asian markets were mixed, with South Korea rebounding on government support, while Hong Kong lagged. European markets traded down ~0.4%. Treasuries were slightly weaker, the Dollar Index rose 0.2%, gold gained 0.4%, Bitcoin futures rose 1%, and WTI crude fell 0.5%.

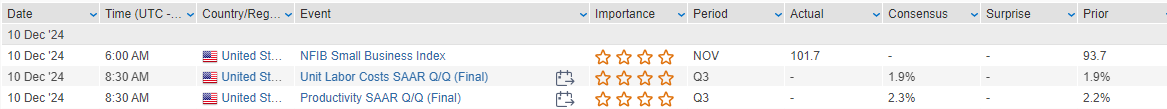

Markets await Wednesday’s November CPI report, expected to show a 0.3% m/m increase, bringing y/y headline CPI to 2.7% (core y/y unchanged at 3.3%). Other macro data this week includes PPI, initial claims, and import/export prices. NFIB small business optimism jumped to its highest level since June 2021. The RBA kept rates unchanged but included dovish tweaks in its statement.

Company-Specific Highlights

- ORCL (-13.5%): Delivered underwhelming fiscal Q2 results; Q3 guidance only in line at the high end. AI/cloud infrastructure commentary was positive, but elevated expectations and 2H margin pressure weighed on sentiment.

- LLY (+1.3%): Announced a $15B share buyback and a 15% dividend increase.

- MDB (+7.9%): Beat and raised guidance but flagged margin dampeners from GTM investments and CFO transition.

- TOL (+2.4%): Q4 deliveries, orders, GM, and EPS all beat expectations; upbeat QTD commentary despite high bar scrutiny on GM guidance.

- CASY (+4.6%): EBITDA came in ahead of expectations.

- MTN (+3.2%): Boosted by strong pass sales and lodging bookings acceleration.

- HQY (-2.5%): Beat and raised, though initial FY26 outlook was light.

- AI (+8.3%): Beat on key metrics and raised FY25 revenue guidance.

- BRZE (-6.1%): Q3 beat, but Q4 revenue guidance only captured consensus amid elevated expectations.

US equities declined on Monday, with the S&P 500 (-0.61%), Nasdaq (-0.62%), and Dow (-0.54%) all closing lower. The Russell 2000 underperformed with a -0.67% decline. The market’s weakness came after a mixed performance last week, where big tech drove gains for major indices. On Monday, big tech was mixed, with NVIDIA (-2.6%) and AMD (-5.6%) among the notable decliners due to regulatory and competitive concerns. Financials also dragged the market, as banks, life insurers, and credit cards faced pressure.

Commodity equities and Chinese technology stocks outperformed, buoyed by a fresh wave of China stimulus sentiment. Sectors like chemicals, machinery, and autos also saw gains, while food stocks benefited from M&A activity. Treasuries were weaker, with a touch of curve steepening. The Dollar Index rose 0.1%, while gold gained 1%. Bitcoin futures dropped -5.3%, and WTI crude rose 1.7%.

Markets remain focused on key macro events, particularly Wednesday’s US CPI report, which could shape the Federal Reserve’s December FOMC policy decision. The market currently prices an ~85% probability of a 25 bp rate cut in December. Other macro themes include renewed geopolitical concerns, particularly after the collapse of the Assad regime in Syria, which had minimal market impact. China stimulus headlines following a Politburo meeting and ahead of the Central Economic Work Conference also drew attention. Economic releases were light, with October wholesale inventories meeting expectations. Inflation expectations from the NY Fed’s consumer survey ticked higher for both one-year (to 3.0%) and longer-term horizons.

Company News by GICS Sector

Communication Services

- IPG (Interpublic Group) +3.6%: To be acquired by OMC (Omnicom Group) in a stock-for-stock deal valued at $13B+. Combined 2023 revenue is expected to reach $25.6B.

- OMC (Omnicom Group) -10.3%: Declined following the announcement of the IPG acquisition.

- CMCSA (Comcast) -9.5%: Dropped after management at the UBS Global Media Conference highlighted expectations of over 100,000 broadband subscriber losses in Q4. ARPU is expected at the lower end of prior guidance.

- TMUS (T-Mobile) -6.1%: Declined after warning of weak upgrade rates and back-end-loaded Q4 results, noting risks to performance during UBS commentary.

Information Technology

- NVDA (NVIDIA) -2.6%: Fell as China’s State Administration for Market Regulation launched an antitrust investigation into Nvidia’s Mellanox acquisition.

- AMD (Advanced Micro Devices) -5.6%: Downgraded to neutral from buy by BofA, citing concerns over competitive pressures in AI and custom chips.

- APP (Applovin) -14.7%: Declined after failing to gain inclusion in the S&P 500, despite being a rumored candidate.

- SMCI (Super Micro Computer) +2.3%: Rose after receiving a filing extension from Nasdaq for its 10-K and 10-Q.

Financials

- APO (Apollo Global Management) +18.3%: Gained after subsidiary Novolex confirmed a $6.7B acquisition of PTVE (Pactiv Evergreen) at $18/share, a 22.6% premium to its last close.

- PAYO (Payoneer Global) -7.6%: Downgraded to market perform at KBW, citing valuation and limited EBITDA margin growth prospects.

Consumer Staples

- HSY (Hershey) +10.9%: Jumped after MDLZ (Mondelez) reportedly considered acquiring Hershey in an early-stage discussion. MDLZ fell -2.3% on the news.

Consumer Discretionary

- REAL (The RealReal) +39.1%: Soared on an upgrade to overweight from Wells Fargo, which cited improving margins and reaccelerating top-line growth.

- M (Macy’s) +1.8%: Rose after reports that activist investor Barington Capital is pushing for spending cuts and a potential spin-off of its real estate assets.

Industrials

- DOW (Dow Inc.) +1.8%: Announced the sale of a 40% equity stake in its Gulf Coast infrastructure assets to Macquarie Asset Management for $2.4B.

- ASTS (AST Spacemobile) +2.6%: Signed a long-term agreement to provide Vodafone space-based cellular broadband services through 2034

Eco Data Releases | Tuesday December 10th, 2024

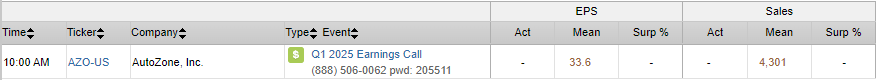

S&P 500 Constituent Earnings Announcements | Tuesday December 10th, 2024

Data sourced from FactSet Research Systems Inc.