S&P futures are down 0.2% Thursday morning after US equities closed mostly higher Wednesday, with big tech and semis leading gains. The Nasdaq hit another record high, surpassing 20K. Asian markets were mostly up overnight, led by Japan, South Korea, and China’s Shenzhen. European markets are slightly higher (~0.1%). Treasuries weakened, with yields up 2-3 bp across the curve. The dollar index is down 0.2%, gold is off 0.4%, Bitcoin futures are down 1%, and WTI crude is up 0.2%.

Market dynamics are muted, with a ~98% chance of a 25 bp Fed rate cut priced for next week. ECB is expected to announce a 25 bp rate cut today, following the SNB’s surprise 50 bp easing. China’s Central Economic Work Conference outlined support measures, including rate cuts and market stabilization efforts. On the geopolitical front, Hamas concessions have raised hopes for a hostage deal in Gaza.

US PPI and initial claims data are due today, alongside the ECB decision and a $22B Treasury bond auction. Import/export prices close out the week Friday. Key upcoming events include Wednesday’s FOMC decision, updated SEP, and several major economic data releases, including retail sales and core PCE inflation.

Corporate highlights:

- ADBE-US: Fiscal Q4 beat expectations, but FY25 guidance came in light due to slowing top-line growth.

- UBER-US: Gained after positive bookings commentary at Barclays Conference.

- KR-US: Announced $7.5B share repurchase program.

- OXM-US: Missed Q3 and lowered FY guidance but noted improved performance post-election.

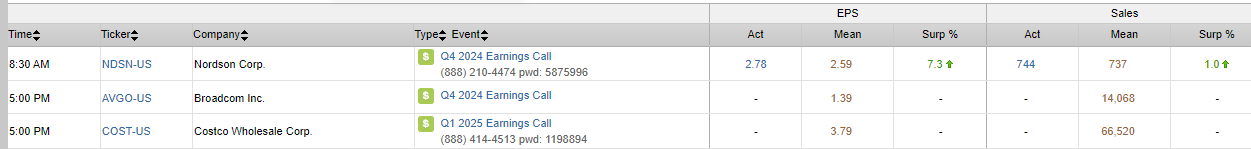

- Earnings ahead: Reports from AVGO-US and COST-US due after the close

US equities closed mostly higher on Wednesday, with the Nasdaq climbing 1.77% to set a new record above the 20K mark, driven by gains in big tech. The S&P 500 rose 0.82%, while the Dow was up 0.22%, and the Russell 2000 advanced 0.48%. Treasuries weakened for a third consecutive day, with a steeper curve. The dollar index gained 0.3%, gold rose 1.4%, and Bitcoin futures rallied 5.3% to move back above $100K. WTI crude climbed 2.5%.

The largely in-line November CPI report reinforced expectations of a December rate cut, with market odds nearing 95%. The report highlighted some pressure from new and used vehicles, while shelter costs decelerated, with owners’ equivalent rent hitting its lowest level since January 2021. Semis and big tech led the charge, with gains fueled by upbeat AI and computing headlines. Other factors included positive sentiment from sell-side conferences, mixed M&A activity, and lingering uncertainty around potential Trump tariffs and regulatory scrutiny.

The Bank of Canada cut rates by 50 basis points, as expected. US 10-year note auctions were well-received, with the highest bid-to-cover ratio since 2016. Thursday brings PPI and initial claims data, while import/export prices will cap the week on Friday.

Corporate News by GICS Sector

Information Technology

- Broadcom (AVGO): Up 6.6%. Reports surfaced that the company is collaborating with Apple (AAPL) on a new AI chip.

- C3.ai (AI): Down 8.5%. Downgraded to underweight at JPMorgan due to uneven growth, subpar margins, and high costs for further expansion.

- Photronics (PLAB): Up 10.8%. Posted FQ4 earnings and revenue beats, citing strong demand in integrated circuits and flat panel displays driven by AI and edge computing.

- Dropbox (DBX): Up 5.2%. Announced a $2.0B secured term loan due 2029 and a $1.2B share repurchase program

Communication Services

- Alphabet (GOOGL): Continued strong momentum, supported by quantum computing advancements that could solve problems beyond the reach of current supercomputers.

- Match Group (MTCH): Down 4.8%. Revised Q4 revenue guidance lower due to FX impacts and offered cautious commentary on Tinder new user growth. Announced a dividend and $1.5B share buyback program.

- Reddit (RDDT): Up 6.4%. Initiated at overweight by Wells Fargo, highlighting advertising monetization as a key EBITDA driver.

Consumer Discretionary

- Macy’s (M): Down 0.8%. Q3 earnings exceeded expectations, but GM softness and a 13% cut to FY EPS guidance at the midpoint weighed on sentiment.

- Stitch Fix (SFIX): Up 44.4%. Delivered a strong beat on FQ1 revenue, margins, and EBITDA. Active clients and net revenue per active client surpassed expectations. Raised FY25 guidance.

- Dave & Buster’s (PLAY): Down 20.1%. Missed Q3 EPS, revenue, and comps. Flagged headwinds from weather disruptions, construction impacts, and weaker consumer demand.

Health Care

- Cigna (CI): Down 5.6%. Under pressure alongside other managed care names following bipartisan legislation to require divestiture of pharmacy businesses within three years.

- Bausch + Lomb (BLCO): Down 12.1%. Financial Times reported Blackstone had cooled on its joint takeover bid due to valuation concerns.

Industrials

- Boeing (BA): Up 4.5%. Reuters reported the company restarted production of its 737 MAX jets last week.

- Fox Factory Holding (FOXF): Up 3.4%. Upgraded to buy at Stifel, citing valuation and recovery momentum in the high-margin bike business.

Consumer Staples

- Hershey (HSY): Down 5.4%. Reports emerged that Hershey Trust rejected Mondelez’s (MDLZ) takeover offer, deeming it too low.

- Mondelez (MDLZ): Up 2.2%. Announced a $9B buyback and reaffirmed its commitment to pursuing bolt-on acquisitions.

Eco Data Releases | Thursday December 12th, 2024

S&P 500 Constituent Earnings Announcements | Thursday December 12th, 2024

Data sourced from FactSet Research Systems Inc.