S&P futures are up 0.3% Friday morning following Thursday’s pullback. Stocks are on track to finish the week mostly lower, though tech provides some support. Asian markets were weaker, with Greater China underperforming as the Hang Seng and Shanghai Composite fell over 2%. European markets are up 0.3%. Treasuries are slightly weaker, the dollar index is up 0.1% (driven by yen weakness), gold is down 0.8%, Bitcoin futures are up 0.4%, and WTI crude is up 0.8%.

Earnings are boosting sentiment, with AVGO and RH rallying after positive updates. AVGO reported better-than-expected Q1 guidance, highlighting AI growth, while RH gained despite an EPS miss, citing accelerating demand and reduced tariff risks from exiting China sourcing. Broader market discussions include seasonality support versus concerns about narrowing market breadth.

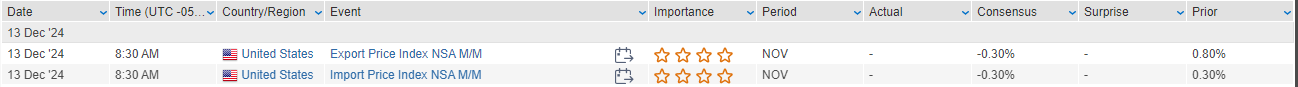

Import and export prices are the only data scheduled for today. The focus shifts to next week’s FOMC decision on Wednesday, alongside retail sales, industrial production, and housing data earlier in the week. Personal income and core PCE inflation reports will close the week.

US equities closed lower on Thursday, with the S&P 500 declining 0.54%, the Nasdaq down 0.66%, and the Dow off 0.53%. Small-cap stocks led the losses, with the Russell 2000 falling 1.38%. The S&P 500 is on track for a weekly decline, though the Nasdaq maintains WTD gains after hitting a new ATH of 20K on Wednesday. Treasury yields rose again, with the curve steepening for the fifth consecutive session. The dollar index strengthened by 0.3%, while gold fell 1.7% after five straight days of gains. Bitcoin futures declined 1.5%, and WTI crude slipped 0.4%.

The market reaction followed a hotter-than-expected headline PPI for November, which came in at 0.4% m/m versus the 0.3% consensus, while core PPI aligned with forecasts at 0.2%. Initial jobless claims rose to 242K, above expectations of 224K. The ECB cut interest rates by 25 bp as anticipated, with further rate cuts expected in January and March. The SNB delivered a more aggressive 50 bp easing. China’s Central Economic Work Conference reaffirmed plans for rate cuts, fiscal stimulus, and domestic demand support to stabilize the economy.

Looking ahead, the market is focused on next week’s FOMC policy decision, with a 98% chance of a 25 bp rate cut priced in. Key economic reports next week include retail sales, industrial production, and housing data, culminating in core PCE inflation and Michigan consumer sentiment on Friday.

GICS Sector News

Information Technology

- Adobe (ADBE): Fell 13.7% after fiscal Q4 results topped expectations, but Q1 and FY25 guidance disappointed. Key concerns included a ~200 bp slowdown in top-line growth and delayed AI monetization. Creative Cloud ARR was another area of disappointment.

- Ciena (CIEN): Rose 15.5% on FQ4 revenue beat, though EPS and margins were light. Management highlighted strong order trends, normalized inventories, and raised long-term revenue growth targets, driven by AI/cloud demand.

Consumer Discretionary

- Oxford Industries (OXM): Dropped 8.6% after Q3 results missed expectations due to hurricanes, election-related disruptions, and macro headwinds. FY guidance was lowered, though management noted improvements post-election and a strong start to the holiday season.

Healthcare

- Keros Therapeutics (KROS): Plummeted 73.2% after halting dosing in two arms of its phase 2 trial for cibotercept due to unexpected adverse events. The company expects full trial results in Q1 2025.

- Corcept Therapeutics (CORT): Declined 6.3% after its phase 2 study of Dazucorilant for ALS failed to meet its primary endpoint. The study will continue to assess overall survival, with results expected in March 2025.

Industrials

- Lockheed Martin (LMT): Fell 1.5% amid reports that Trump and Musk are scrutinizing costs and efficiency of the F-35 program. Separately, Goldman Sachs issued cautious commentary on the 2025 defense outlook.

Financials

- MetLife (MET): Gained 3.6% after unveiling a five-year strategy targeting double-digit adjusted EPS growth and a $25B free cash flow goal.

Consumer Staples

- Keurig Dr Pepper (KDP): Added 1.7% following an upgrade to buy at Deutsche Bank, which highlighted stable earnings and contributions from partner brands.

- Celsius Holdings (CELH): Gained 7.5% following an initiation at JPMorgan with an overweight rating, citing valuation and improving gross margins.

Communication Services

- Warner Bros. Discovery (WBD): Jumped 15.4% after announcing a new corporate structure dividing the company into two operating divisions: Global Linear Networks and Streaming & Studios, aimed at improving flexibility.

Eco Data Releases | Friday December 13th, 2024

S&P 500 Constituent Earnings Announcements | Friday December 13th, 2024

No Constituents reporting today

Data sourced from FactSet Research Systems Inc.