S&P futures down 0.3% in Tuesday morning trading after US equities finished mostly higher Monday, led again by big tech, while value lagged growth by over 100 bp. Weakness persisted in commodity equities and healthcare. Asian markets fell overnight, with South Korea, India, and China’s Shenzhen down over 1%. European markets are up ~0.2%. Treasuries weaker with curve flattening; 10-year yields above 4.40%. Dollar index +0.1%, gold -0.4%, Bitcoin futures +0.7%, WTI crude -1.2%.

Big tech strength remains the key story amid AI sentiment and rotational flows, though NVDA-US continues to face headwinds. Concentration scrutiny persists as S&P breadth weakens for the 11th straight session. Expectations for Wednesday’s Fed meeting include a 25 bp rate cut paired with slower easing guidance. Tariff concerns linked to Trump 2.0 and skepticism over China stimulus remain in focus.

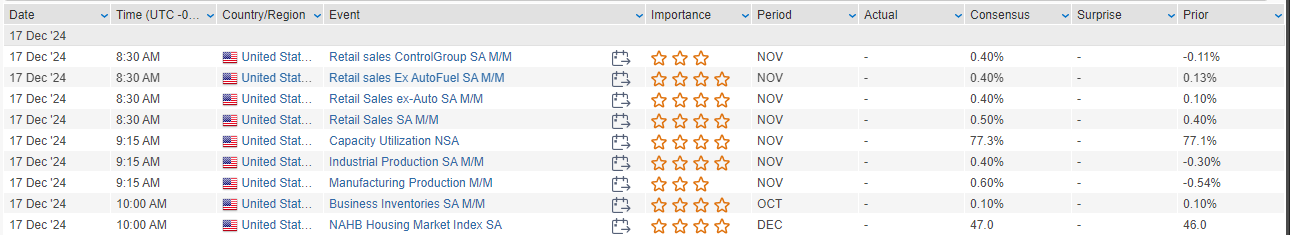

Key economic releases today include retail sales (expected +0.5% m/m) and industrial production. This week features housing starts (Wednesday), the FOMC decision and Powell press conference (Wednesday), followed by Q3 GDP revisions, initial claims, and PCE inflation data later in the week.

Corporate Highlights:

- PFE-US reaffirmed FY24 guidance; FY25 EPS and revenue midpoints slightly ahead of estimates.

- NUE-US preannounced weaker volumes and pricing in its steel mills segment.

- EBAY-US authorized a new $3B share repurchase program.

- WM-US raised its quarterly dividend by 10%.

- AFRM-US announced a $750M convertible note offering.

- MKC-US reportedly in talks to acquire Sauer Brands for ~$1B.

- MOH-US secured new contracts in Michigan and Idaho.

- BABA-US to sell its Intime department store unit, booking a $1.3B loss

US equities ended mostly higher on Monday, with the Nasdaq hitting a fresh record high while the S&P 500 finished flat. Big tech and semiconductors led the market higher, with notable gains in TSLA-US and GOOGL-US, while NVDA-US remained under pressure, now in correction territory. Energy was the key laggard, while broader concerns over deteriorating market breadth continued, as the S&P saw negative breadth for the 11th straight session.

Key economic releases included the December flash PMIs, which offered mixed signals. Manufacturing PMI fell to a three-month low, impacted by weaker expectations due to tariff and inflation concerns. However, the services PMI hit its highest level in 38 months, buoyed by strong new orders and cooling price growth. The Empire Manufacturing Index missed expectations, showing retreating new orders, weaker shipments, and moderation in prices.

Treasuries were little changed after last week’s yield surge. The dollar index declined 0.1%, though strengthened against the yen. Gold fell 0.2%, while Bitcoin futures surged 4.3%, hitting a record $108K before pulling back. WTI crude settled lower by 0.8%.

Markets are now focused on Wednesday’s FOMC meeting, where the Fed is expected to cut rates by 25 basis points. The rest of the week brings retail sales, industrial production, Q3 GDP revisions, PCE inflation, and final consumer sentiment data.

Key Earnings This Week

High-profile companies set to report include LEN-US (Lennar), MU-US (Micron), FDX-US (FedEx), NKE-US (Nike), ACN-US (Accenture), and CCL-US (Carnival Corp).

Company News by GICS Sector

Information Technology

- AMBA-US (Ambarella): +5.1% | Upgraded to buy at Bank of America; cited AI product growth, ASP acceleration, and strong future demand for 2nm nodes.

- TER-US (Teradyne): +5.1% | Upgraded to overweight at JPMorgan; noted accelerating TAM growth, supported by semi-test demand from mobility and AI ASICs.

- NTAP-US (NetApp): +3.4% | Upgraded to overweight at JPMorgan; forecast improving IT budgets for datacenter storage, driven by AI application prep.

- OKTA-US (Okta): +3.4% | Upgraded to overweight at JPMorgan; firm highlighted growing demand for identity solutions.

- KEYS-US (Keysight Technologies): +2.6% | Upgraded to overweight at JPMorgan; noted cyclical recovery through 2025 and improved Spirent deal visibility.

- SMCI-US (Super Micro Computer): -8.3% | Bloomberg reported company is exploring equity and debt raises with Evercore’s assistance.

- AOSL-US (Alpha & Omega Semiconductor): -4.8% | Ming-Chi Kuo flagged thermal issues with its chips, suggesting NVDA-US may look for alternative suppliers.

- MCHP-US (Microchip Technology): -1.4% | Downgraded to underperform at Bank of America; cited demand concerns after recent earnings miss and fab closure.

Consumer Discretionary

- TSLA-US (Tesla): +6.1% | Upgraded at Wedbush; optimism surrounding AI opportunities, FSD rollout, and potential Cybercab launch. Price of Model S raised by $5K in the US.

- CPRI-US (Capri Holdings): +3.7% | Reportedly looking to sell Jimmy Choo and Versace to focus on improving the Michael Kors brand.

- M-US (Macy’s): +1.0% | Upgraded to buy at Gordon Haskett; analysts upbeat on Q4 comp outlook and activist investor influence.

- F-US (Ford): -3.9% | Downgraded to underperform at Jefferies; analysts flagged concerns about inventory overhang, European strategic decisions, and warranty cash outflows.

Industrials

- HON-US (Honeywell International): +3.7% | Exploring strategic alternatives, including a potential separation of its aerospace business; welcomed by activist shareholder Elliott.

Healthcare

- VRDN-US (Viridian Therapeutics): +20.7% | Announced positive results from Phase 3 trial for thyroid eye disease treatment; BLA submission expected in H2 2025.

- EWTX-US (Edgewise Therapeutics): +18.4% | Reported positive Phase 2 results for Becker muscular dystrophy treatment, achieving the primary endpoint.

- LFST-US (LifeStance Health Group): +8.1% | Upgraded to neutral at Goldman Sachs; expectations for ongoing operational improvement.

Energy

- STLD-US (Steel Dynamics): Guided Q4 EPS below consensus on weaker pricing and lower shipments.

Financials

- BHLB-US (Berkshire Hills Bancorp) and BRKL-US (Brookline Bancorp): Reportedly in merger discussions, with a deal potentially announced this week.

Consumer Staples

- LW-US (Lamb Weston): +3.7% | Activist investor JANA Partners called for leadership changes and strategic alternatives, including a potential sale.

Eco Data Releases | Monday December 17th, 2024

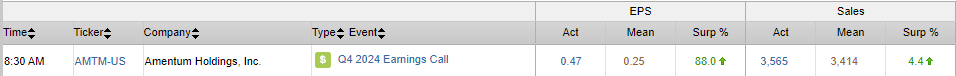

S&P 500 Constituent Earnings Announcements | Monday December 17th, 2024

Data sourced from FactSet Research Systems Inc.