US equity futures are slightly higher Tuesday morning, with S&P futures up 0.2%, following Monday’s session where stocks closed near their best levels, led by strong performances in big tech and semiconductors. Asian markets were mostly higher overnight, with Greater China bourses gaining over 1% on the back of reports about potential record stimulus. European markets are also higher, up around 0.2%. Treasuries are steady after yields rose on Monday, while the dollar index is up 0.2%. Gold is slightly higher, Bitcoin futures are down 0.1%, and WTI crude has gained 0.6%.

The focus today is on China stimulus, with reports indicating Beijing plans a record CNY3T special treasury bond issuance in 2025. While this has lifted sentiment in Asian markets, recent stimulus measures from China have had limited sustained effects. In the US, market concerns remain centered on weak breadth, stretched valuations, a less aggressive Fed, and upward pressure on yields and the dollar. However, bullish sentiment persists, driven by a soft- or no-landing economic outlook, resilient consumers, AI advancements, and deregulation optimism.

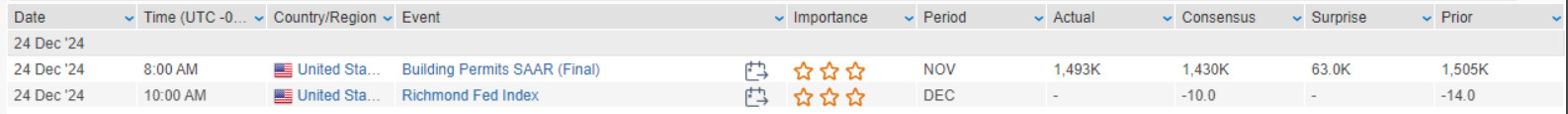

The Richmond Fed manufacturing index is the only major release today, with expectations for a slight improvement to -11 in December from -14 in November. The Treasury will also auction $70B in five-year notes. Markets are closed on Wednesday for Christmas, with initial jobless claims on Thursday and trade balance and wholesale inventories data on Friday. Key releases next week include PMI figures, home prices, and the ISM manufacturing index.

X-US remains in focus as a government review board deadlocked on Nippon Steel’s proposed acquisition. The final decision will be made by President Biden, who has previously opposed the deal. BLDR-US announced its acquisition of Alpine Lumber, expected to close in early Q1 2025 and be accretive to EPS next year. ALTM-US shareholders have approved its transaction with Rio Tinto. INSW-US will be added to the S&P Small Cap 600. BKD-US announced a refinancing deal addressing a significant portion of its 2027 debt maturities. NEUE-US will be taken private in a $1.3B deal.

US Equities: Mostly higher Monday: Dow +0.16%, S&P 500 +0.73%, Nasdaq +0.98%, Russell 2000 -0.22%. Stocks extended Friday’s gains, rebounding from Wednesday’s sharp selloff. Big tech and semis led gains, while sectors like staples retailers, HPCs, software, and capital goods lagged.

Treasuries and Commodities: Treasuries weaker across the curve, with the dollar index up 0.4%. Gold fell 0.6%, and Bitcoin futures dropped 3.7%. WTI crude settled down 0.3%.

Key Drivers: Big tech and semis led a quiet session, though weaker breadth and upward pressure on yields/dollar remain concerns. Averted government shutdown offered little directional impact, though thoughts that last week’s hawkish Fed reaction was overdone contributed to optimism.

Economic Data:

- Conference Board Consumer Confidence (Dec): Missed expectations, though 12-month inflation expectations and labor market differential improved.

- New Home Sales (Nov): Below forecasts, with inventories rising to the highest since 2007.

- Durable Goods Orders (Nov): Headline figure declined more than expected, but core capital goods orders and shipments were better than anticipated.

Overnight Markets: Asian equities mostly higher, with Hang Seng leading gains (+1.08%) driven by property developer strength. European markets opened down ~0.1%. Treasury yields eased slightly, while crude, gold, and copper posted modest gains.

Company News by GICS Sector

Consumer Discretionary

- HMC-US (Honda Motor): +12.7% Plans to merge with NSANY-US (Nissan) by 2026, forming the third-largest automaker globally.

- JWN-US (Nordstrom): -1.5% To be taken private by Nordstrom family and Liverpool in a $6.25B all-cash deal ($24.25/share).

Consumer Staples

- WMT-US (Walmart): -2.1% Sued by CFPB for allegedly opening unauthorized deposit accounts for over 1M delivery drivers with fintech partner Brach.

Health Care

- LLY-US (Eli Lilly): +3.7% Received FDA approval for Zepbound to treat sleep apnea in adults with obesity.

Information Technology

- QCOM-US (Qualcomm): +3.5% Prevailed in key licensing dispute with ARM-US.

- ARM-US (Arm Holdings): -4.0% Declined following an adverse ruling in the licensing case against Qualcomm.

Industrials

- XRX-US (Xerox Holdings): +12.6% Announced $1.5B acquisition of Lexmark, expected to close in 2H-25. Company also halved its dividend to $0.50 per share to finance the deal.

Communication Services

- RUM-US (Rumble): +81.2% Secured a $775M strategic investment from cryptocurrency company Tether

Eco Data Releases | Tuesday December 24th, 2024

S&P 500 Constituent Earnings Announcements | Tuesday December 24th, 2024

No constituents report today

Data sourced from FactSet Research Systems Inc.