We’d like to take a moment wish everyone a happy 2025! May your endeavors be fruitful, your resolutions successful and your interactions pleasant in the new year!!

S&P futures are up 0.4% in Tuesday premarket trading after Monday’s weaker session, where the S&P and Nasdaq each posted their second consecutive 1%+ decline. European markets are mostly higher, while some Asian markets were closed for New Year’s Eve. Treasuries are firmer with a flattening curve, the dollar index is down 0.1%, gold is up 0.3%, Bitcoin futures are down 0.2%, and WTI crude is up 0.9%.

With little on the calendar today, markets appear to stabilize after recent weakness, though the anticipated Santa Claus rally has failed to materialize. Despite this, major indices are poised to close out 2024 with strong gains, with the S&P 500 set for its second consecutive 20%+ annual rise, the first since 1998. Optimism for 2025 remains on a strong economy, Fed easing, solid corporate earnings, and resilient consumer spending.

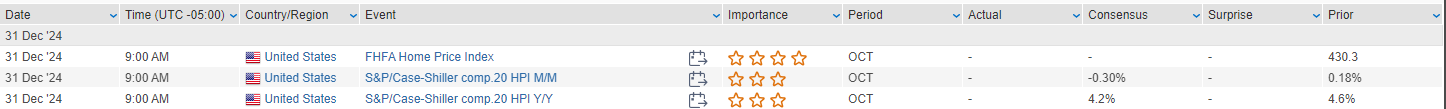

Today’s economic updates include the October Case-Shiller and FHFA home-price indices. Later in the week, jobless claims, construction spending, and ISM manufacturing data will be released. Overnight, the Treasury Department reported a significant cybersecurity incident linked to Chinese hackers, adding to recent concerns about cyber threats.

US equities closed lower on Monday, with the Dow down 0.97%, S&P 500 off 1.07%, Nasdaq dropping 1.19%, and Russell 2000 declining 0.75%. Despite closing off intraday lows, the S&P and Nasdaq recorded their second consecutive declines of more than 1%. Big tech and broader technology sectors underperformed, while energy, homebuilders, regional banks, and REITs showed relative strength. Treasuries firmed with some curve steepening after yields hit seven-month highs late last week. The dollar index rose 0.1%, gold fell 0.5%, Bitcoin futures declined 0.2%, and WTI crude rose 0.6%.

The market pullback lacked a specific catalyst but was attributed to profit-taking, rebalancing ahead of year-end, and liquidity constraints. Goldman Sachs estimated over $20B of US pension-fund equity selling. While the widely anticipated “Santa Claus rally” failed to materialize, the S&P remains on track for back-to-back annual gains exceeding 20%. Investors remain focused on US economic outperformance, though concerns persist over bond yield trends, inflation dynamics, deficits, and trade/tariff uncertainties under potential Trump 2.0 policies.

Economic Updates

- November Pending Home Sales: Increased 2.2% m/m, beating expectations, as buyers capitalized on more inventory. October data was revised lower.

- December Chicago PMI: Printed at 36.9, below the 43.0 consensus, reflecting continued weakness in manufacturing.

- Dallas Fed Manufacturing Index: Surprised positively.

- Upcoming Releases: FHFA and S&P Case-Shiller home price indices (Tuesday), initial claims, construction spending, and manufacturing PMI (Thursday), and ISM manufacturing and vehicle sales (Friday). Official China PMIs are due Monday evening.

Corporate News by GICS Sector

Health Care

- AXSM-US (-2.2%): Axsome Therapeutics announced mixed phase 3 results for AXS-05 in Alzheimer’s disease agitation. One trial arm met its primary endpoint, but another failed to achieve statistical significance.

- HAIN-US (-5.9%): Hain Celestial fell after reports that a US federal court declined to dismiss a class-action lawsuit alleging the company mislabeled baby food products containing unsafe arsenic levels.

Financials

- FNMA-US (+36.1%): Fannie Mae surged along with Freddie Mac (FMCC-US) after Bill Ackman indicated a credible path out of conservatorship could emerge soon.

Consumer Discretionary

- SEAT-US (+19.8%): Vivid Seats rose on reports the company is exploring a sale following takeover interest.

- TSLA-US: Tesla is set to release Q4 delivery numbers this week.

Industrials

- BA-US (-2.3%): Boeing declined after South Korea’s Ministry of Transport launched an investigation into the country’s 101 Boeing 737-800 planes following a fatal crash.

Information Technology

- NVDA-US: Nvidia gained attention as an FT article highlighted its robotics ambitions as the next major growth driver.

Eco Data Releases | Monday December 31st, 2024

S&P 500 Constituent Earnings Announcements | Monday December 31st, 2024

No constituents report today

Data sourced from FactSet Research Systems Inc.