S&P futures up 0.6% Thursday morning, starting 2025 on a positive note after a four-session decline ended 2024, with tech underperforming. European markets are mostly lower after a weak Asian session. Treasuries firmer across the curve. Dollar index up 0.2%, while gold is up 0.6%, Bitcoin futures rise 3.7%, and WTI crude gains 1.6%.

Stocks are rebounding after recent weakness despite light volumes and no significant narrative shifts. The S&P remains negative for the traditional “Santa Rally” period but ended 2024 with a strong 20%+ annual gain for the second consecutive year. Bulls remain optimistic about the economic backdrop, corporate earnings growth, and consumer resilience, though cautious tones persist.

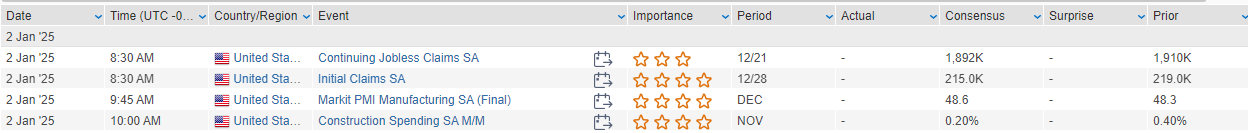

The economic calendar picks up with jobless claims and construction spending today, followed by December ISM manufacturing on Friday. Fedspeak resumes Friday with remarks from Daly and Barkin. Key data next week includes ISM services, FOMC minutes, and December payrolls.

In corporate news, AAPL-US launched four days of iPhone discounts in China. TSLA-US faces scrutiny after a Cybertruck fire in Las Vegas, with Q4 delivery numbers due today. SYNA-US announced an Edge AI collaboration with GOOGL-US. ATUS-US and MSG Networks remain in contentious carriage negotiations. TPC-US appointed its president as CEO as part of a planned succession.

US equities closed mostly lower on Tuesday, with the Dow down 0.07%, S&P 500 off 0.43%, Nasdaq dropping 0.90%, and the Russell 2000 gaining 0.11%. This marked the fourth consecutive day of declines for the S&P 500, its longest year-end losing streak since 1968. Major indices struggled to maintain early session strength, weighed down by underperformance in big tech, semiconductors, and software. Despite the year-end weakness, the S&P 500 posted over 20% annual gains for the second consecutive year, the first such streak since 1998. Analysts remain optimistic about 2025, citing a strong economy, Fed easing, and healthy corporate earnings prospects.

Treasuries were mixed, with the curve steepening, while the dollar index rose 0.3%. Gold climbed 0.9%, Bitcoin futures fell 0.7%, and WTI crude settled up 1.0%, highlighting strength in the energy sector. On the economic front, the October Case-Shiller home price index rose 0.3% m/m, beating expectations of a 0.3% decline, while the FHFA house-price index gained 0.4%, following a 0.7% increase in September. The Treasury Department reported a “major cybersecurity incident” tied to Chinese hackers, adding to recent Salt Typhoon attacks on telecom firms.

Notable Corporate News by GICS Sector

Energy

- Comstock Resources (CRK): Declined 3.9% after Gerdes Energy Research downgraded the stock to “sell” from “neutral,” citing valuation concerns and higher capital intensity.

- United States Steel (X): Rose 9.5% following reports from The Washington Post that Nippon Steel submitted an updated merger proposal to the White House, including guarantees granting the US government veto power over reductions in production capacity.

Industrials

- FTAI Aviation (FTAI): Gained 13.9% after issuing FY25 adjusted EBITDA guidance of $1.10-$1.15B, exceeding FactSet consensus of $1.06B.

Information Technology

- Dave, Inc. (DAVE): Dropped 8.0% after the Federal Trade Commission (FTC) referred its case against the company to the Department of Justice. The FTC alleged misrepresentation and surprise fees, with the company announcing changes to its mandatory fee structure in response.

Eco Data Releases | Thursday January 2nd, 2025

S&P 500 Constituent Earnings Announcements | Thursday January 2nd, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.