S&P futures up 0.5% Tuesday morning, continuing last week’s rally. Breadth remains a highlight with the equal-weight S&P outperforming by ~100 bp. Standout sectors include banks, builders, credit cards, commodity equities, and machinery. Asian markets mostly higher overnight, led by Hong Kong (+1%), while European markets are flat. Treasuries firmer with a bull flattening curve. Dollar index down 0.6%. Gold and WTI crude down 0.6% and 2.2%, respectively. Bitcoin futures up 0.3%.

Markets are reacting to less hawkish tariff signals from President Trump, who delayed imposing tariffs immediately. However, concerns persist after Trump floated the idea of 25% tariffs on Canadian and Mexican imports over immigration and fentanyl. A flurry of executive orders dominated headlines but held less market significance compared to upcoming decisions on tariffs and taxes.

A light macro week lies ahead, with no major US economic reports until Thursday’s initial claims. Friday features S&P US flash PMIs, University of Michigan sentiment, and December existing home sales. The Fed enters its blackout period before the January 29 FOMC meeting, where rates are expected to remain unchanged.

Notable Corporate Updates:

- AAPL-US: China smartphone sales fell 18% in Q4, dropping to third place behind Huawei and Xiaomi. Shares downgraded at Jefferies on expectations of fiscal Q1 revenue miss and softer guidance.

- LLY-US & NVO-US: GLP-1 drug plays saw little boost from favorable headlines about reducing addictions and Alzheimer’s risk.

- COST-US: Unionized workers voted to authorize a strike.

- SBUX-US: Plans layoffs by early March to improve efficiency.

- KMB-US: Bloomberg reported the company is considering selling its international tissue business for ~$4B.

US equities rallied on Friday, capping off a week of solid gains across major indices. The S&P 500 rose 1.00%, the Nasdaq gained 1.51%, and the Dow climbed 0.78%, with small caps (Russell 2000) up 0.40%. Equal-weight S&P 500 lagged today but outperformed the cap-weighted index for the week. Treasuries were mixed with some curve flattening, while the dollar index gained 0.3%. Gold declined 0.1%, WTI crude fell 0.6%, and Bitcoin futures rose 4.6%, surpassing $105K.

The broader market narrative remains centered on easing Treasury yields following cooler core CPI and PPI data, alongside dovish Fedspeak. Early Q4 earnings reports, particularly from major banks, were well received, with better-than-expected 2025 NII guidance a recurring theme. However, lingering uncertainties about Trump 2.0 policies and their potential impacts remain. Overseas, China’s Q4 GDP beat expectations, but concerns about tariffs muted any positive sentiment. A ceasefire between Israel and Hamas is expected to begin Sunday.

Economic data showed December housing starts at the highest level since February, and permits also exceeded forecasts. Industrial production and capacity utilization data came in better than expected. Cleveland Fed’s Hammack highlighted lingering inflation concerns in an overnight interview. The Fed enters its blackout period ahead of the January 29 FOMC meeting.

News by GICS Sector:

Information Technology:

- QRVO-US (Qorvo): +14.4%; Starboard Value disclosed a 7.7% stake, boosting shares.

- INTC-US (Intel): +9.2%; Speculation of acquisition interest propelled shares.

- NET-US (Cloudflare): +2%; Upgraded to buy at Citi, citing AI optimism and improving sales trends.

Energy:

- SLB-US (Schlumberger): +6.1%; Strong Q4 results led by international activity and increased dividend/share buybacks.

- FLNC-US (Fluence Energy): -7.3%; Declined on news of a fire at Vistra’s energy storage facility.

- VST-US (Vistra): -1.8%; Impacted by the Moss Landing facility fire, leading to evacuation in California.

Health Care:

- NVO-US (Novo Nordisk): -5.3%; Declined on news that Ozempic and Wegovy are subject to Medicare price negotiations.

- STT-US (State Street): -2.9%; Despite better-than-expected earnings, missed on servicing fees and NIM.

Industrials:

- JBHT-US (J.B. Hunt): -7.4%; Q4 results were mixed, with Intermodal performing well, but Q1 profit guidance disappointed.

- FAST-US (Fastenal): -2.3%; Earnings flagged a soft manufacturing backdrop.

Comm. Services

- LITE-US (Lumentum): +5.7%; Upgraded by Barclays due to optimism in module business growth.

Financials

- HOOD-US (Robinhood): +4.5%; Named a top pick at Morgan Stanley, citing potential benefits from increased retail trading.

Materials:

- RIO-US (Rio Tinto): +2.2%; Bloomberg reported preliminary merger talks with Glencore, though skepticism remains about synergies and cultural fit

Eco Data Releases | Tuesday January 21, 2025

No data releases on the calendar for today

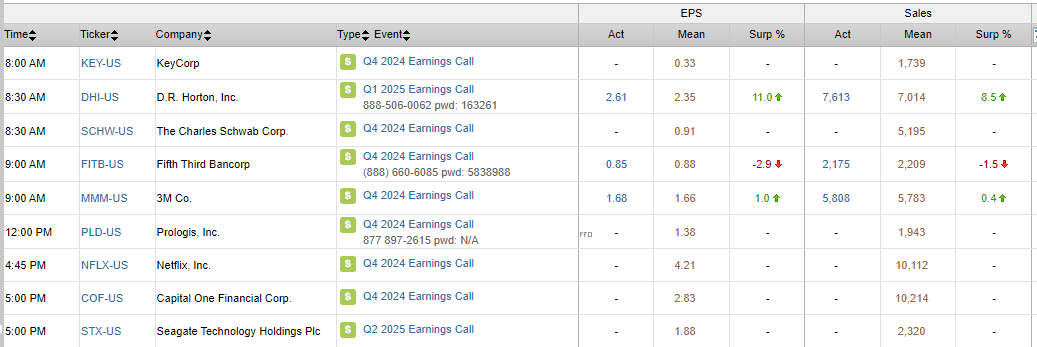

S&P 500 Constituent Earnings Announcements | Tuesday January 21, 2025

Data sourced from FactSet Research Systems Inc.