S&P futures up 0.4% in Wednesday morning trading, building on Tuesday’s rally where strong breadth saw over 80% of the S&P 500 advance, with the equal-weight index outperforming. Asian markets were mixed overnight, with Japan gaining 1.5%, while Hong Kong and China declined. European markets are higher, up ~0.8%. Treasuries are slightly weaker, the dollar index is down 0.2%, gold is up 0.5%, Bitcoin futures are down 1.9%, and WTI crude is up 0.5%.

Key Drivers:

Earnings Strength: NFLX-US surged after beating key metrics, reporting record subscriber additions, and raising guidance despite FX headwinds. UAL-US also delivered strong results and guidance, citing robust demand.

Policy Focus: Washington remains in focus with the AI investment theme gaining traction following the Stargate infrastructure announcement. Trade concerns linger with Trump eyeing USMCA renegotiations and mixed rhetoric on China tariffs.

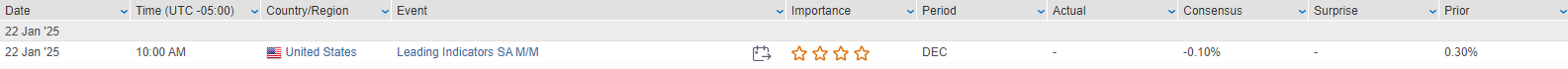

Economic Calendar: No major US data today. Thursday brings initial claims, with PMIs and consumer sentiment rounding out the week. The Fed is in its blackout period ahead of the January FOMC meeting, where rates are expected to remain unchanged at 4.25-4.50%. Probability of a March rate cut is slightly above 25%.

Notable Earnings Updates:

- NFLX-US: Beat on all metrics, including record subscriber growth; raised guidance.

- COF-US: EPS beat despite NIM and NII misses due to lower provisions.

- UAL-US: Results and guidance exceeded expectations on strong demand.

- STX-US: Beat estimates; positive takeaways despite light revenue guidance for Q1.

- ZION-US: NII and fees beat, though provisions faced scrutiny.

US equities closed higher on Tuesday with the Dow +1.24%, S&P 500 +0.88%, Nasdaq +0.64%, Russell 2000 +1.85%. Breadth remained strong, with the equal-weight S&P outperforming the cap-weighted index by ~100 bp over the past week. Outperformers included semiconductors and AI-linked names, software, hard disk drive makers, online brokers (SCHW), apparel, dollar stores, aerospace and defense, electricals/multis (MMM), engineering and construction, hospitals, cruise lines, airlines (JBLU), homebuilders, paper and packaging, autos, casual diners, small-caps, and utilities. Big tech saw mixed performance, with AAPL a notable laggard. Other underperformers included energy, property and casualty insurers, exchanges, drug stores (WBA), beverages, copper/aluminum, and household products.

Treasuries were firmer with a flattening yield curve, while the dollar was little changed. Gold gained 0.4%, Bitcoin futures rose 1.2%, and WTI crude fell 2%, recovering slightly from session lows.

Stocks benefited from ongoing optimism regarding Trump administration policies. Day-one tariff announcements on China were less hawkish than expected, although Trump’s comments suggesting tariffs on Canada and Mexico have introduced volatility. Headlines about Trump’s plan to announce private-sector AI infrastructure investments provided an additional boost to sentiment. Market positives also included lower rates, improving breadth, cyclical rotations, and solid early Q4 earnings results. Investors continue to await further clarity on tariffs and tax policy, as well as key big-tech earnings scheduled for the week of January 27.

Company-Specific News

Information Technology

- AAPL: -3.2%; reported an 18% drop in Q4 China smartphone sales and received downgrades from Jefferies and Loop Capital.

- ORCL: +7.2%; gained on the announcement of the Stargate AI project involving OpenAI and SoftBank.

- QRVO: +4.0%; upgraded to overweight by Morgan Stanley, citing potential earnings recovery with Starboard Value involvement.

- INTC: +1.3%; upgraded to hold by HSBC, noting limited downside risk following a 40% decline since July.

Consumer Discretionary

- URBN: +9.9%; upgraded to overweight by Morgan Stanley after strong Q4 preannouncements and positive management commentary.

- SBUX: Announced plans for layoffs by early March to improve operational efficiency.

- WING: +2.8%; upgraded to overweight by Morgan Stanley, citing expected unit growth and restrained pricing over the past five years.

Comm Services

- NFLX: +35.5%; announced “Olivia,” an AI-enabled personal health concierge app, and benefited from disclosure of Nancy Pelosi purchasing call options in the stock.

Health Care

- MRNA: +5.4%; received $590 million from HHS to accelerate mRNA-based influenza vaccine development.

- WBA: -9.2%; DOJ filed a lawsuit alleging the company knowingly filled unlawful prescriptions, including opioids.

Industrials

- JBLU: +4.2%; became the first airline to accept Venmo for flight bookings, with plans to expand the feature to its mobile app.

- MMM: +4.2%; posted Q4 beats on revenue and EPS, with strong organic growth and positive trends across all segments.

- CW: +4.2%; initiated with a buy rating at Citi, citing Department of Defense spending priorities.

Financials

- SCHW: +5.9%; beat Q4 EPS and revenue estimates, driven by strong asset management and trading revenues, as well as new brokerage account openings.

- KEY: -3.6%; Q4 earnings beat, but FY25 NII guidance and loan/deposit growth came in below expectations.

Utilities

- VST: +8.5%; evacuation orders lifted after the fire at its Moss Landing battery storage facility.

Materials

- PLD: +7.1%; posted a Q4 FFO beat, expressed optimism about strong leasing activity and FY25 guidance.

- CF: -3.5%; downgraded to sector perform by RBC due to headwinds from urea pricing and increased exports from China.

Consumer Staples

- GAP: +6.1%; upgraded to buy by Argus Research, citing valuation and positive momentum in the company’s turnaround efforts.

Eco Data Releases | Wednesday January 22, 2025

S&P 500 Constituent Earnings Announcements | Wednesday January 22, 2025

Data sourced from FactSet Research Systems Inc.