S&P futures down 0.2% in Thursday morning trading. Comes after US equities finished mostly higher on Wednesday with the S&P briefly trading above 6100. Tech (particularly AI trade) the standout while defensives and value lagged and breadth was negative after six straight sessions that saw more than two-thirds of S&P constituents higher. Asian markets mixed overnight with Japan outperforming and South Korea weak, down over 1%. European markets narrowly mixed. Treasuries mostly weaker with curve steepening. Dollar index up 0.1%. Gold down 0.6%. Bitcoin futures down 2.2%. WTI crude off 0.1%.

Quieter from a headline perspective this morning, including when it comes to tariffs. Elsewhere in Washington, Politico reported Republican leaders mulling big debt-and-funding deal with Democrats. Nothing particularly meaningful from Wednesday evening earnings, while market seems to be looking ahead to big tech results next week. Also some focus on favorable late-January seasonality, near-term reopening of corporate buyback window, vol reset, systematic fund buying, recent rate reprieve (where stretched short positioning seems to have helped) and US exceptionalism.

- PYPL-Chief Product Officer John Kim to depart company.

- KMI-Q4 a bit light but highlighted leverage to expedited energy infrastructure projects under Trump 2.0. DFS-US EPS ahead on better NIM/NII and lower provisions.

- EA-lowered FY25 bookings guidance, blaming slowdown in Global Football.

- MTB-announced $4B buyback plan. AA-US EBITDA and FCF better with help from stronger alumina.

- KNX-Q4 better with OR a tailwind and reiterated guide, flagging gradual improvement in freight conditions. HXL-US guidance light.

- SLG-FFO beat and leasing performance improved.

- PLXS-pressured by slightly weaker Mar Q guidance.

- IPAR-Q4 sales in line, on track to hit FY24 EPS guidance and talked up GUESS strength.

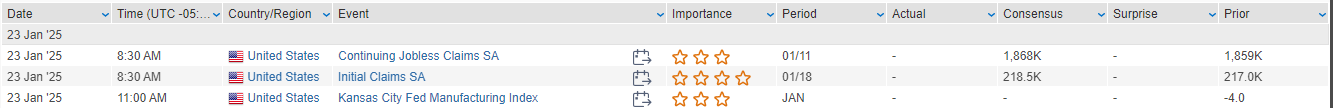

Another quiet macro day with just initial claims on the US economic calendar. Street looking for a slight uptick to 220K from 217K in prior week. S&P US flash manufacturing and services PMIs, final University of Michigan consumer sentiment (and inflation expectations) for January and December existing home sales cap off the week on Friday. No Fedspeak scheduled for this week amid the blackout period into the January FOMC meeting. Fed widely expected to leave rates unchanged at 4.25-4.50% on 29-Jan, while the probability of a 25 bp rate cut at the March meeting is only slightly above 25%.

US Equities Close Mostly Higher: Dow +0.30%, S&P 500 +0.61%, Nasdaq +1.28%, Russell 2000 -0.61%

US equities ended mostly higher on Wednesday, with the S&P 500 briefly trading above the 6100 mark but failing to close at a new record. Breadth turned negative after six straight sessions of broad market participation. Big tech was a key driver of the day’s gains, led by NVDA and MSFT. Other outperformers included entertainment (NFLX), software (ORCL), semiconductors, networking/communications, HPCs (PG), credit cards (COF), and exchanges. Underperformers included energy, banks, insurers, asset managers, autos, home improvement, airlines, managed care, pharma, industrial metals, chemicals, paper/packaging, small caps, REITs, and utilities.

Treasuries weakened, with the belly of the curve underperforming. The dollar index gained 0.2%, particularly strong against the yen. Gold rose 0.4%, Bitcoin futures fell 1.9%, and WTI crude ended down 0.5%.

The market focused on AI-related optimism following the “Stargate” infrastructure investment announcement and a strong start to the Q4 earnings season, highlighted by NFLX’s blowout results. Tariff developments remain volatile, with Trump threatening Canada, Mexico, China, and the EU, though markets are downplaying immediate risks.

The recent $13B auction of 20-year bonds was well received after recent auction underperformance. Thursday features initial claims, and Friday brings S&P US flash PMIs, University of Michigan consumer sentiment (and inflation expectations), and December existing home sales. The Fed is in a blackout period ahead of the January FOMC meeting, where rates are widely expected to remain unchanged at 4.25-4.50%.

Company-Specific News by GICS Sector

Information Technology

- NVDA (+9.7%): Benefited from AI-related enthusiasm tied to the “Stargate” initiative.

- ORCL (+6.7%): Extended gains on news of AI infrastructure investments involving Oracle, SoftBank, and OpenAI, with a $100B initial investment.

- STX (+6.8%): Q2 EPS and revenue beat; Q3 revenue guidance was light, but the company cited HAMR technology as a positive driver.

- TDY (+6.5%): Q4 EPS and revenue beat, though FY25 guidance slightly below consensus; strong demand in defense and space cited.

Consumer Discretionary

- APTIV (+1.5%): Announced plans to separate its electrical distribution systems business, reaffirmed FY outlook.

Financials

- COF (+4.0%): Q4 EPS beat on lower provisions; NIM and NII missed, but analysts highlighted strong consumer credit trends and tailwinds in card volume.

- ALLY (+3.9%): Q4 EPS beat, in-line revenue; announced sale of its credit card business to CardWorks, expected to close in 2025.

- IBKR (+8.8%): Q4 earnings and revenue beat; commissions revenue rose on higher trading volumes.

- TRV (+3.2%): Q4 EPS and revenue beat, driven by lower combined ratios and catastrophe losses.

Healthcare

- JNJ (-1.9%): Q4 earnings slightly beat but quality of results questioned; MedTech growth below expectations, FY25 guidance bookends consensus.

- MRNA (+5.4%): Received $590M in HHS funding for mRNA-based pandemic influenza vaccine development.

Industrials

- GEV (+2.7%): Q4 revenue light but orders up 22%; analysts cited strong performance in Power and Electrification segments.

- TXT (-3.5%): Q4 EPS beat, but revenue and margins disappointed; FY25 EPS guidance midpoint below consensus due to strike-related impacts.

Energy

- HAL (-3.6%): Q4 earnings in line, but NA revenues fell on lower stimulation activity; company flagged softer North American outlook for 2025.

Consumer Staples

- PG (+1.9%): Q4 earnings and revenue ahead, with organic growth driven by Beauty and Grooming segments; FY25 guidance maintained despite FX headwinds.

- CELH (-5.5%): Downgraded to hold at TD Cowen due to observed sales deceleration and increased competition.

Communication Services

- NFLX (+9.7%): Record net adds and strong guidance lifted shares. Beat on all metrics, including record 19M net adds; raised 2025 revenue and margin guidance despite FX headwinds; announced plans to raise prices in key markets.

Materials

- FLNC (-7.5%): Downgraded at Jefferies over concerns of margin compression in the energy storage sector.

Utilities

- VST (+8.5%): Lifted after evacuation orders near the company’s Moss Landing facility were rescinded.

Real Estate

- PLD (+7.1%): Continued strong demand trends in datacenter and energy businesses supported earnings outlook.

Other Notable Movers

- AGYS (-20%): Q3 revenue missed expectations; Q4 guidance reduced.

- VSAT (-8.8%): Announced corporate reorganization with key leadership changes.

Eco Data Releases | Thursday January 23, 2025

S&P 500 Constituent Earnings Announcements | Thursday January 23, 2025

Data sourced from FactSet Research Systems Inc.