S&P futures are up 0.3% Tuesday morning after Monday’s selloff, where the Nasdaq 100 dropped 3% amid AI-related weakness, with NVDA losing nearly $600B in market value. Positive breadth emerged as investors rotated into staples, banks, healthcare, and other tech. Asian markets were mixed, with the Nikkei down 1.5%, while Hong Kong posted gains. European markets rose ~0.3%. Treasuries softened, the dollar index gained 0.5% on tariff headlines, and gold, Bitcoin, and WTI crude all edged higher.

Markets are attempting to rebound as fears surrounding DeepSeek’s AI impact ease, with optimism on potential demand boosts from efficient computing and overblown AI capex concerns. Tariffs remain a focus, with Trump proposing higher global rates and targeting sectors like semis, pharma, and autos.

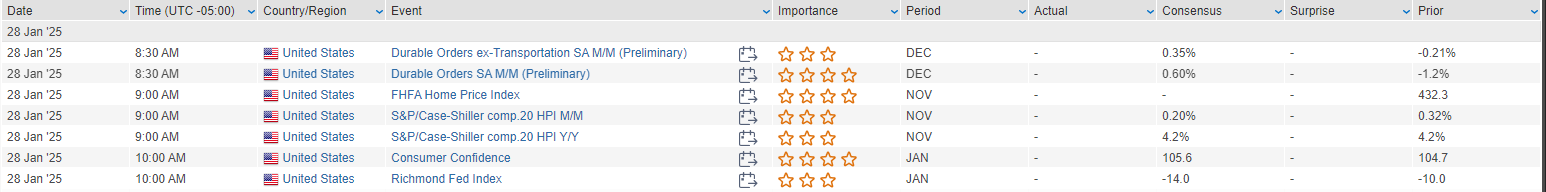

Key earnings updates include SAP (beat, cautious FY25 guidance), NUE (Q4 beat, soft Q1 outlook), WRB (strong combined ratio), and SANM ($300M buyback). Economic data today includes durable goods orders, consumer confidence, and Richmond Fed manufacturing, ahead of the FOMC decision Wednesday and GDP and PCE data later in the week.

US equities were mostly lower Monday, with the Nasdaq posting its worst day since December 18, while the S&P ended just off session highs. Despite declines, breadth was positive as the equal-weight S&P 500 outperformed the cap-weighted index. Losses followed two weeks of gains, including a fresh S&P all-time high last Thursday. Weakness was driven by semiconductors, AI-linked stocks, utilities, and software, while outperformers included telecom, China tech, cybersecurity, homebuilders, and managed care.

The selloff centered on Chinese AI startup DeepSeek, whose open-source models rival US chatbots at lower costs, raising concerns over US hyperscaler spending, market concentration, and US-China tech tensions. Broader losses were cushioned by defensive and rate-sensitive rotations. Tariff uncertainties also weighed, with Colombia acquiescing to US demands and potential tariffs on Mexico and Canada looming for March.

Economic data provided mixed signals. December new home sales and the January Dallas Fed index exceeded expectations, while Treasury auctions showed solid demand. Key macro events ahead include Tuesday’s durable goods and consumer confidence reports, Wednesday’s FOMC decision (expected to hold rates steady), and Thursday’s Q4 GDP and core PCE inflation data

Stock-Specific News by GICS Sector

Information Technology

- NVIDIA (NVDA, -16.9%): Under pressure as DeepSeek claims raised concerns about AI capex and competitiveness. Some skepticism about cost claims tempered the selloff.

- Aspen Technology (AZPN, +3.3%): To be acquired by Emerson Electric for $265/share in cash, valuing AZPN at $17B. Expected to close in 1H-25.

Communication Services

- Interpublic Group (IPG, +2.6%): Upgraded to overweight at JPM, citing valuation and confidence in deal-related risks being overblown.

Consumer Discretionary

- Vail Resorts (MTN, +5.6%): Activist investor Late Apex Partners called for leadership changes, a dividend cut, and network growth.

- Ralph Lauren (RL, -3.2%): Downgraded to market perform at Raymond James, citing valuation concerns and FX headwinds after an 80% rally over the past year.

Consumer Staples

- Merck (MRK, +2.5%): FDA granted priority review for WELIREG for treating advanced pheochromocytoma and paraganglioma.

Financials

- SoFi Technologies (SOFI, -10.3%): Q4 results beat estimates, but FY25 EBITDA and EPS guidance disappointed. Analysts noted strong revenue growth but weak guidance weighed on sentiment.

- Bank of Hawaii (BOH, +4.3%): Q4 results slightly ahead of consensus. Declared a $0.70/share dividend.

Health Care

- ARKO Corp (ARKO, +2.3%): Released positive topline results from the SYMMETRY Phase 2B study, showing significant reversal of cirrhosis due to MASH.

Industrials

- Emerson Electric (EMR): Announced acquisition of Aspen Technology for $17B to consolidate control over the remaining 43% of shares.

Real Estate

- Crown Castle (CCI, +4.5%): JMP initiated coverage at outperform, citing the large-scale digital infrastructure spend as a growth driver.

Utilities

- AT&T (T, +6.3%): Q4 earnings and revenue beat expectations, driven by Mobility net adds and solid Fiber growth. FY25 guidance reaffirmed.

Eco Data Releases | Monday January 28, 2025

S&P 500 Constituent Earnings Announcements | Monday January 28, 2025

Data sourced from FactSet Research Systems Inc.