S&P futures up 0.3% Friday morning following a five-day losing streak for the S&P and Nasdaq. US equities ended mostly lower Thursday, with big tech dragging on weakness in Tesla (TSLA) and Apple (AAPL). Asian markets were mixed overnight, while European markets are down 0.5%. Treasuries are firmer with curve flattening, the dollar index is down 0.3%, gold is up 0.1%, Bitcoin futures are down 1%, and WTI crude is off 0.4%.

The market is attempting to stabilize after soft December performance. Bullish factors include seasonality, above-trend US growth, and LDD% earnings growth, while bearish pressures stem from Fed policy uncertainty, bond yield increases, dollar strength, tariff risks, and weak China growth.

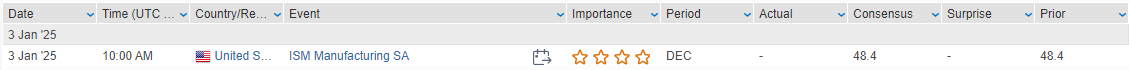

Today’s macro focus is the ISM manufacturing index, expected to slightly decline to 48.2. Richmond Fed President Barkin speaks later in the morning, and the House Speaker vote is also scheduled, with Johnson expected to win. Next week features a packed US economic calendar with ISM services, JOLTs, ADP payrolls, FOMC minutes, and nonfarm payrolls.

Corporate highlights include AAPL facing reports of a 47% y/y drop in November shipments of foreign-branded smartphones to China. TSLA noted record China sales of 657K vehicles in 2024 despite softer Q4 deliveries. US Steel (X) is under pressure on reports Biden may block the Nippon Steel deal. NLY announced a $1.5B share repurchase authorization.

US equities closed mostly lower on Thursday, with the Dow down 0.36%, the S&P 500 off 0.22%, and the Nasdaq falling 0.16%, while the Russell 2000 managed a slight gain of 0.07%. The S&P and Nasdaq marked their fifth consecutive daily declines, as early strength once again faded in the afternoon. Big tech exhibited mixed performance, weighed down by Tesla (TSLA) and Apple (AAPL), while relative strength was seen in energy, semiconductors, and biotech stocks. Treasuries were narrowly mixed, with some curve steepening. The dollar index rose 0.7%, particularly strong against the euro and sterling. Gold gained 1.1%, Bitcoin futures rose 4.7%, and WTI crude settled up 2.0%, supported by strong oil prices.

The broader market struggled for upward momentum, with continued commentary on the lack of a “Santa Rally” during the typically favorable year-end seasonality period. Nevertheless, the S&P 500 concluded 2024 with its second consecutive 20%+ annual return, marking a historically strong year. Bulls remain optimistic, citing a resilient consumer, strong corporate earnings growth, and supportive economic conditions, while bears point to stretched valuations, inflationary risks from Trump-era trade policies, and concerns about the labor market and Fed policy.

Economic data releases showed initial jobless claims at 211K, better than expectations, and continuing claims declining to 1.844M from 1.896M, reversing a prior three-year high. The final December manufacturing PMI improved to 49.4 from the flash reading of 48.3, signaling persistent contraction but at a slower pace. December construction spending was flat m/m, missing the forecast of a 0.2% increase. ISM manufacturing data and Fedspeak from Daly and Barkin are due Friday, with Governor Kugler scheduled to discuss monetary policy on Saturday.

Corporate News by GICS Sector

Energy

- +8.4% CEG-US (Constellation Energy): Announced an $840M deal to sell power to US government agencies.

Information Technology

- +8.1% SYNA-US (Synaptics): Collaborating with Google (GOOGL) on Edge AI for IoT, a significant step into AI and IoT markets.

- +4.5% NET-US (Cloudflare): Upgraded to Buy from Sell by Goldman Sachs, citing improved sales productivity and growing traction with its Act III product suite.

- +1.8% CACI-US (CACI International): Upgraded to Outperform by Raymond James, citing valuation, accelerated growth, and higher-value technology offerings.

Consumer Discretionary

- -6.1% TSLA-US (Tesla): Q4 deliveries of 495,570 fell short of the 504,770 consensus, marking the first y/y decline in full-year deliveries in over a decade.

- +5.8% LYFT-US (Lyft): The Information reported Amazon (AMZN) could acquire the company in 2025.

- +4.7% UBER-US (Uber Technologies): Added to Goldman Sachs’ US Conviction List, reflecting optimism about its growth prospects.

Consumer Staples

- -7.5% FUL-US (H.B. Fuller): Preannounced FY24 EPS of $3.84 vs consensus of $4.15, citing weaker-than-expected conditions and delayed orders in key end markets.

Healthcare

- -81.4% NMRA-US (Neumora Therapeutics): Disappointing Phase 3 trial results for navacaprant in major depressive disorder caused shares to plummet. Further trial updates expected on January 14.

Financials

- -8.9% SOFI-US (SoFi Technologies): Downgraded to Underperform by KBW, citing valuation concerns.

Eco Data Releases | Friday January 3rd, 2025

S&P 500 Constituent Earnings Announcements | Friday January 3rd, 2025

Data sourced from FactSet Research Systems Inc.