S&P futures up 0.6% in Monday morning trading, building on Friday’s rally that saw the S&P snap a five-day losing streak with major indices up over 1%. Despite Friday’s bounce, US equities ended mostly down for the week. Treasuries slightly weaker with the curve bull steepening. Dollar index down 0.3%, gold off 0.4%, Bitcoin futures up 0.2%, and WTI crude down 0.2%.

Markets are supported by positive AI sentiment and reports suggesting potential changes to Trump’s tariff plans. Weekend highlights include Trump’s call for a single reconciliation bill addressing tax cuts and other priorities, hawkish Fedspeak on inflation, and additional China stimulus headlines. Reports of Canadian PM Trudeau’s potential resignation added to G7 political volatility.

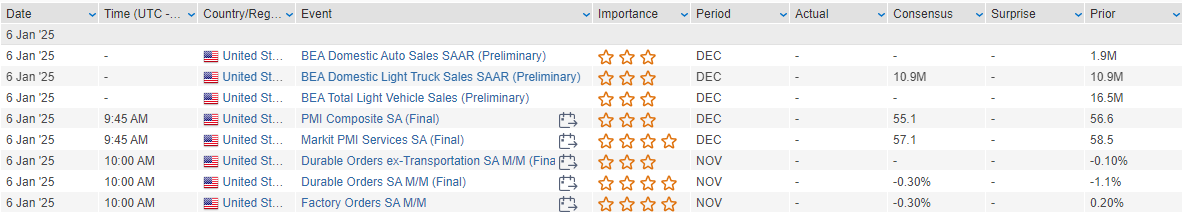

Busy macro week ahead: November factory orders and a $58B 3-year note auction headline Monday, alongside Fed comments. Key events this week include JOLTS, ISM services (Tuesday), ADP payrolls, FOMC minutes (Wednesday), and December jobs data (Friday). Treasury auctions of 10- and 30-year notes also on tap.

Corporate news: NVDA-US CEO to deliver CES keynote Monday, spotlighting AI momentum, with MSFT-US highlighting its $80B AI-enabled datacenter investment. MRVL-US seen as a potential AI winner over AVGO-US . Bloomberg reported PAYX-US nearing a deal to acquire PYCR-US . Nippon expected to sue over the blocked US Steel (X-US) deal. ACI-US, CAG-US, and WBA-US report earnings this week. SCOTUS to hear TikTok’s appeal on Friday.

US equities ended the week on a positive note, with the Dow up 0.80%, S&P 500 gaining 1.26%, Nasdaq rising 1.77%, and Russell 2000 up 1.65%. This marked a break from a five-day losing streak for the S&P and Nasdaq. Major indices, however, logged a mixed performance for the holiday-shortened week. Notable outperformers included big tech, with strong rallies from NVIDIA (NVDA) and Tesla (TSLA), and strength in sectors such as semiconductors, managed care, regional banks, and credit cards. Laggards included beverages (due to a Surgeon General’s label proposal), industrial metals, hospitals, airlines, and REITs. Treasuries weakened across the curve, while the dollar index fell 0.4%. Gold slipped 0.5%, Bitcoin futures rose 1.1%, and WTI crude gained 1.1%.

The S&P’s Friday rally followed a weaker December and a disappointing “Santa Rally” period. Market optimism remains anchored on above-trend US economic growth, expectations for low-double-digit earnings growth, and continued consumer resilience. However, headwinds persist, including a less aggressive Fed easing cycle, rising bond yields, dollar strength, tariff risks, and geopolitical uncertainties. ISM manufacturing data printed at 49.3, beating expectations (48.2), with improvements in new orders but declines in employment and increases in prices paid. The 119th Congress opened with Mike Johnson reelected as House Speaker. Next week brings key economic data, including ISM services, JOLTS job openings, FOMC minutes, and nonfarm payrolls, alongside additional Treasury supply.

Company News by GICS Sector

Information Technology

- AAPL (-2.6%): Remains under pressure following reports of aggressive iPhone discounts in China and a Reuters report indicating a 47% y/y drop in shipments of foreign-branded smartphones to China in November.

- SQ (+6.2%): Upgraded to outperform from market perform at Raymond James, citing confidence in 2025 growth prospects and expectations for double-digit growth in Seller GPV.

Consumer Discretionary

- TSLA (+4.8%): Gained following reports of record 2024 China sales of 657K vehicles despite softer Q4 deliveries.

- RIVN (+24.5%): Surged after reporting Q4 deliveries (14,183) and production (12,727) that exceeded expectations, aligning with full-year guidance.

Communication Services

- CHWY (+6.2%): Upgraded to outperform at Wolfe Research due to anticipated customer growth, a focus on pet health, and product catalysts, including international expansion.

Financials

- FNMA (+29.8%) and FMCC (+30.2%): Rallied after the Treasury Department announced plans to facilitate an orderly termination of conservatorships.

Materials

- X (-6.5%): Declined after President Biden officially blocked Nippon Steel’s acquisition of the company, citing national security concerns.

Health Care

- UNH (+1.5%): Benefited from a broader rally in managed care stocks, supported by market optimism about easing Medicare Advantage headwinds in 2025.

Consumer Staples

- TAP (-3.4%): Pressured following a call by the U.S. Surgeon General to update cancer risk warnings on alcoholic beverages.

Utilities

- CEG (+8.4%): Announced an $840M power supply agreement with US government agencies, boosting shares

Eco Data Releases | Monday January 6, 2025

S&P 500 Constituent Earnings Announcements | Monday January 6, 2025

No constituents reporting today

Data sourced from FactSet Research Systems Inc.