The S&P 500 and the Nasdaq added to their recent record highs up 0.07% and 0.14% respectively. The Dow again lagged off 0.13%. While the major large cap. indices ended in a familiar pecking order, the sector performance spread was a bit different with the XLF taking a leadership turn for the day adding 0.70% while the XLV and XLY were also among the leaders. A firming XLF would be a welcome addition to the leadership mix as Discretionary has been distinguishing itself positively as well. The big banks will kick of Q3 Earnings on Friday with JPM, WFC and C reporting.

Crude finished up slightly at $81.26 per barrel on the WTI contract. Commodities prices were off 0.64% as measured by the Bloomberg Commodities Index and the US 10yr Yield closed up at 4.2959%. The DXY turned higher after a recent decline finishing just above the 105 level. Large Cap. stocks continued their outperformance trend vs. Small and Mid.

Equities surged higher after mid-day on Fed. Chairman Powell’s comments, but that enthusiasm was walked back into the close amidst Citigroup analyst Drew Pettit’s call to “take profits” on AI.

Mortgage apps and Wholesale data is on the economic calendar for Wednesday.

Eco Data Releases | Wednesday July 10th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 07/10/2024 07:00 | MBA Mortgage Applications | 5-Jul | — | — | -2.60% | — |

| 07/10/2024 10:00 | Wholesale Inventories MoM | May F | 0.60% | — | 0.60% | — |

| 07/10/2024 10:00 | Wholesale Trade Sales MoM | May | 0.30% | — | 0.10% | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Wednesday July 10th, 2024

No S&P 500 constituents report today

Worldwide Wednesday

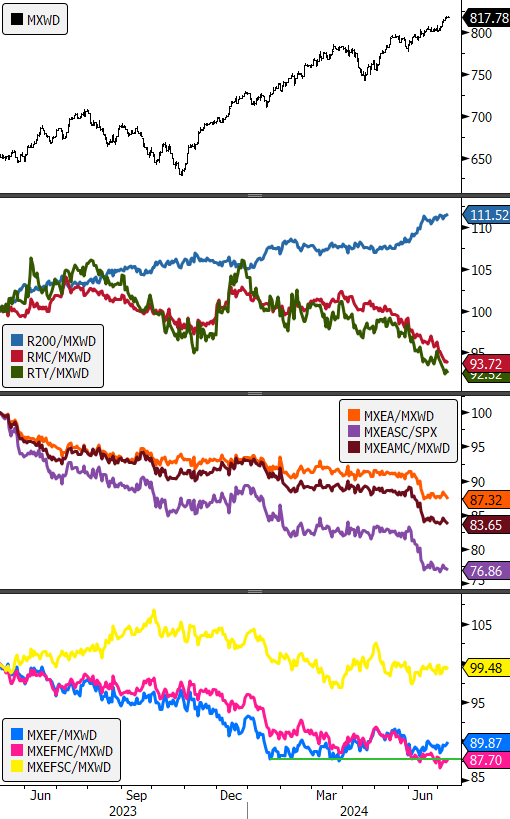

With the 4th of July week behind us, it’s time to revisit ex-US equity market performance to see what the geographical alternative to US equities is looking like. The chart below benchmarks US, EAFE and EM regions against the MSCI All Country World Index (ACWI). It divides each region into Large, Mid and Small Cap. and indexes relative performance to 100 at the start of the period. In this way we can see leadership and laggards very starkly over the past 12 months.

For most of these indices the status quo remains in place. US Small and Mid-Cap. stocks continue to lag with all the alpha accruing to the Mega Cap’s. EAFE had a horrible month of June while the only slight Ex-US improvement comes from EM in the form of the Large and Small Cap. EM indices stabilizing to flat performance from their previous downtrends. Nonetheless, this is progress, and we should be looking for confirmation in the form of fresh multi-month relative highs to confirm a potential bullish reversal. One would expect that investors can’t wait to diversify away from the narrow group of stocks that have been working for most of the past 2 years.

- MSCI All Country World Index, 1yr, daily price

- Panel 2: Russell Mega Cap. | Russell Mid-Cap. | Russell 2000 (Relative to ACWI)

- Panel 3: MSCI EAFE Large Cap. | EAFE Mid-Cap. | EAFE Small Cap.

- Panel 4: MSCI EM Large Cap. | EM Mid-Cap. | EM Small-Cap.

Sources: Bloomberg