The S&P 500 (+1.02%) and the Nasdaq (+1.18%) added to their recent record highs with the Dow perking up as well adding 1.09%. Some signs of “animal spirits” as the Bull is firmly in control of the tape. A strong intra-day bounce was attributed to Chairman Powell’s comment that he has “some confidence” on cooling inflation.

The S&P 500 is in clear overbought territory on a daily and weekly basis. The latter typically signals strong forward 12-month results for the Index, though the profit curve on that long-term signal typically underperforms in the near-term (1-6 weeks) after it is registered. This dovetails with the seasonals for a presidential election year if the current year follows the historical pattern. Our technical view on the S&P 500 is a longer-term upside target near 6140 and potential for near-term correction to 5268. We expect corrections to be bought.

Crude was higher on the day settling at $82.71 for a barrel of WTI. The Bloomberg Commodities Index was off 0.25% while the DXY was down 0.08%.

At the sector level the Materials sector reversed recent declines with the XLB up 1.34% on the day that exhibited broad participation with 10 of 11 Sectors in the green. Only XLE was in the red off 1.96% despite a higher barrel.

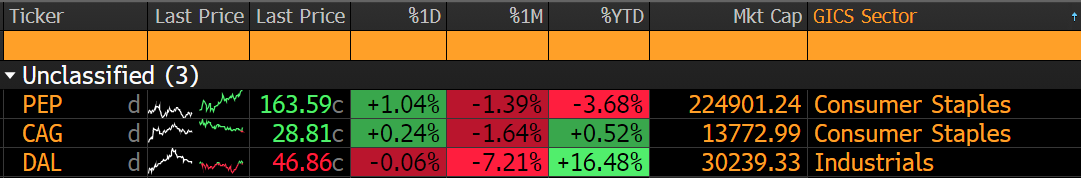

CPI data is due out Thursday and a hot print could turn the tape in a hurry after the borderline giddy (we jest) endorsement from the Fed Chairman. Earnings are back on the menu with DAL, PEP and CAG reporting.

Eco Data Releases | Thursday July 11th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 07/11/2024 08:30 | CPI MoM | Jun | 0.10% | — | 0.00% | — |

| 07/11/2024 08:30 | CPI Ex Food and Energy MoM | Jun | 0.20% | — | 0.20% | — |

| 07/11/2024 08:30 | CPI YoY | Jun | 3.10% | — | 3.30% | — |

| 07/11/2024 08:30 | CPI Ex Food and Energy YoY | Jun | 3.40% | — | 3.40% | — |

| 07/11/2024 08:30 | CPI Index NSA | Jun | 314.614 | — | 314.069 | — |

| 07/11/2024 08:30 | CPI Core Index SA | Jun | 318.78 | — | 318.14 | — |

| 07/11/2024 08:30 | Real Avg Hourly Earning YoY | Jun | — | — | 0.80% | 0.70% |

| 07/11/2024 08:30 | Real Avg Weekly Earnings YoY | Jun | — | — | 0.50% | — |

| 07/11/2024 08:30 | Initial Jobless Claims | 6-Jul | 235k | — | 238k | — |

| 07/11/2024 08:30 | Continuing Claims | 29-Jun | 1860k | — | 1858k | — |

| 07/11/2024 14:00 | Monthly Budget Statement | Jun | -$76.1b | — | -$347.1b | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Thursday July 11th, 2024

Equities Overbought, Setup for Correction in August

- S&P 500 Index, 3yr, weekly | 14-wk RSI

- Weekly RSI overbought readings are a hallmark of a strong trend and typically correlate with strong forward returns. Keep in mind, while the short-term trader may take profit at overbought levels, those same levels are a mathematical certainty when a market is in a strong bull trend.

- Our Long-term price projection for the S&P 500 is 6140, 9% above today’s Wednesday’s closing price

- We expect any correction to be accumulated around near-term support on the chart at the 5270 level

Sources: Bloomberg