US equities capped the week on a sour note with the S&P 500 finishing down 0.71% and registering its biggest weekly decline since April (-1.97%). The Nasdaq had it even worse, falling 0.81% on Friday for a weekly decline of 3.65%. The Dow was a beneficiary of rotation on the week, posting a 0.72% weekly gain despite also closing lower on Friday. At the sector level there was more signs of reversion as the XLK was the lone sector underperforming the S&P 500 this week as rotation out of established bull market leadership remained a theme.

Futures contracts for the major indices have turned positive in the Monday AM session as of this writing with the Nasdaq E-mini in the lead.

Crude Oil continues to drift lower trading below $80 for the first time since mid-June, while the 10yr US Treasury Yield hovers around 4.2%.

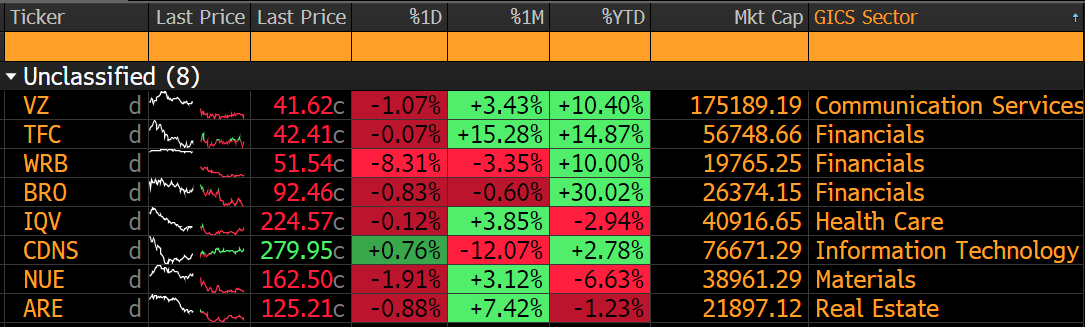

It’s a light economic calendar for Monday with the Chicago Fed National Activity Index the lone release. Later in the week we will get Existing Home Sales data, GDP, Jobless Claims and Personal Spending data among others. On the earnings calendar, a mix of co.’s headlined by VZ and CDNS, the latter of which is at an important potential pivot on the chart.

Eco Data Releases | Monday July 22nd, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 07/22/2024 08:30 | Chicago Fed Nat Activity Index | Jun | -0.09 | — | 0.18 | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Monday July 22nd, 2024

CDNS will be an important tell for the Large Cap. Software Industry as a whole. The stock has been part of the leadership cohort throughout the post-pandemic cycle but is now at a key intermediate-term support level. Earnings results after the bell will be pivotal.

- CDNS 1yr, daily (200-day m.a.| Relative to S&P 500)

- Relative curve is back to August 2023 lows. Further weakness confirms the downtrend and should be interpreted as a sell signal for the stock

Momentum Monday: More tactical downside for Semiconductors

Semiconductors have been an important leadership group since the advent of the current bull cycle in early 2023. A wide positive spread in performance vs other areas of the equity market and a new round of bets on the Fed’s forward interest rate policy have spurred profit taking within the group. We expect a FOMO impulse to trigger buying before the uptrend breaks. The dilemma for tactical investors is how extended the index became.

- Philadelphia Semiconductor Index (SOX) 1yr, daily (200-day m.a.| Relative to S&P 500)

- The SOX Index has potential for a 15% near-term drawdown to support, in this case the bottom of the congestion zone coinciding with its 200-day m.a.

Sources: Bloomberg