US equities shook off their worst week of the year to rally back on Monday with the Nasdaq leading the major indices higher up 1.58% while the S&P 500 added 1.08% and the Dow gained 0.32%.

Discretionary and Info Tech. shares led the way at the sector level with XLK and XLY outperforming the S&P 500. Energy was the only sector to finish in the red with the XLE off 0.63% while Staples and Materials also finished in the bottom.

Market commentaries attributed the bullish tone to optimism about Kamala Harris entering the presidential race in place of President Joe Biden. Also, some important earnings announcements are due this week with GOOGL and TSLA set to report, the former after the bell on Tuesday.

The Yield on the US 10yr inched higher to 4.25% while the WTI Crude contract settled lower at $78.23. International stocks sold off, but overseas futures are perking up as we write this.

Eco Data Releases | Tuesday July 23rd, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 07/23/2024 08:30 | Philadelphia Fed Non-Manufacturing Activity | Jul | — | — | 2.9 | — |

| 07/23/2024 10:00 | Richmond Fed Manufact. Index | Jul | -6 | — | -10 | — |

| 07/23/2024 10:00 | Richmond Fed Business Conditions | Jul | — | — | -11 | — |

| 07/23/2024 10:00 | Existing Home Sales | Jun | 3.99m | — | 4.11m | — |

| 07/23/2024 10:00 | Existing Home Sales MoM | Jun | -3.00% | — | -0.70% | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Tuesday July 23rd, 2024

GOOGL, TSLA and Homebuilders highlight a busy day of earnings releases. Important financials MCO, MSCI, COF and V are also on the docket. We should get a nice check on the potential for a further move higher in cyclicals given the names on the list.

- GOOGL 1yr, daily (200-day m.a.| Relative to S&P 500)

- If all is well, GOOGL should be a BUY heading into its earnings report with the RSI showing a near-term oversold condition in a strong uptrend

Tactical Tuesday

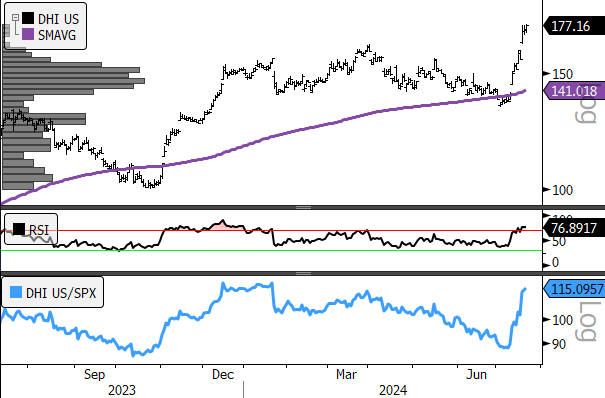

On the flipside from the near-term oversold condition on the GOOGL chart is a very overbought condition for DHI. A big move in either direction is likely signal here, but in the context of tactical moves, the good news looks like it’s price in in the near-term.

- DHI 1yr, daily (200-day m.a.| Relative to S&P 500)

- Chart is very overbought near-term. This looks like a stock to fade tomorrow, but as mentioned above, it is likely signal either way as a strong report would signal resurgent demand without much change in the level of rates, a very strong sign for the consumer

Sources: Bloomberg