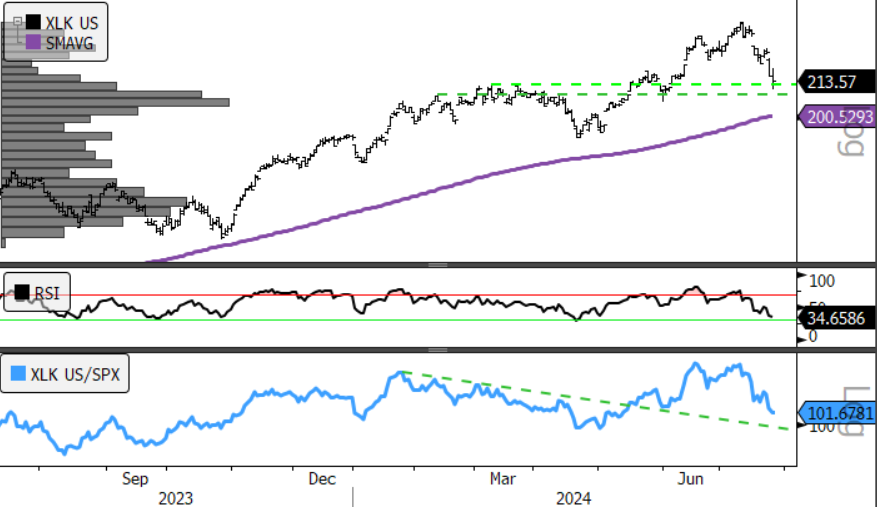

Pressure continued on XLC and XLK shares as major US indices closed mixed with the Dow up 0.20% while the S&P 500 finished off 0.51% and the Nasdaq composite gave back 0.93%. XLK is now registering a classic near-term oversold condition, and we expect buyers to start sizing up opportunities and defending near-term support.

The energy sector bounced with the WTI contract moving higher by 0.34%. Energy, Financials, Industrials and Cyclicals led on the day as min vol. sectors and Growth sectors continued selling.

Interest rates rose with the yields on the 2yr and 10yr Treasuries higher along with the Bloomberg Commodities Index. The Russell 2000 continued its recent surge, adding 1.26% despite softness in the large cap. US indices.

The economic calendar continues to be full with Personal Income and Spending reports due out before the bell and UofM surveys following later in the morning.

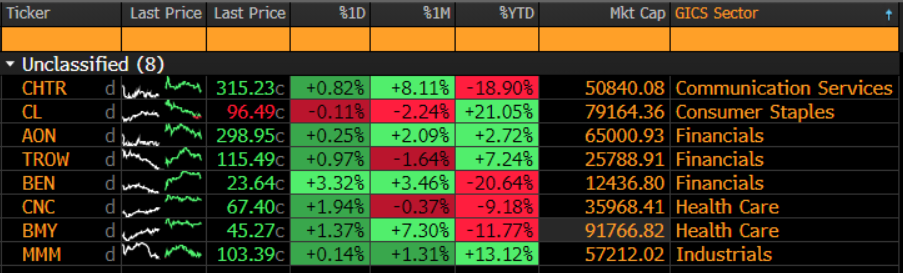

A bit of a reprieve from the earnings calendar with less than 10 names reporting. BMY, CHTR and CL.

Eco Data Releases | Friday July 26th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 07/26/2024 08:30 | Personal Income | Jun | 0.40% | — | 0.50% | — |

| 07/26/2024 08:30 | Personal Spending | Jun | 0.30% | — | 0.20% | — |

| 07/26/2024 08:30 | Real Personal Spending | Jun | 0.30% | — | 0.30% | — |

| 07/26/2024 08:30 | PCE Price Index MoM | Jun | 0.10% | — | 0.00% | — |

| 07/26/2024 08:30 | PCE Price Index YoY | Jun | 2.40% | — | 2.60% | — |

| 07/26/2024 08:30 | Core PCE Price Index MoM | Jun | 0.20% | — | 0.10% | — |

| 07/26/2024 08:30 | Core PCE Price Index YoY | Jun | 2.50% | — | 2.60% | — |

| 07/26/2024 10:00 | U. of Mich. Sentiment | Jul F | 66.4 | — | 66 | — |

| 07/26/2024 10:00 | U. of Mich. Current Conditions | Jul F | 64.4 | — | 64.1 | — |

| 07/26/2024 10:00 | U. of Mich. Expectations | Jul F | 67.5 | — | 67.2 | — |

| 07/26/2024 10:00 | U. of Mich. 1 Yr Inflation | Jul F | 2.90% | — | 2.90% | — |

| 07/26/2024 10:00 | U. of Mich. 5-10 Yr Inflation | Jul F | 2.90% | — | 2.90% | — |

| 07/26/2024 11:00 | Kansas City Fed Services Activity | Jul | — | — | 2 | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Friday July 26th, 2024

Factor Friday

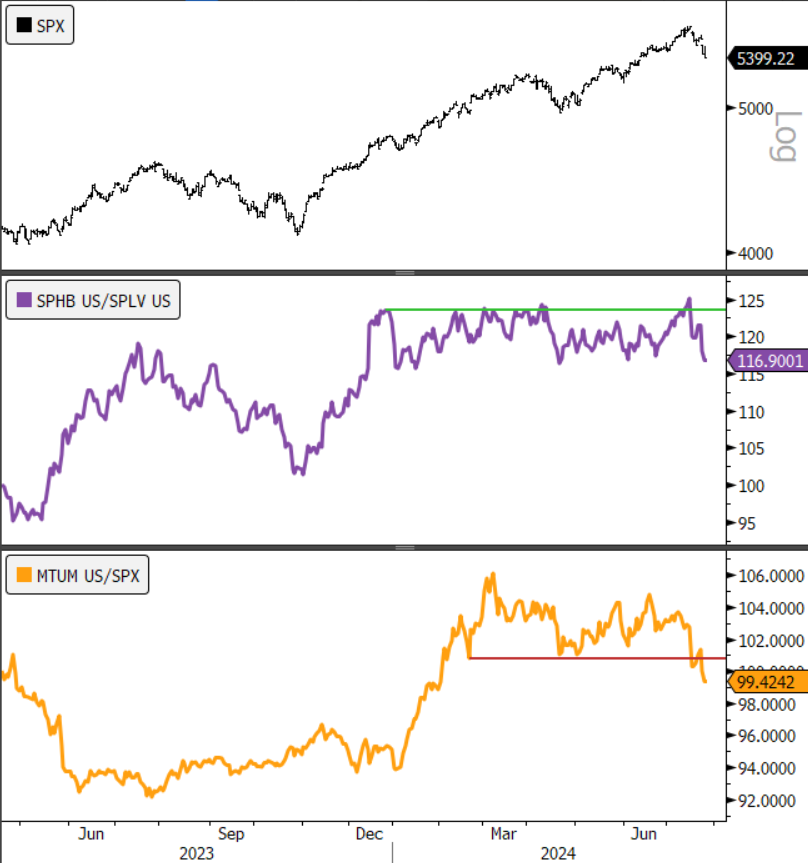

Earnings season has sparked rotation against the Technology Sector. XLK now sits oversold at near-term support and we expect the buyer to step in. The ETF is now oversold on each of our big three technical measures, RSI, price and relative strength. Further, the factor trade has turned decidedly against XLC and XLK with the SPHB at lows vs. SPLV and the MTUM ETF breaking down vs. the S&P 500.

- XLK 1yr, daily (200-day m.a. | Relative Strength )

- Panel 1: S&P 500 High Beta ETF/S&P 500 Low Vol. ETF

- Panel 2: MTUM Relative to S&P 500 (normalized to 100)

Sources: Bloomberg